Introduction to SALT: Blockchain-Backed Loans

Introduction to SALT: Blockchain-Backed Loans

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

On December 31, 2016, the total cryptocurrency market cap was less than $18 billion. Just one year later, that number approached $800 billion. As cryptocurrencies rose in value, so did the number of people looking at them as a viable investment vehicle. As a result, cryptocurrency investors are holding billions of dollars of valuable digital assets.

Thanks to digital lending platforms, cryptocurrency owners can now use their digital assets as collateral to secure real loans in fiat currency.

Blockchain-Backed Loans

SALT, a digital lending platform based in Denver, Colorado, is among the first lending platforms to enter the crypto space.

Led by CEO Shawn Owen, SALT expands the possibilities for the blockchain to bring a new methodology to the lending marketplace.

The organization boasts a collection of more than 25 team members and advisors. Most notably, Erik Voorhees, CEO of Shapeshift, is a member of SALT’s board of directors.

Their full title, “Secured Automated Lending Technology,” is indicative of their purpose and process. Accordingly, SALT dubs its service as “traditional lending secured by non-traditional collateral.”

Collateral vs. Credit Score

SALT harnesses the power of the blockchain and its accompanying smart contracts to create a new system for distributing loans.

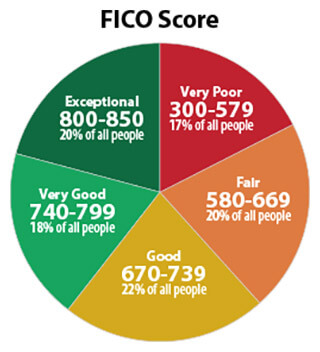

Most lenders determine a borrower’s worthiness by assessing his or her credit score. If borrowers receive a favorable rating, then they are likely to secure a loan.

However, for various reasons, many people have a tarnished credit score, and they are unable to access many of the lending opportunities available to others.

SALT changes the lending paradigm by relying on a borrower’s collateral to determine their creditworthiness. More specifically, SALT allows users to offer their cryptocurrencies and other blockchain-based assets as collateral.

In many ways, this is a novel use-case for cryptocurrencies, and the process is surprisingly simple.

How It Works

Step 1: Acquire a Membership

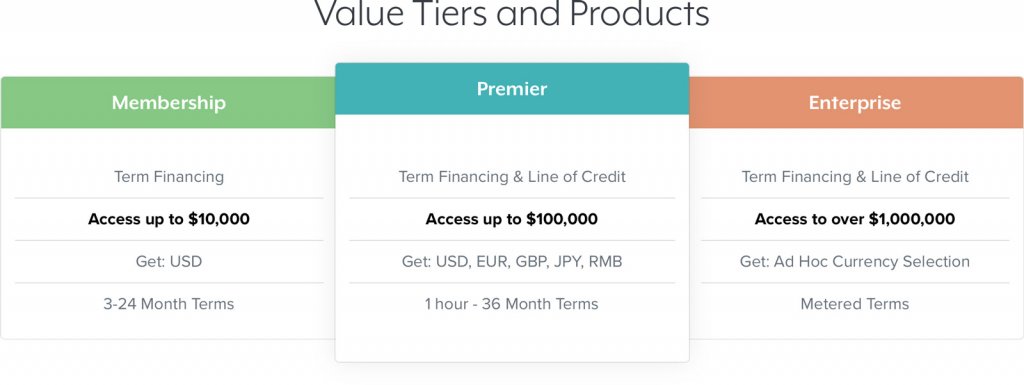

Users become members by purchasing SALT tokens. The platform has three tiers – membership, premier, and enterprise – that offer progressively more accommodating terms for the loans.

Step 2: Send Collateral to the SALT Oracle Wallet

SALT accepts blockchain assets as collateral for a loan. This can include cryptocurrencies like Bitcoin, but it can also include other blockchain-based assets. According to the SALT Q&A page,

“All blockchain assets have the potential to be used as collateral for a Blockchain-Backed Loan.”

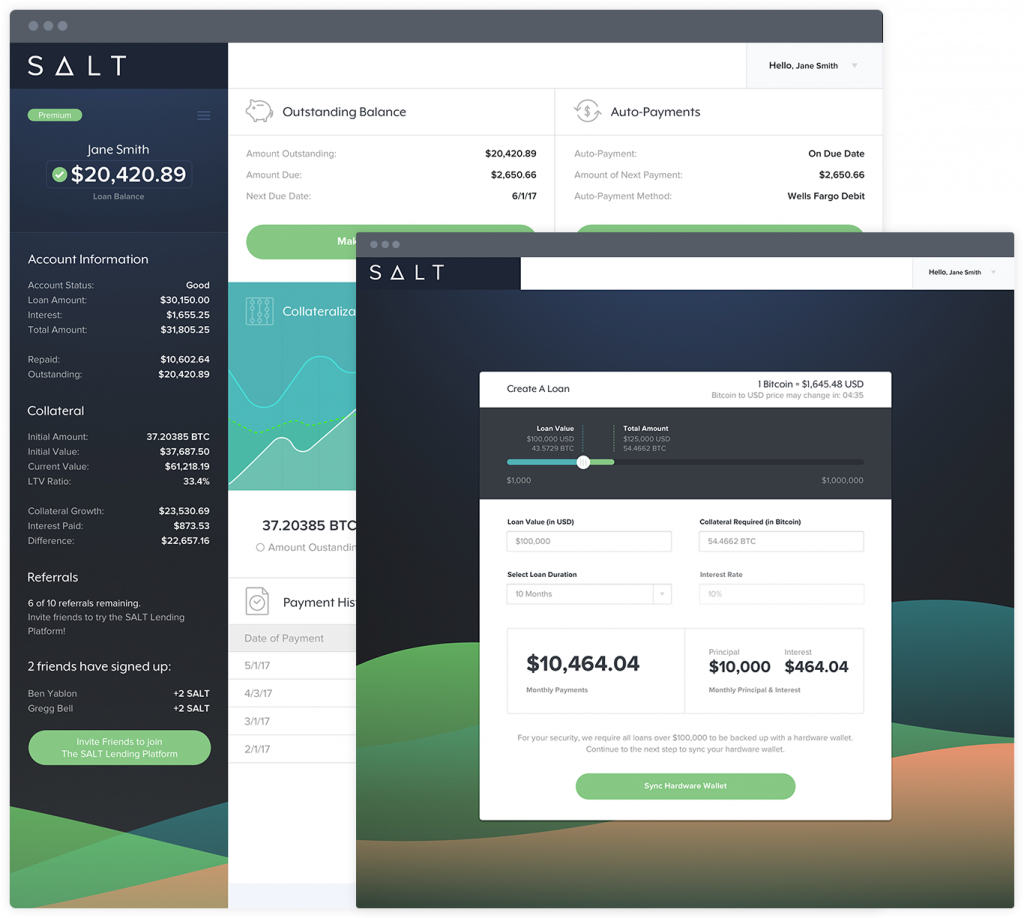

After collateral is verified and accepted, borrowers are sent a Loan Agreement to sign. The speed and ease of smart contracts mean that borrowers receive their funds within just a few days of signing their Loan Agreement.

It’s important to note that the collateral remains the property of the borrower, and they own any price appreciation or depreciation while the asset is being used as collateral.

Step 3: Borrowers Make Payments to the Lender

As with other traditional loans, the repayment calendar and amount are determined beforehand, and users make regular payments until the loan is repaid.

At this time, SALT loans cannot be refinanced. If a borrower misses a payment, a part of the collateral is liquidated to pay that portion of the loan. However, because the borrower owns the collateral assets, SALT ensures that,

“After the principal of the loan and accrued fees are paid out of the collateral, any remaining assets are returned to the borrower.”

Step 4: Collateral Returned

When a borrower repays the entire loan, the collateral is returned. At this point, SALT users are welcome to pursue a new loan, or they can use their blockchain assets for other purposes.

SALT ICO and Price Movement

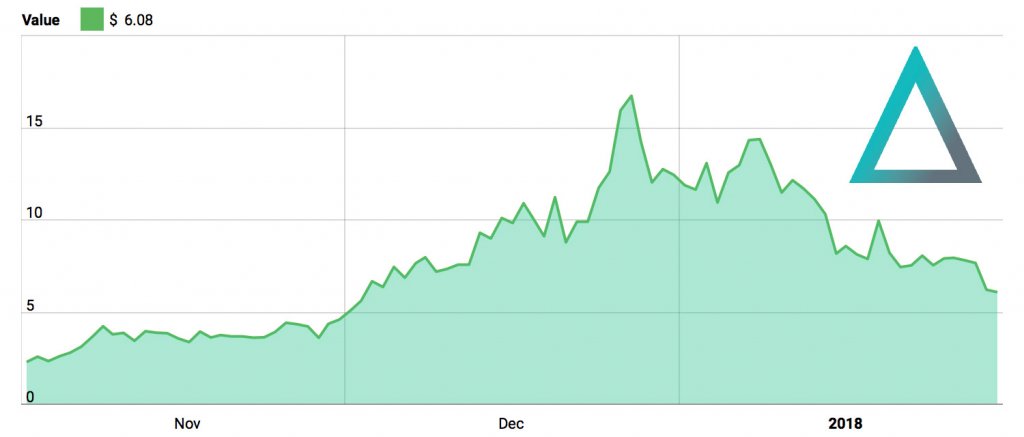

SALT launched its ICO in August 2017. The token sale closed on August 15, 2017, and it raised almost $50 million.

With a total market cap of nearly $320 million, SALT is ranked #77 by market cap, according to the latest data from our coin rankings.

Notable Features

SALT boasts about its ease-of-use as a primary feature of its platform. It’s intuitive design and mobile-friendly platform are intended to cater to crypto enthusiasts and casual investors alike.

Moreover, the promise of an “easy application, fast approval, and no credit checks.” While these promises often accompany less than reputable lending institutions, SALT can reputably make these promises because of the capability of the blockchain and the use of collateral.

In other words, speed and ease-of-use are legitimate qualities rather than predatory promises.

Even without credit checks, SALT insists that they follow anti-money laundering laws and know your customer checks.

SALT Roadmap

SALT has an impressive 2018 product roadmap that includes a development platform, SALT credit cards, altcoin collateralized loans and the SALT Foundation. Combined with their competent business and development team, these seem like very achievable goals for the next year.

SALT Partnerships

The SALT lending platform is predicated on a network of lenders who are fully accredited and are incentivized through competition to offer quality interest rates to borrowers.

SALT has more than a dozen strategic partnerships. These companies are utilizing their services or are partnering in the platform’s development. They include:

SALT Potential Customers

Both individuals and business enterprises have access to SALT’s lending platform. For individuals, there are opportunities for day traders and long-term investors to acquire capital through the lending process. Moreover, there are several use cases for enterprise integration.

The types of member profiles that SALT outlines for individuals will typically include long-term crypto investors ands day-traders.

Their enterprise member profiles are much more broad and would potentially include:

- Exchanges

- Remittance services

- Gaming platforms

- Payment processors

- Miners

- ICOs

- Banks

SALT Community

SALT has a strong social media presence with more than 36,000 Twitter followers. In addition, SALT maintains an active presence on Reddit with almost 4,000 subscribers, and their Facebook community has more than 10,000 members.

Where to Buy SALT

The SALT token is an ERC20 token on the Ethereum blockchain. The SALT token is well-represented on crypto exchanges, and investors can purchase SALT tokens from Binance, Bittrex, and Huobi – each of which is ranked in the top ten crypto exchanges by transaction volume.

SALT tokens can be stored in the platforms native SALT Oracle Wallet or an ERC20 wallet (myEtherWallet, MetaMask, etc).

Concluding Thoughts

SALT joins an emerging crypto lending market that is utilizing the growing popularity of cryptocurrencies to create new services. SALT differentiates itself by using blockchain-based assets to provide fiat loans rather than digital currency loans. In this way, SALT is joining the comprehensive crypto ecosystem with traditional financial expressions.

Its success is largely contingent on its ability to procure viable, accredited lending institutions to participate in their platform. After all, the lending platform is useless if it can’t achieve its most basic function. However, their early success is an encouraging start, and their next steps are worth watching.

If you are interested in learning more about SALT, check out our coin profile or watch this short explainer video (1:36):

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass

Blockchain.com

Blockchain.com

Farside Investors

Farside Investors