Rapid shift in Bitcoin liquidity reflects strong holder conviction

Rapid shift in Bitcoin liquidity reflects strong holder conviction Quick Take

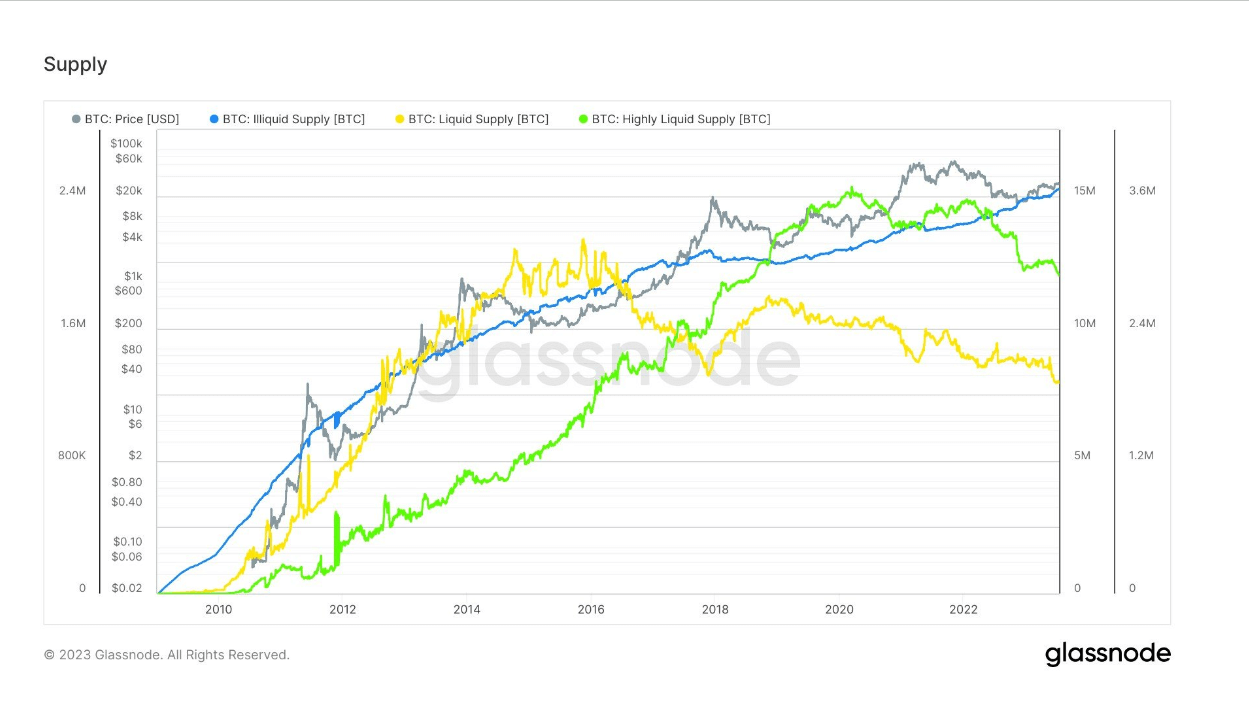

The latest data reveals that a significant portion of the Bitcoin supply, approximately 15.2 million, is deemed illiquid. In other words, these are held by entities that aren’t regularly selling or trading, potentially implying a long-term investment strategy.

On the other hand, around 4 million Bitcoin are classified as liquid or highly liquid, reflecting frequent buying and selling activities. It’s worth noting that the speed of this shift in liquidity since May is one of the fastest ever observed.

This trend could signal increased conviction from holders, reinforcing Bitcoin’s store of value proposition while also potentially leading to reduced selling pressure in the market.