Three metrics showing how 2021 has finally been the year of institutional adoption

Three metrics showing how 2021 has finally been the year of institutional adoption Three metrics showing how 2021 has finally been the year of institutional adoption

For those that have been around crypto for several years, there is a high chance that they have heard the phrase: “institutions are coming”

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

For those that have been around crypto for several years, there is a high chance that they have heard the phrase: “institutions are coming.”

At some point, it even became an overused meme by investors making fun of the high hopes of part of the market over the appreciation of the price of Bitcoin. Prior to COVID-19, institutions publicly investing in cryptocurrencies was rare, but in 2021 cryptocurrency interest has accelerated massively.

Among the most popular news of institutions entering the crypto space, Tesla’s $1.5bn BTC investment caught everyone by surprise. It is true that another US publicly traded companies were accumulating Bitcoin before them, Microstrategy. They continue buying BTC each dip, and nowadays they hold up to $3.66bn.

Not only companies have entered the game, notoriously the first country to have declared Bitcoin as a valid legal currency has been El Salvador. Meanwhile, even US states are considering engaging with Bitcoin, such is the case of Miami, which is considering distributing BTC yield to its residents. The open nature of the blockchain allows access to the trails that these institutions leave and compare over time its impact.

These are some of the multitude of on-chain metrics at IntoTheBlock that highlight how institutional money has been pouring into blockchains in 2021.

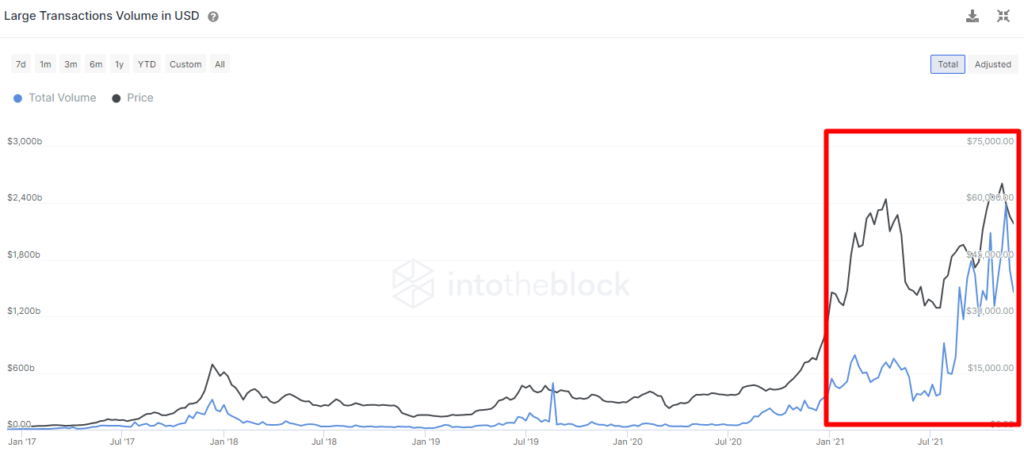

Bitcoin large transactions volume has increased 5x

Bitcoin has been the largest benefactor to onboard most of this demand. Besides its price action doubling its levels this year and reaching almost $70k, there are several indicators showing how not only price rose, but the amount transacted in the blockchain has increased massively.

The best indicator to display this is the volume of transactions greater than $100k, categorized as large transactions at IntoTheBlock. The volume from these transactions has increased from a total of $381B transacted weekly at the start of 2021 to a maximum during this month of $2.39:

This signals how much value is exchanged only on the Bitcoin blockchain, but does not take into account the significant flows that other blockchains have seen. 2021 has been the year that saw predominantly a large adoption of smart contract platforms such as Ethereum, Solana or Avalanche.

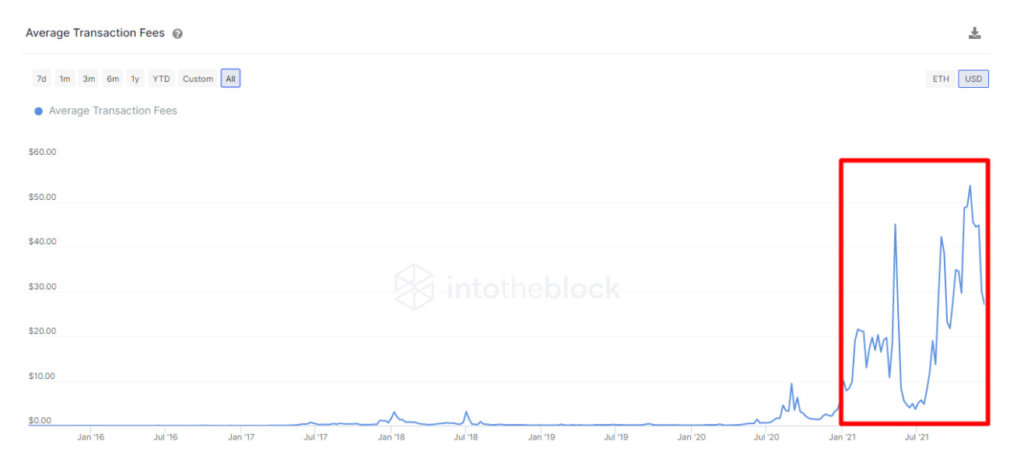

Ethereum has so much demand that a single transaction cost is up to $50

It is a reality that institutional demand has been constantly seeking exposure to the yields that decentralized finance (DeFi) offers. Traditional finance yields are usually an order of magnitude smaller than those available in DeFi.

Ethereum is still the ‘king’ of smart contracts blockchain. Despite losing market share during the last months of the year, it still has remained as the one with the most liquidity, options, and with protocols less risk prone.

A good indicator of how in demand is the Ethereum chain are the average transaction fees in US dollars. Fees paid in dollars are dependent on the price of ETH as well, which helps to measure this demand, since buying ETH is needed to use the network.

In the next chart, we can see the historical variation of the weekly average transaction fees on the Ethereum blockchain. While at the start of the year the usual transaction fee was just $10, at the end of the year we have seen these costing an all-time high of more than $50.

Transaction fees are one of the simplest kinds of transactions, but recently other transactions such as token swaps in decentralized exchanges reached more than $400 per transaction.

Taking into account the total daily paid fees paid in the Ethereum blockchain and dividing it by the daily active users, one can arrive at the conclusion that each active address on Ethereum is paying $413 daily in fees on average for using the blockchain. Paying that amount arguably is not compatible with many retail clients, signaling the potential usage of the blockchain by a majority of institutions.

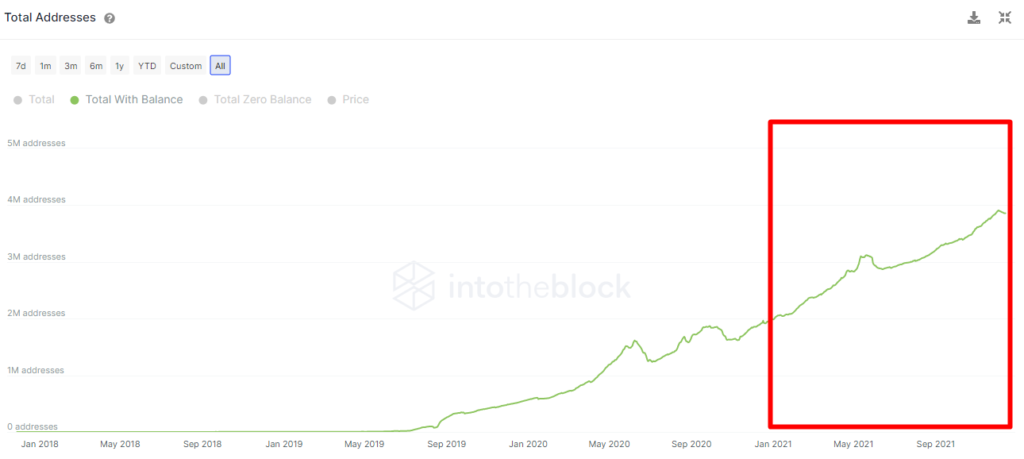

Addresses using USDT have doubled

Nowadays any investor engaging with cryptocurrencies needs to use stablecoins at some point. Either by moving money along the blockchain or by being able to buy and sell cryptocurrencies. It requires stablecoins. And USDT is still the asset used mostly in trading pairs of cryptocurrencies that happen on centralized exchanges, where still most of the volume traded happens, by far.

Institutions often need to move capital either between these centralized exchanges or using custodial services. So the number of addresses that are using USDT is a phenomenal indicator to measure that activity.

The next chart shows the historical variation of the number of addresses with a balance that have interacted with USDT directly. It can be appreciated how it has gone from 1.99M addresses in January 1st to up to 3.9M during its peak this December.

For the time being, the volume traded on DeFi is at least 10 times lower than in centralized exchanges. And USDT is the leading stablecoin in these centralized exchanges. Other stablecoins such as DAI or USDC have seen considerable growth. We believe that such a case better reflects the increase in usage of DAI and USDC in DeFi protocols.

So, as these indicators show, institutions ‘are here’ already. They invest in different cryptocurrencies and use DeFi protocols. Besides the recent crypto market volatility amid the recent macro uncertainty, the interest of institutional investors continues on the rise, and recent surveys seem to confirm it.