Data shows retail interest in Bitcoin plateauing as BTC price stagnates

Data shows retail interest in Bitcoin plateauing as BTC price stagnates Data shows retail interest in Bitcoin plateauing as BTC price stagnates

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin has been facing steep selling pressure over the past 24-hours that has marked an extension of that which was first incurred when it broke below $9,000 earlier this month — a previous support level that BTC bulls had been ardently defending.

This recent downtrend has led retail interest in Bitcoin to plateau, as data surrounding exchange deposits and inflows points to the fact that investors presently have little interest in the cryptocurrency.

Bitcoin’s price faces turbulence amidst market-wide sell-off

At the time of writing, Bitcoin is currently trading up marginally at its current price of $8,530, which marks a steep drop from its weekly highs of just over $9,000 that was set last Sunday.

In spite of this recent drop, it is important to note that BTC is still trading well above its 30-day lows of $7,300 that was set in late-October, just prior to the meteoric rally that sent its price surging to highs of $10,600.

In the near-term, it does appear that the lower-$8,000 region is a strong level of support that will bolster BTC’s price action in the coming hours and days.

Are retail investors losing interest in BTC?

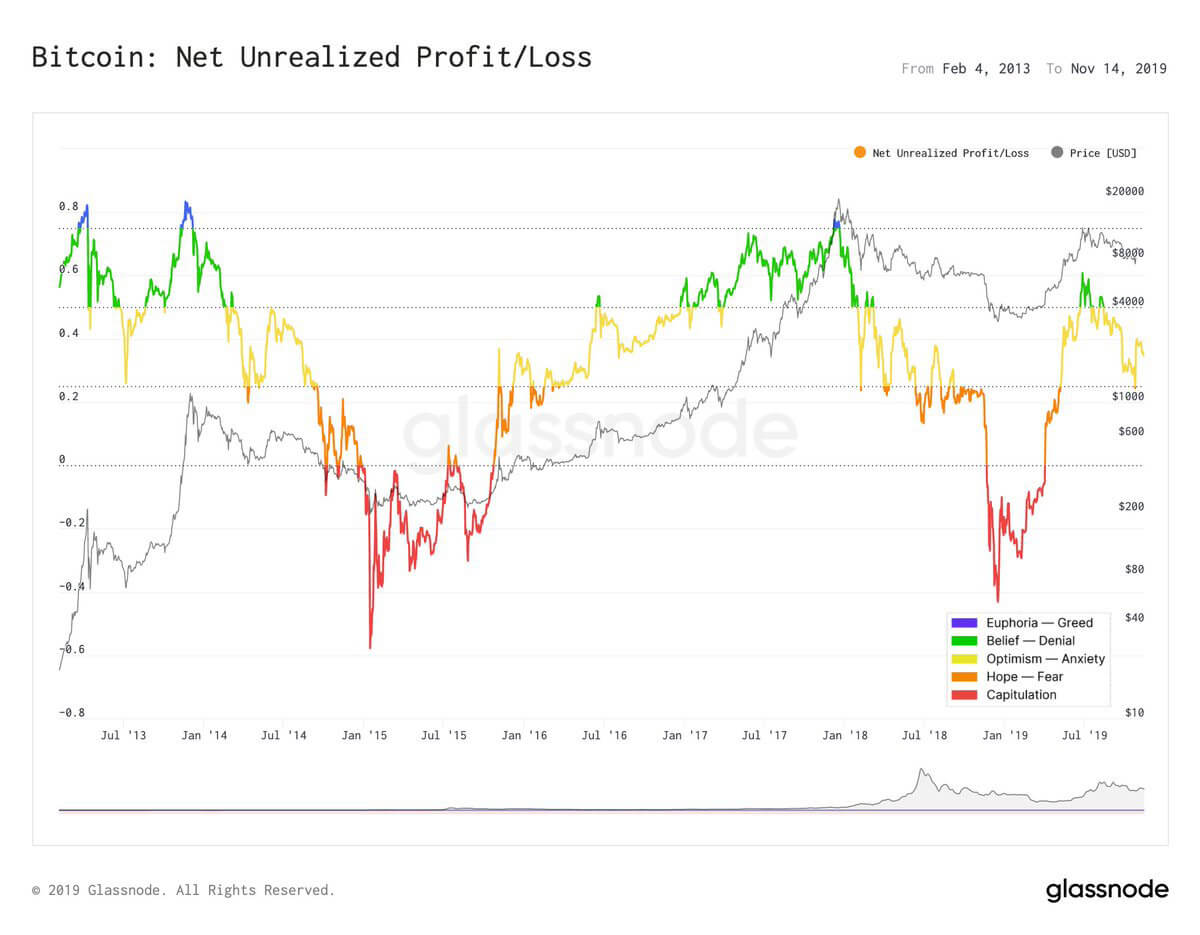

The inability for Bitcoin’s bulls to garner any significant upward momentum may point to the possibility that further losses are in store for the cryptocurrency in the near-term, which is further supported by the fact that inflows of capital to crypto exchanges have been declining, elucidating dwindling interest in the markets from retail investors.

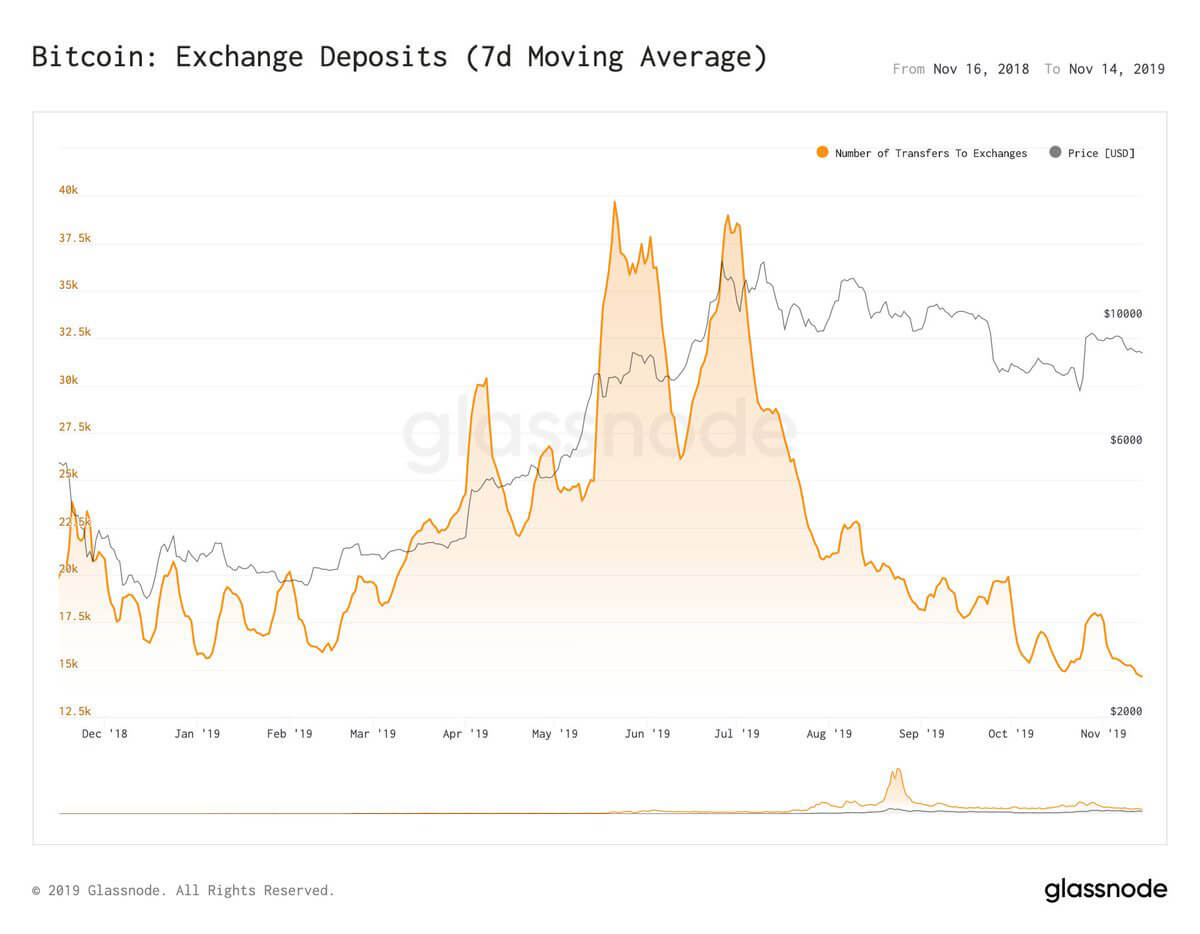

Glassnode, a group focused on blockchain analytics, spoke about this data in a recent tweet, concluding that it signals a “low trading appetite” amongst investors.

“$BTC exchange deposits and inflows have continued to decline over the last week, indicating low trading appetite from investors,” they noted while referencing the chart seen below.

Additionally, according to Glassnode, exchange deposits have dropped off significantly over the past month.

Assuming that this trend extends into the future, the ongoing decline in interest amongst investors may translate into lower trading volume, making BTC increasingly prone to facing further downside.

Bitcoin Market Data

At the time of press 1:39 am UTC on Nov. 17, 2019, Bitcoin is ranked #1 by market cap and the price is up 0.61% over the past 24 hours. Bitcoin has a market capitalization of $154.29 billion with a 24-hour trading volume of $16.36 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:39 am UTC on Nov. 17, 2019, the total crypto market is valued at at $234.2 billion with a 24-hour volume of $56.87 billion. Bitcoin dominance is currently at 65.92%. Learn more about the crypto market ›