This strange set of data shows Bitcoin may be about to enter its mass hysteria phase

This strange set of data shows Bitcoin may be about to enter its mass hysteria phase This strange set of data shows Bitcoin may be about to enter its mass hysteria phase

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Because of the size of Bitcoin’s market, its movements are largely guided by retail investors, with investors’ sentiment regarding the market playing a major role in its long-term trends.

Investor sentiment is rather difficult to quantify, however, with some analysts attempting to use key phrase search scripts to identify the type of terminology that investors are using when it comes to Bitcoin and crypto, subsequently attempting to quantify an emotional sentiment off of this data.

Now, one research group has identified a bizarre indicator of investor sentiment that appears to be predictive of Bitcoin’s price action, and it shows that BTC could soon enter its “mass hysteria” phase.

Usage of the term “Lambo” shows that Bitcoin could soon enter an investor hysteria phase

Bitcoin has been caught within a firm uptrend throughout the past 6 weeks, which has revitalized investor sentiment and has rekindled hope that the markets may soon see significantly further momentum.

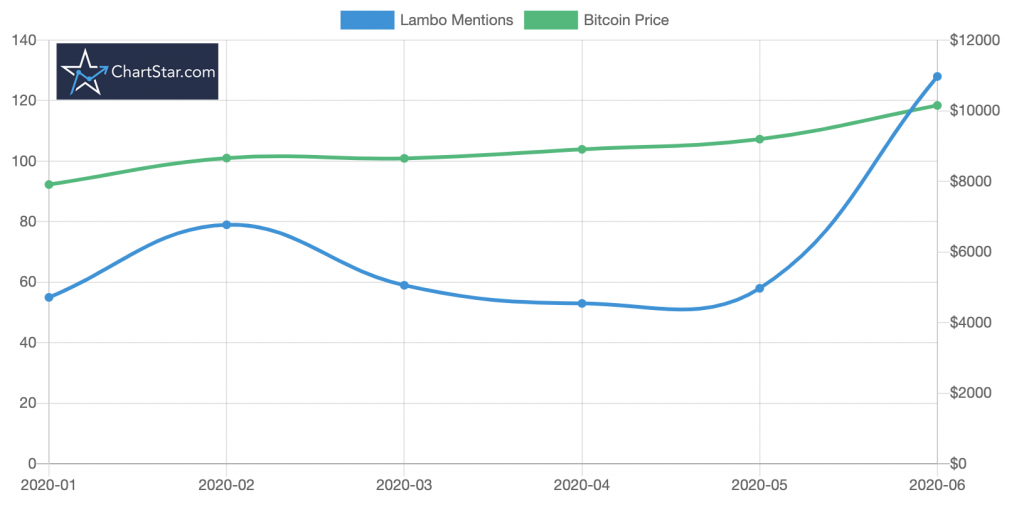

This growing hope may quickly become hysteria, which is elucidated while looking towards data relating to the usage of the term “Lambo” on Reddit.

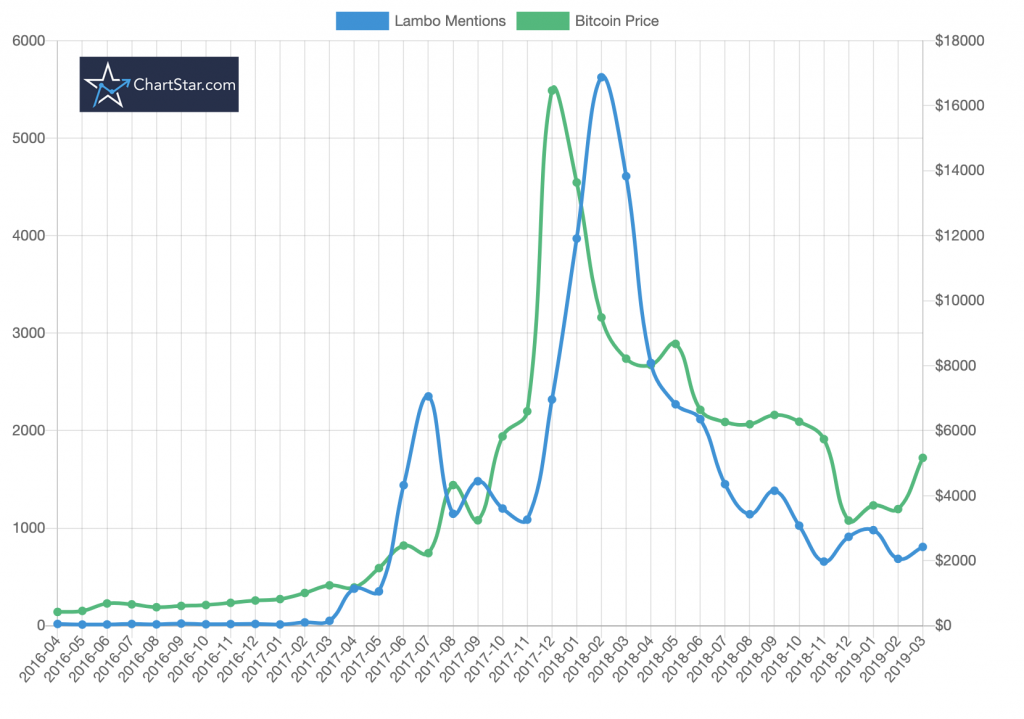

ChartStar, a data-focused trading site, spoke about the close correlation between investor’s use of the term “Lambo” and “Lamborghini” and Bitcoin’s price action, offering a chart showing the striking correlation seen throughout 2017 and 2018.

While looking at the chart seen below, it now appears that the use of these terms is turning parabolic, which could signal that investors are about to enter the “mass retail hysteria” phase that lead Bitcoin into a massive uptrend.

Google Trends data further confirms this notion

As recently reported by CryptoSlate, Google Trend data also seems to suggest that a flood of retail investors could be on the cusp of pouring into the markets.

While examining the search volume on Google related to a few important key phrases, it grows clear that the cryptocurrency’s 2020 rally has piqued interest in the markets, with searches for phrases like “buy Bitcoin” and “Bitcoin Halving” both skyrocketing over the past few weeks.

Because retail investors are such an integral part of Bitcoin and the crypto markets, it is imperative that their current interest in the markets becomes more of a frenzy than a simply tempered interest in order for BTC to see its next parabolic movement.

Bitcoin Market Data

At the time of press 3:55 am UTC on Feb. 16, 2020, Bitcoin is ranked #1 by market cap and the price is down 2.51% over the past 24 hours. Bitcoin has a market capitalization of $182.22 billion with a 24-hour trading volume of $44.91 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 3:55 am UTC on Feb. 16, 2020, the total crypto market is valued at at $295.61 billion with a 24-hour volume of $172.71 billion. Bitcoin dominance is currently at 61.64%. Learn more about the crypto market ›