Price Watch: Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin are Deep in the Red

Price Watch: Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin are Deep in the Red Price Watch: Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin are Deep in the Red

Photo by Takahiro Taguchi on Unsplash

At press time, most major cryptocurrencies are deep in the red, with entitles like Ethereum and Ripple experiencing anywhere between five and twelve percent drops over the last 24 hours. This marks an unfortunate change from Monday when currencies like Bitcoin – then trading for about $8,500 – were showing minor signs of potential recovery.

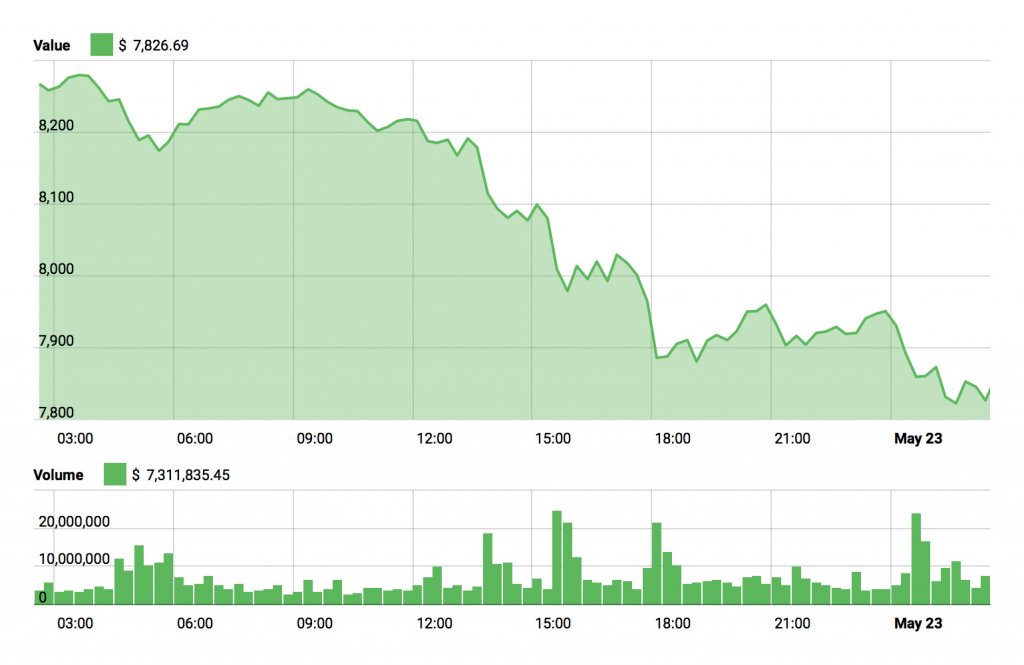

Bitcoin (BTC)

Bitcoin has fallen by over $500 since our last price piece, and is now trading for just over $7826.69.

In a recent interview on CNBC’s Fast Money, Fundstrat’s Tom Lee again pushed the notion that Bitcoin would reach $25,000 by the end of 2018, though he offered more explanation this time around, assuring enthusiasts that the currency doesn’t need to undergo daily price spikes to reach this goal.

Lee stated:

“Let’s say we think [Bitcoin] can reach $25,000. This does not require Bitcoin to go up every day until the end of the year. Remember – the ten best days account for all the return of Bitcoin. If you didn’t own Bitcoin for ten days each year, you lost 25 percent a year since 2010.”

In addition, cryptocurrency and Italian food enthusiasts everywhere are celebrating Bitcoin Pizza Day, which has been a popular event since May 22, 2010. It was on this date that programmer Laszlo Hanyecz purchased two pizzas for approximately 10,000 BTC, a sum that would be worth over $80 million today.

A Twitter account dedicated to the “holiday” is providing 24-hour updates regarding how much the pizzas would have presently cost based on the latest bitcoin price(s).

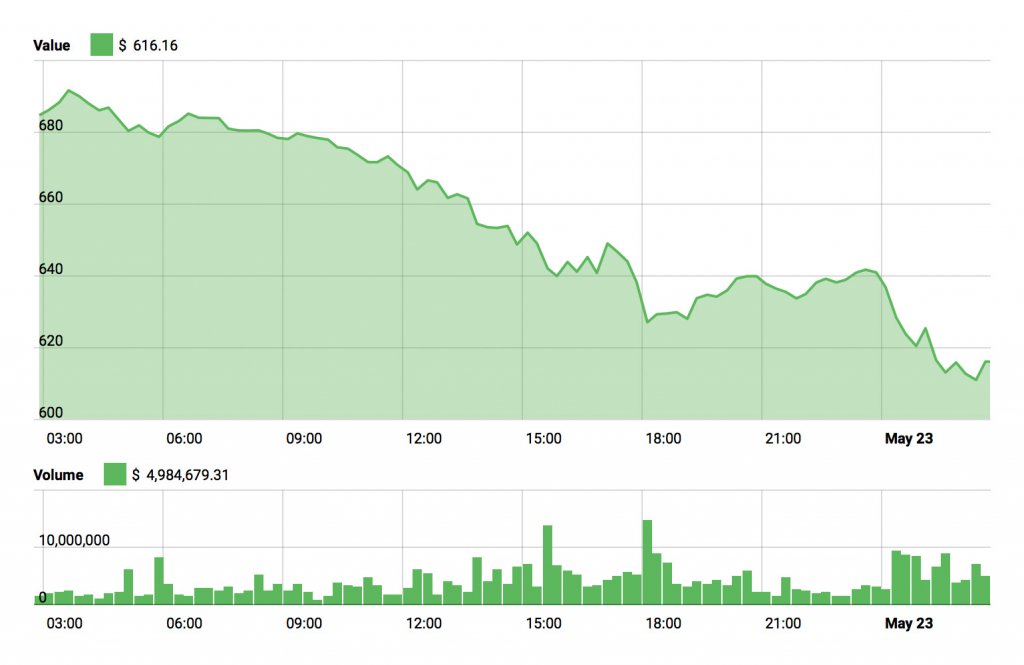

Ethereum (ETH)

After jumping beyond the $715 mark, Ethereum has dropped to $616, which is $98 less than our previous price piece.

Several major players in the financial arena – including JPMorgan Chase & Co. – grouped together a year ago to form the Ethereum Enterprise Alliance (EEA), now considered one of the biggest collaborative efforts in the cryptocurrency space.

The association recently unveiled its next big move with Enterprise Ethereum Client Specification 1.0, which will be the first in a series of common standards for Ethereum development designed to give large businesses easy entry to the Ethereum blockchain and distributed ledger technology (DLT).

EEA executive director Ron Resnick explained,

“The EEA’s Enterprise Ethereum Specification is the result of 18 months of intense collaboration between leading enterprise, technology and platform members within our technical committee. This EEA open-source, cross-platform framework will enable the mass adoption at a depth and breadth otherwise unachievable in individual corporate silos.”

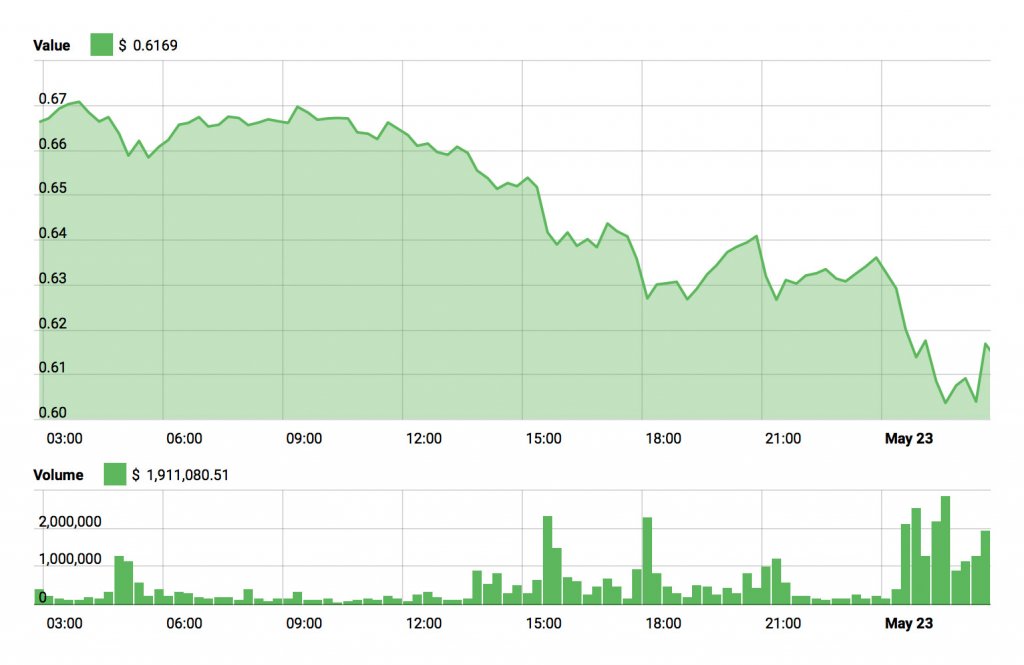

Ripple (XRP)

Ripple is presently trading for 61 cents, roughly seven cents less than where it stood during our previous price discussion.

Executives recently announced they were looking to change XRP’s trading symbol from a simple “X” to something more “curvaceous” and universal, thus amplifying Ripple’s many use cases. At press time, an official design has not been chosen.

Bitcoin Cash (BCH)

Bitcoin Cash has fallen by $190 since our last price piece and is currently trading for roughly $1,049.03. In the past seven days, the currency has lost 17 percent of its value.

With the hard fork now over, CEO of 360 Blockchain USA Jeff Koyen calls Bitcoin Cash one of the most “controversial” coins to exist in the cryptocurrency space.

Koyen noted:

““They insist on calling BCH the ‘real bitcoin.’ This shows confusion among crypto newcomers, and really angers a lot of veterans. As a result, it’s more volatile than most.”

Koyen also commented that Bitcoin Cash miners are being rewarded with only a fraction of their original profits, which suggests BCH might be “struggling to gain traction.”

Litecoin (LTC)

Litecoin has fallen to $124. This is about thirteen dollars less than where it stood during our previous price article.

The currency recently enjoyed newfound publicity after crypto-trading app Abra added direct Litecoin deposits and withdrawals to its platform. LTC will also be used in the app’s smart contract system, allowing investors access to even more altcoins in the future.

Market Summary

The total cryptocurrency market cap has sunk to $344 billion, roughly $39 billion less, or 9% lower than where it stood during our previous price discussion. With many major cryptocurrencies and altcoins trapped in the red, investors are again advised to trade responsibly and prepare themselves for additional losses as the market remains extemeley volatile.

CoinGlass

CoinGlass

CryptoQuant

CryptoQuant

Farside Investors

Farside Investors