This economic model suggests Ethereum’s price will be boosted by DeFi’s growth

This economic model suggests Ethereum’s price will be boosted by DeFi’s growth This economic model suggests Ethereum’s price will be boosted by DeFi’s growth

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Ethereum network has been seeing some of its heaviest utilization ever throughout the past couple of months.

Most of this fresh on-chain activity can be attributed to the rapid growth of the DeFi sector, which is primarily built upon ETH’s blockchain.

Participation in most DeFi protocols requires that users transact between Ethereum and other ERC-20 tokens. As a result, heightened participation in this rapidly growing ecosystem is driving massive demand for the ETH network.

One result of this is rising transaction fees. Data suggests that there is a historical correlation between fees and market cap, suggesting that the crypto may currently be undervalued.

Ethereum transaction fees rocket as DeFi participation continues mounting

The launch of Compound in mid-June sparked a “yield farming” trend in which users leverage different collateral in order to harvest DeFi incentives.

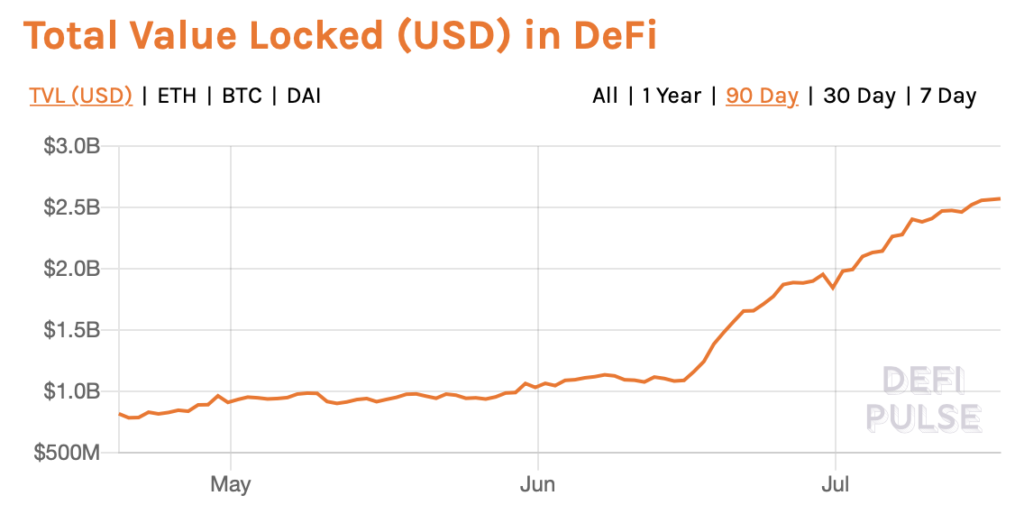

According to data from DeFi Pulse, the emergence of this trend has significantly perpetuated the growth seen by the sector. One metric that elucidates this is the total USD value locked within all protocols, which just hit an all-time high of $2.57 billion.

Currently, Compound has the highest value of USD locked within the protocol, closely followed by Maker and Synthetix.

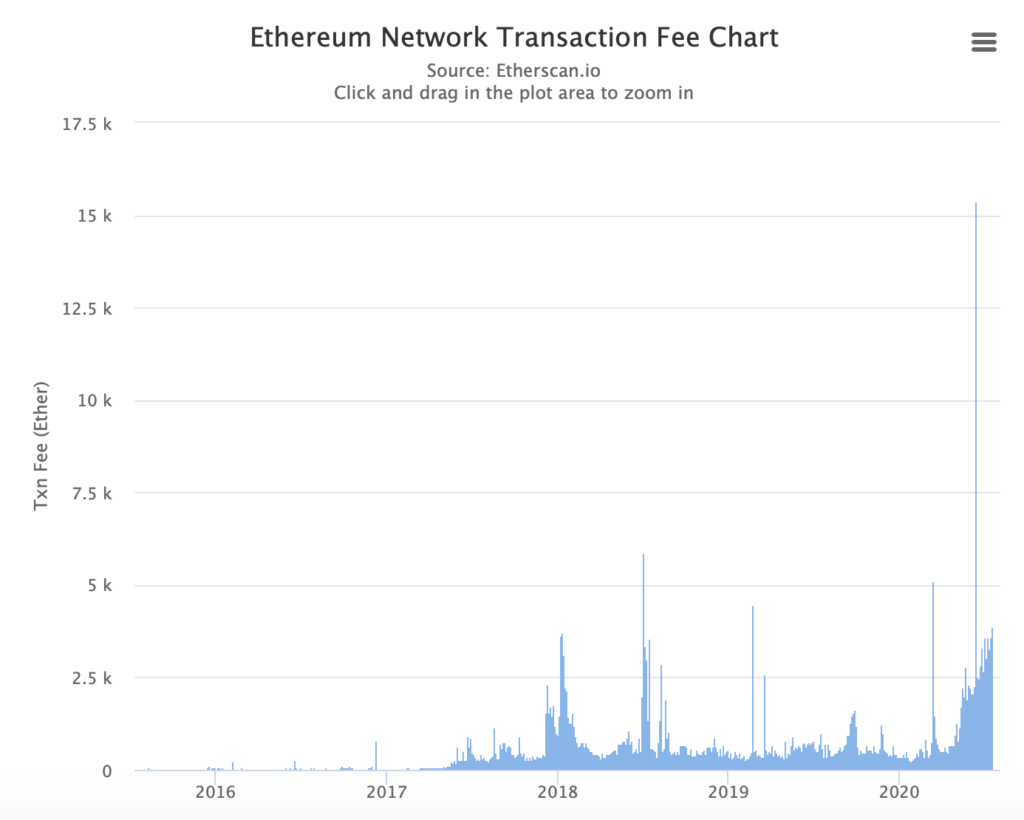

The transactions taking place on these platforms are driving a massive surge in Ethereum transaction fees.

According to data from Etherscan.io, the network’s fees are currently trending around their highest levels ever seen.

As seen on the above chart, they saw a similar spike during the ICO craze in late-2017 and early 2018, although the growth was less stable than that seen presently.

Heightened fees can be considered a sign of the demand for the network. The higher the fees, the higher demand.

Naturally, this metric points to underlying network health when it is trending upwards as it is now.

This model suggests ETH’s market cap is directly correlated to network demand

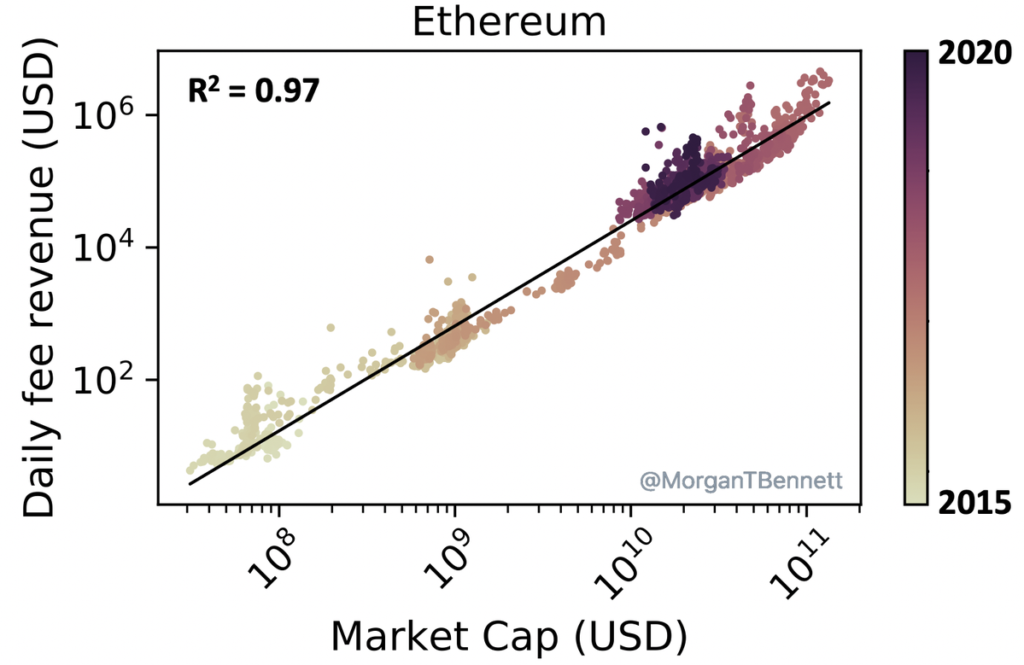

One model put forth by a data analyst seems to suggest that Ethereum may be undervalued at the present moment.

A user on Twitter named Morgan Bennett recently put forth a model that has since gained popularity, showing that there is a linear correlation between daily fee revenue and ETH’s market capitalization.

“Some people think that Ethereum will be successful but ETH won’t have any value. Let me debunk this meme with one single plot.”

As can be seen in the above scatter plot chart, the cluster of current data points for ETH fees suggests that the cryptocurrency has a fair market cap of somewhere around $32 billion (10 to the 10.5th power).

At the present moment, Ethereum’s current market cap sits around $26 billion, roughly 20 percent below what the model suggests could be a fair value.

What is important to consider here isn’t so much that Ethereum may (or may not) be undervalued at the present moment, but rather that there is a direct correlation between the demand for the network and the cryptocurrency’s value.

As ecosystems built on top of ETH continue flourishing, they will likely create a tailwind that helps life the crypto’s price higher as well.