Report: Traders move to XRP for cross-exchange transactions increase whenever ETH transaction fees surge

Report: Traders move to XRP for cross-exchange transactions increase whenever ETH transaction fees surge Report: Traders move to XRP for cross-exchange transactions increase whenever ETH transaction fees surge

Photo by Bill Mackie on Unsplash

An Xpring report on May 13 stated XRP exchanges see increased inflow/outflow volumes whenever Bitcoin and Ethereum networks are hit by surging transaction fees and congestion.

Traders move to XRP during crunch

While the sample sizes in terms of days were not specified, Xpring notes XRP cross-exchange transactions went up significantly when Ethereum — widely-used as a market on-ramp — was congested.

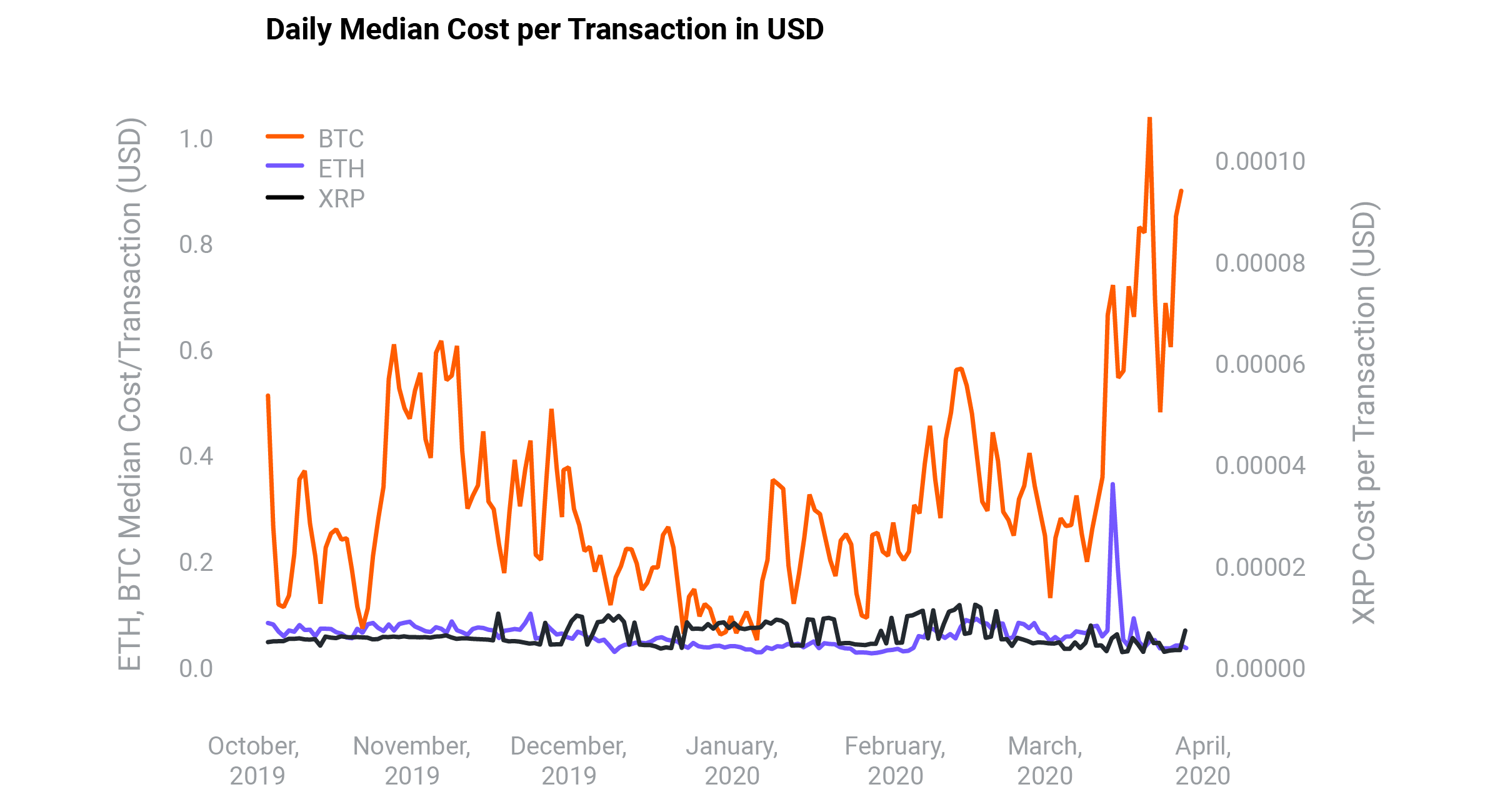

The report said Bitcoin fees went up by a maximum of 500 percent in the weeks leading to halving. Ethereum’s network was similarly strained. On some days in March 2020, users even faced waiting times of 44 minutes per transaction, even though fees did not increase as much:

#ETH network congestion. Average time for confirmations 2680 seconds (44 minutes) https://t.co/a2U8vF3Q9P pic.twitter.com/nPENzWA4yH

— CZ Binance ??? (@cz_binance) March 12, 2020

Shae Wang of Xpring, who authored the report, notes such periods led to difficulties in inter-exchange flows. Notably, the cryptocurrency is dominated by traders and arbitrage seekers, and inflated fees or slower transaction times means investing strategies are greatly impacted.

The report adds:

“The observed XRP transactions increase is likely a result of traders using XRP as an alternative rebalancing asset.”

XRP seemingly emerges as a transfer alternative ahead of popular options. Wang points to cross-transaction data — XRP transfers rose 226 percent when Etheuem fees spiked by 400 percent in March.

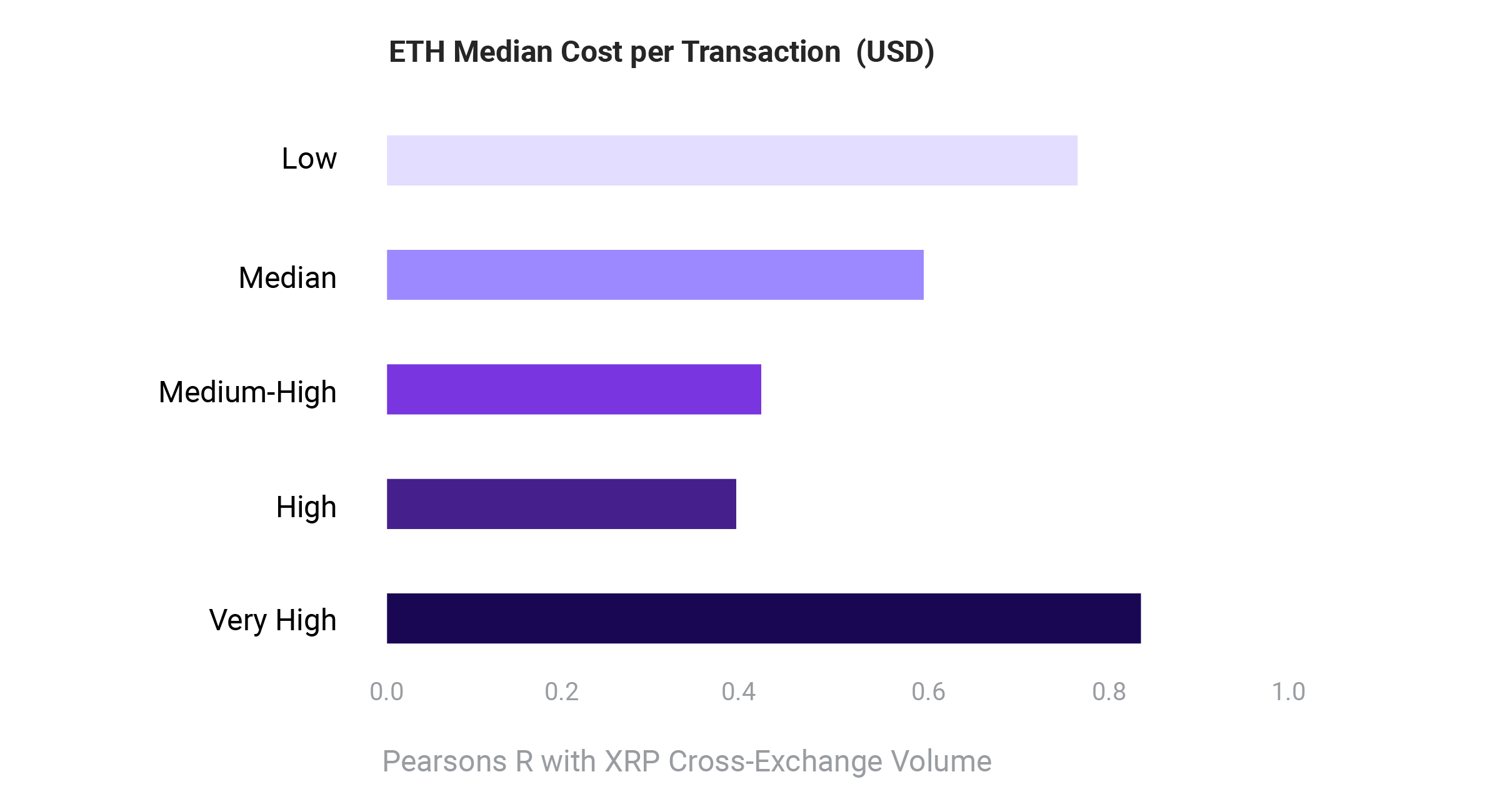

The above graphic used the “Pearsons R” system to calculate the correlation. As seen, XRP transfers went over 0.6 — deemed a “high” correlation — each time ETH fees increased.

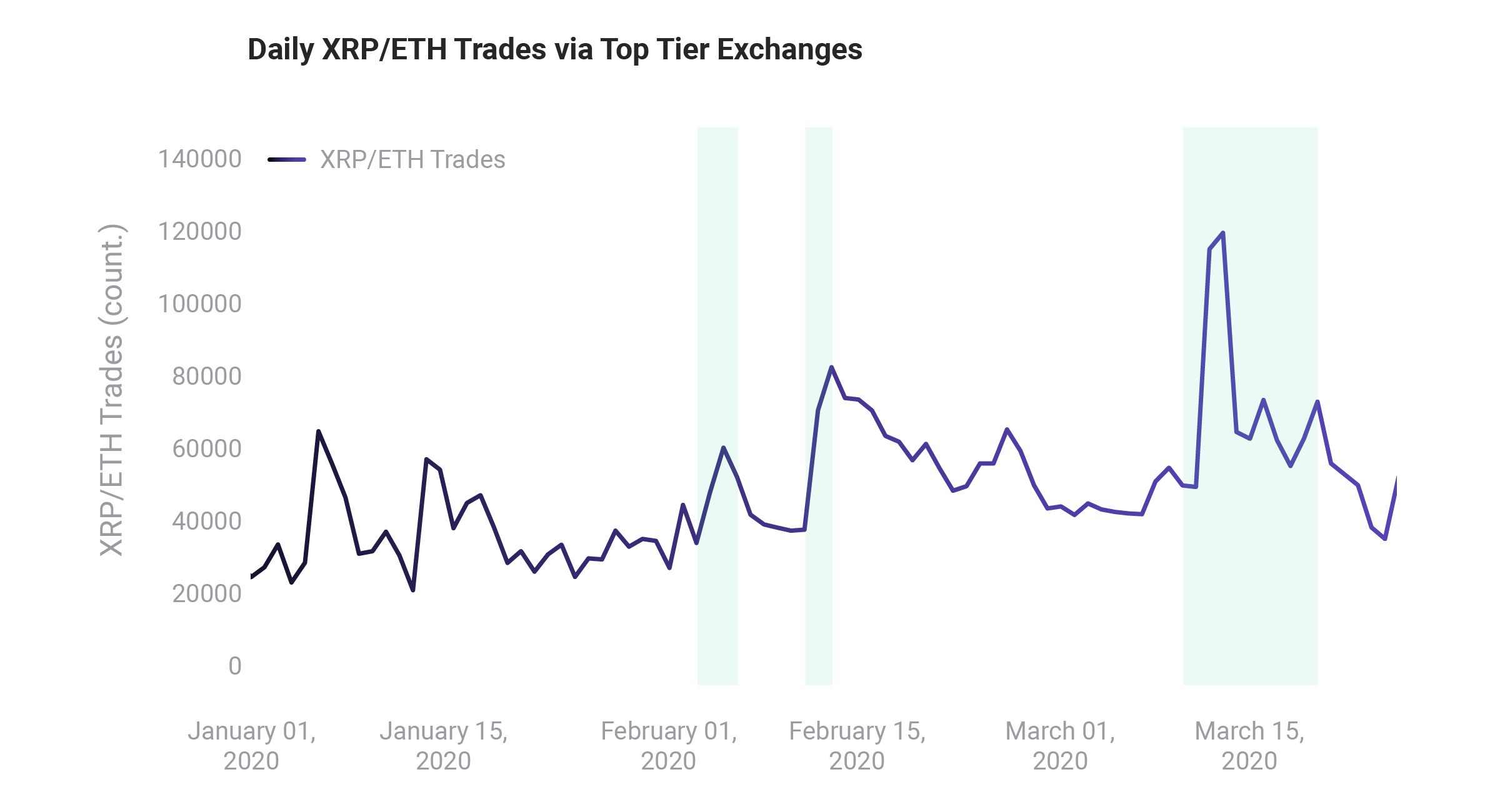

Another metric validates the hypothesis. The graph displays XRP/ETH trades on large crypto-exchanges increased on the days of high ETH fees:

The report noted XRP fees remained relatively stable even as Bitcoin/Ethereum fees surged. While this is not an in-build feature, XRP has previously been widely-used for liquidity in both crypto and traditional markets.

Meanwhile, Wang cautions against taking “correlation for causation,” meaning the relationship between XRP behavior with ETH’s fees may not be a permanent feature of the cryptocurrency market. The latter gradually shifts to a PoS protocol to upgrade against congestion during active periods, and while the dates are not confirmed yet, it may mean XRP’s liquidity hedge won’t be longlived.