Research: Tether shines as leading stablecoin in evolving market

Research: Tether shines as leading stablecoin in evolving market Research: Tether shines as leading stablecoin in evolving market

Tether extends its dominance to 55% of the stablecoin market as BUSD woes deepen.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

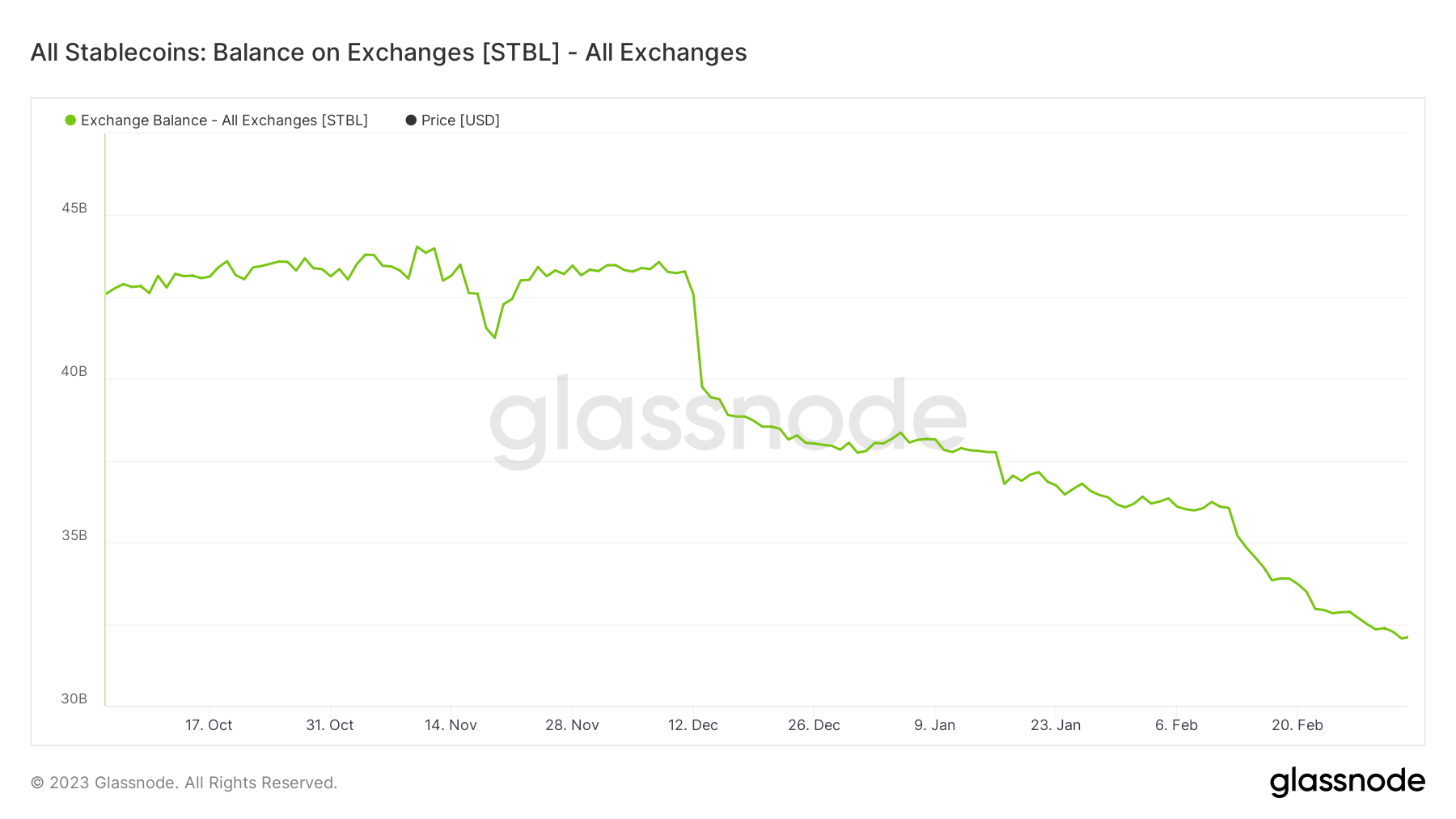

Following the FTX disaster in November, the stablecoin market has significantly changed, losing $12 billion in value.

More recently, the issue was compounded by troubles at BUSD as the New York Department of Financial Services (NYFDS) ordered Paxos to cease token issuance.

Glassnode data analyzed by CryptoSlate showed Tether has emerged as the clear winner in the market restructuring, despite ongoing, long-running suspicions about the token’s ability to meet its liabilities.

Stablecoin roundup

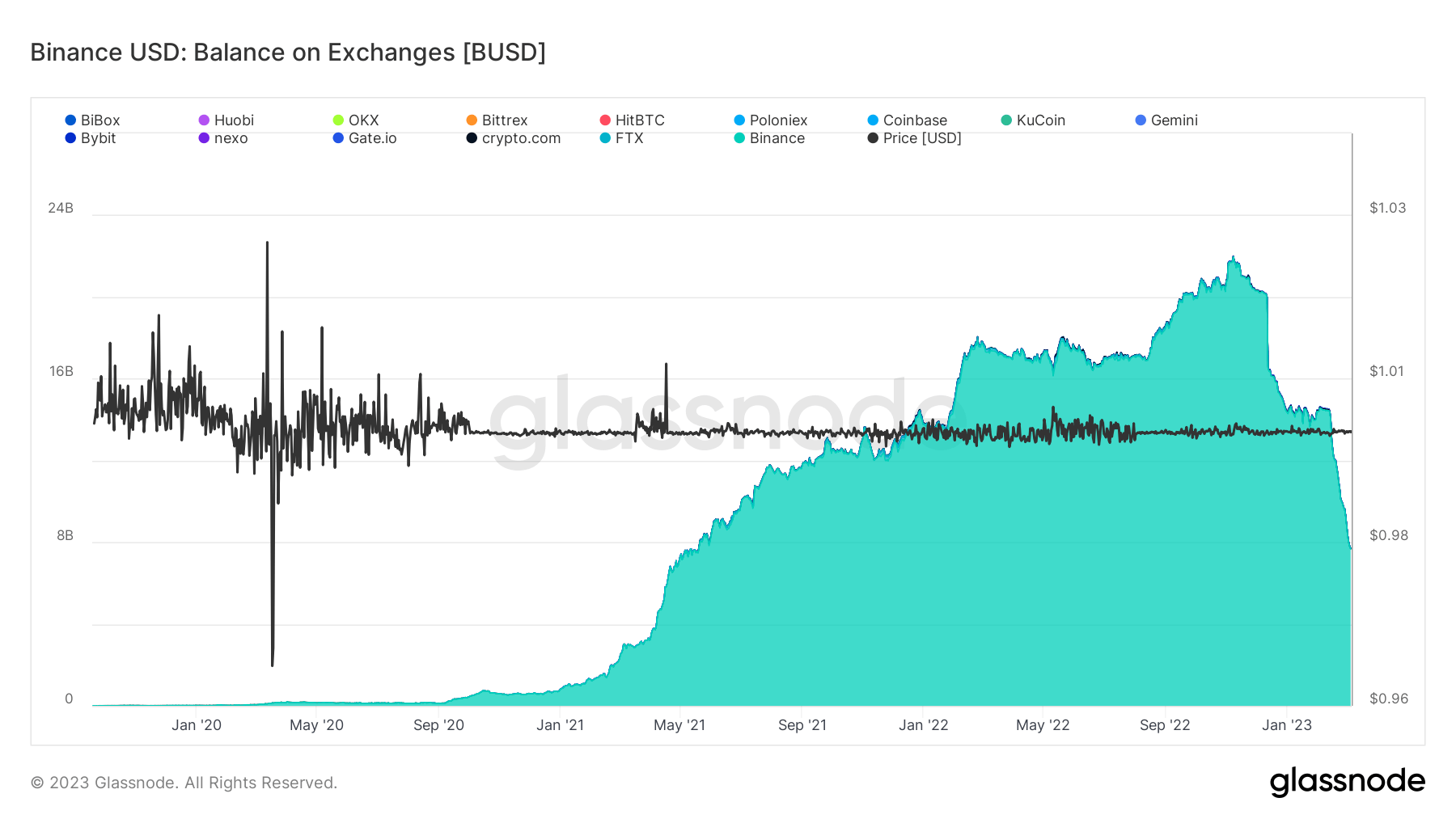

Since November 2022, the market dominance of BUSD has halved, sinking from 14% market share to 7% over the past four months.

The chart below shows balances held on exchanges peaking at $22 billion around mid-November 2022. Following that, as the FTX saga took hold, a sharp dip found a support level of around $14 billion.

However, as rumors of BUSD’s reserve discrepancies circulated, another sell-off occurred, dropping the current exchange balance to less than $8 billion.

Interestingly, since November 2019, Binance has held the overwhelming majority of BUSD consistently, with other exchanges barely featuring.

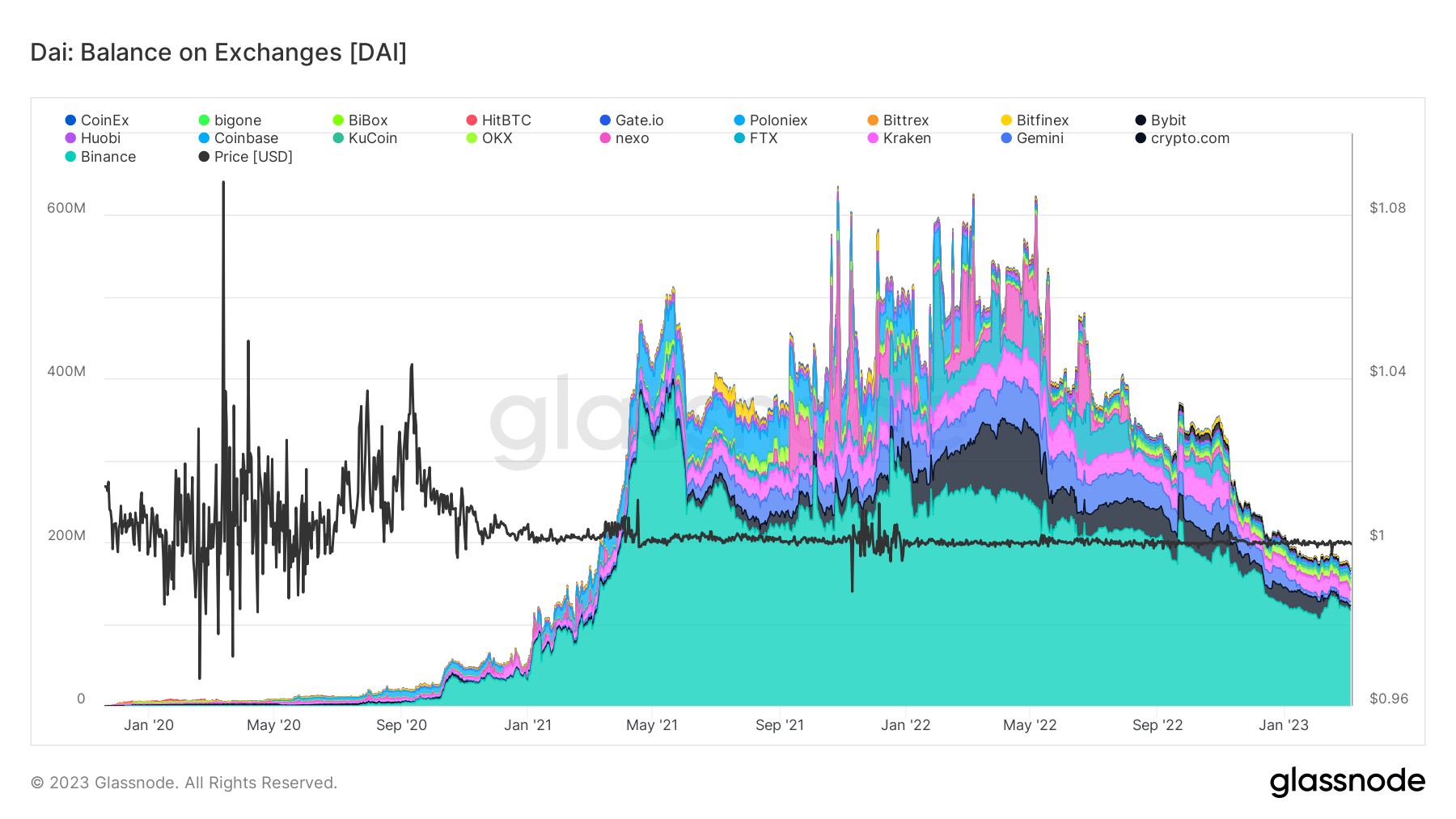

Meanwhile, DAI’s market dominance has held relatively flat, accounting for approximately 4% of the market since November 2022.

Nonetheless, as depicted in the chart below, DAI held on exchanges has been trending downwards since May 2022.

Binance holds the most DAI, at 120 million of the 160 million total. But having shed its 2021 and 2022 holdings is now heading back to late 2020 levels.

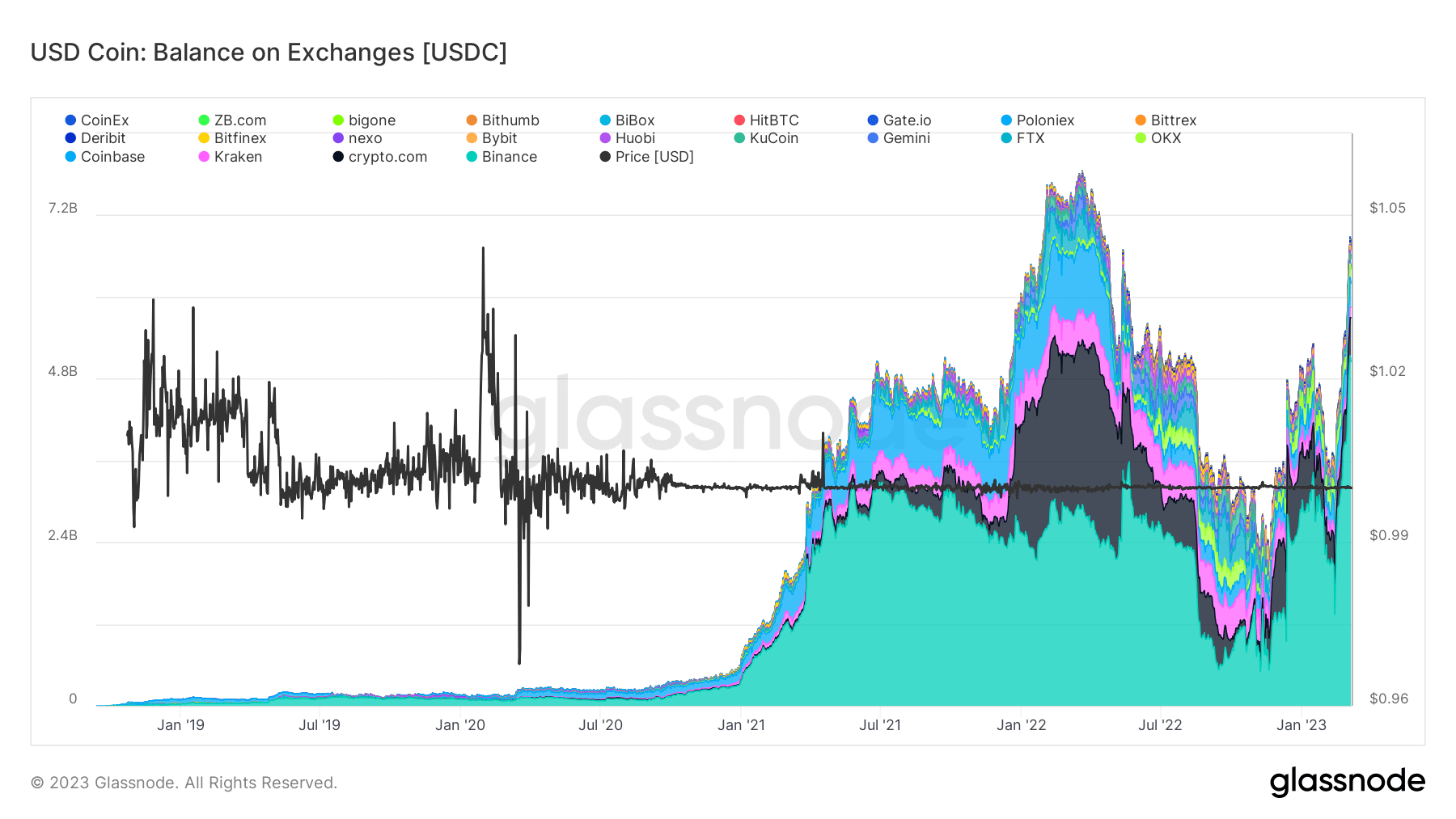

USDC has experienced a net benefit from BUSD’s downfall, with dominance increasing to 34% of the stablecoin market.

The balance held on exchanges has spiked to near April 2022 highs. The majority is held on Binance, currently accounting for 5 billion tokens, with Crypto.com coming in second at 645 million.

Tether shines

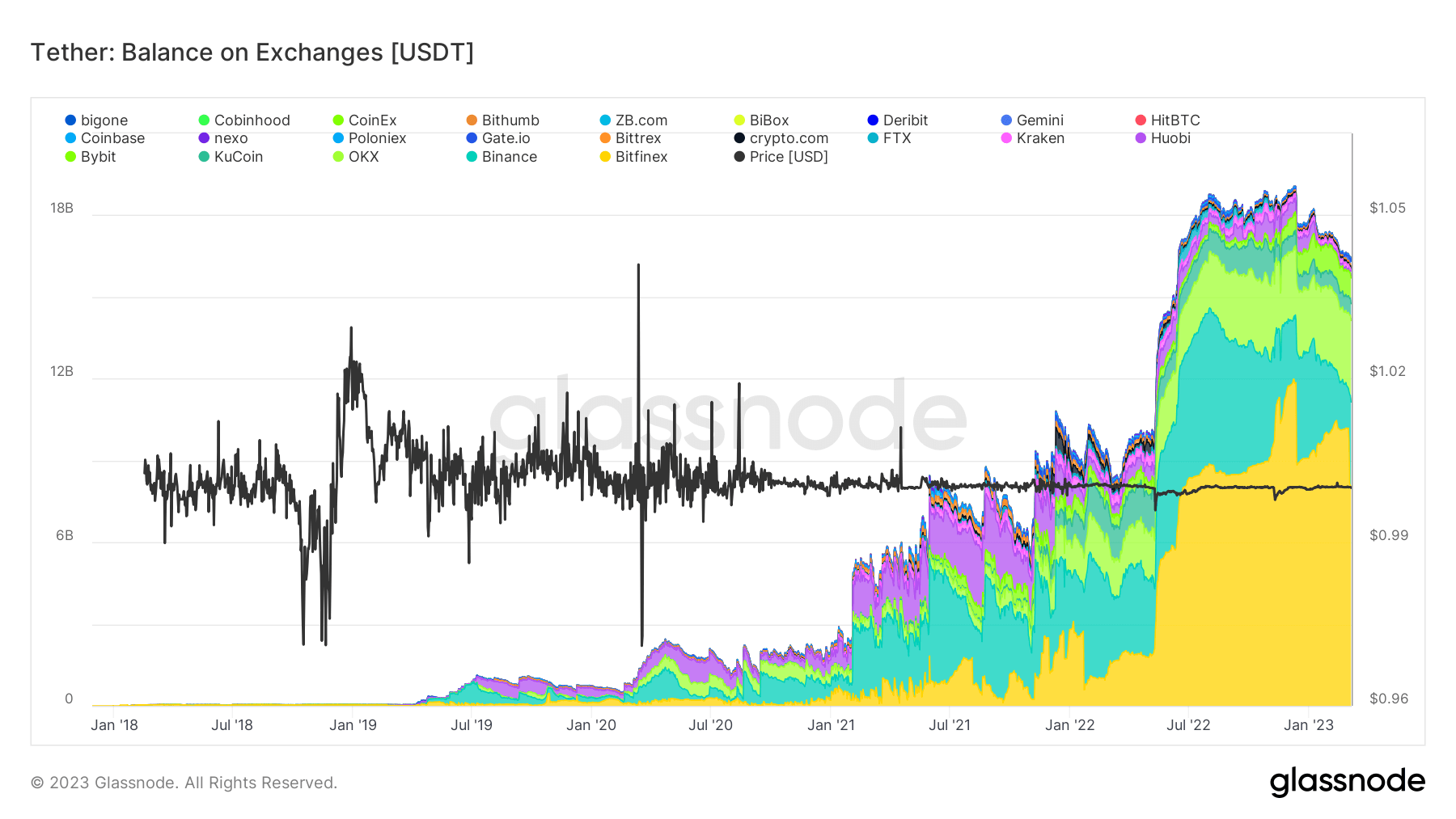

Tether has seen the most significant benefit from changing stablecoin market dynamics. The chart below shows a significant uptrend in the USDT balance on exchanges.

Market dominance now exceeds 55%, with Bitfinex holding the majority stake, increasing its share from 1.8 billion in June 2022 to over 10 billion at present.

However, this week saw Bitfinex offload approximately $2 billion of USDT, but around $16 billion remains on exchanges.

While USDC’s dominance remains flat, USDT has added nearly 8% market share over the past five months, making it the leading dollar-backed stablecoin by a significant margin.

Farside Investors

Farside Investors