Profitable Bitcoin supply nears cycle peak, could precede market correction

Profitable Bitcoin supply nears cycle peak, could precede market correction Quick Take

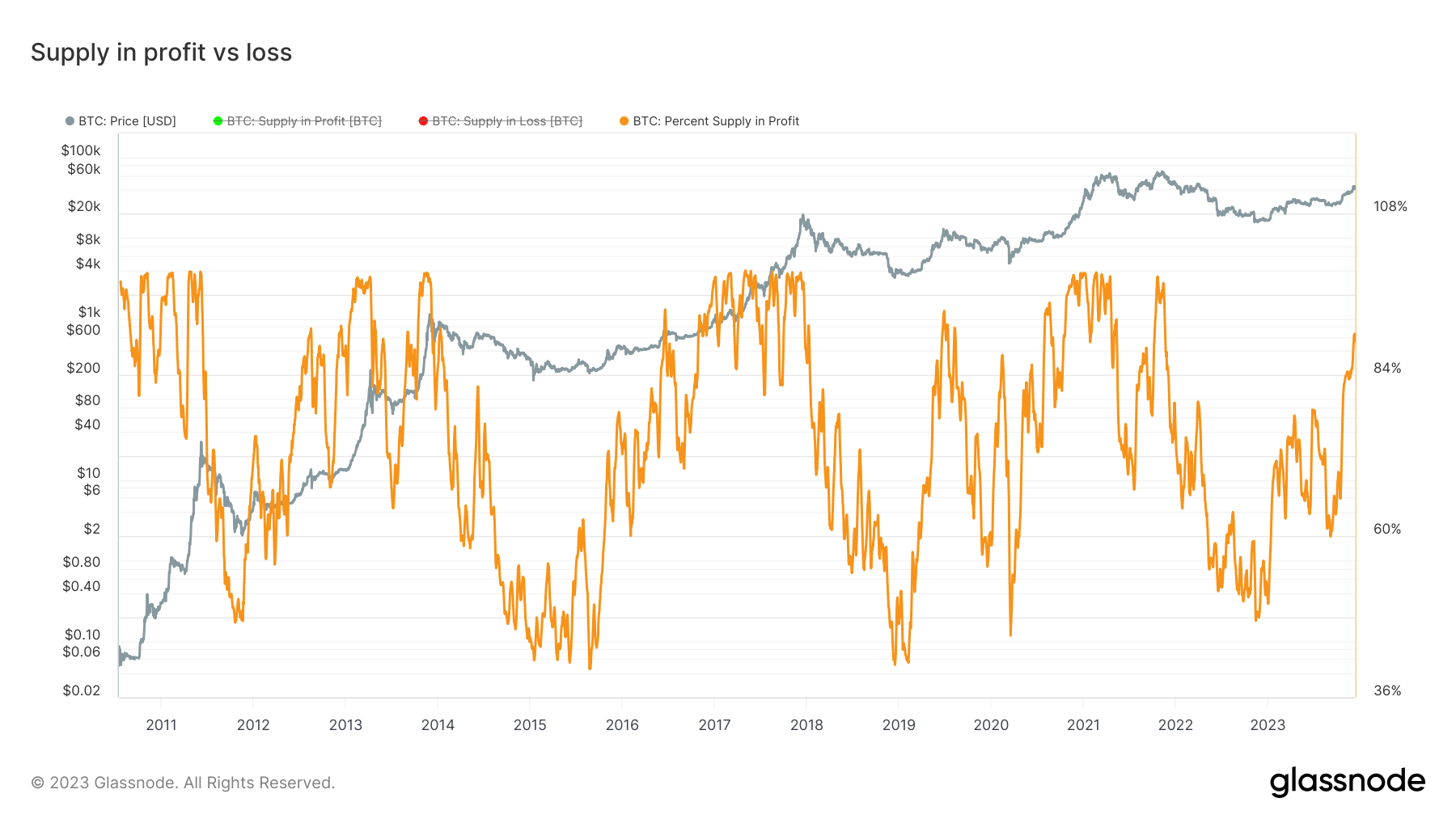

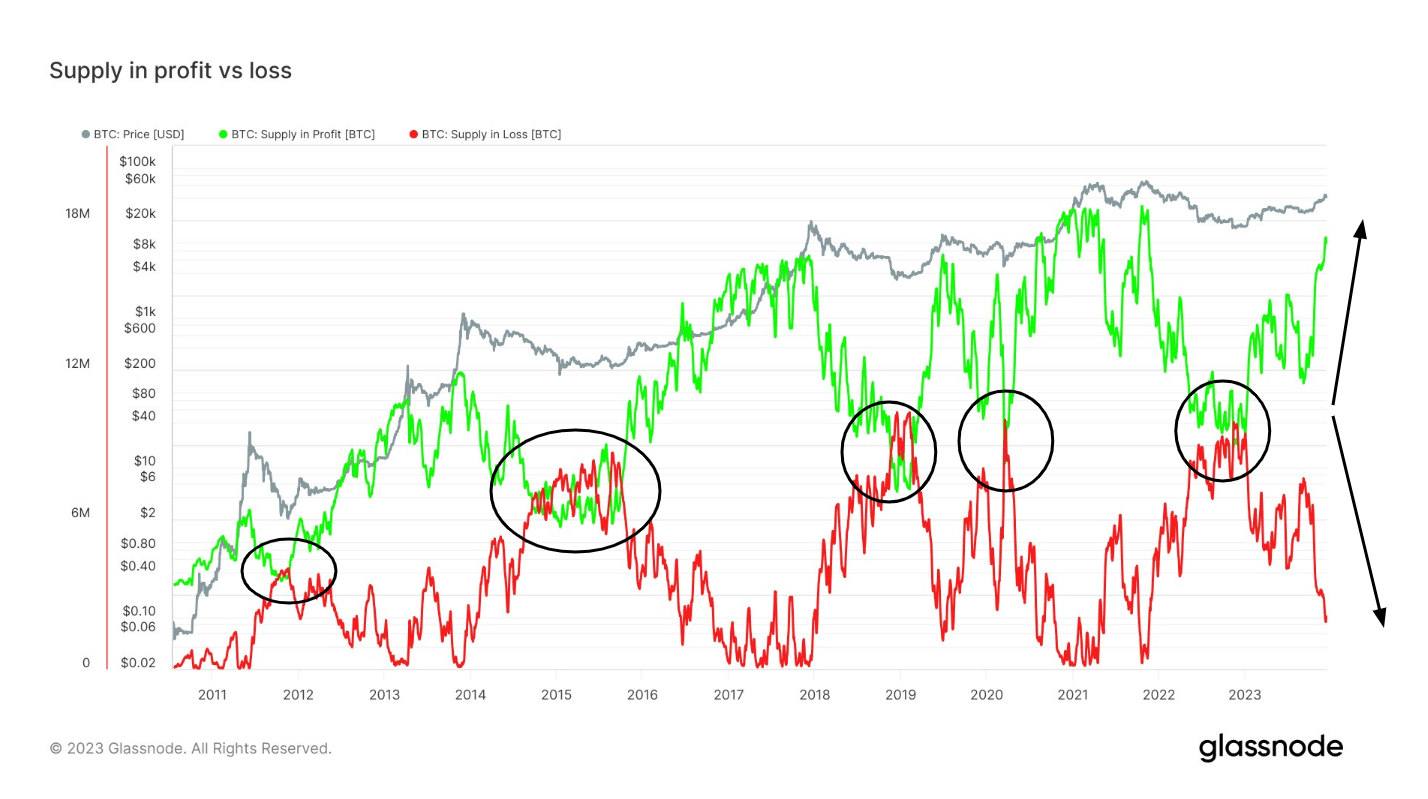

Analyzing the supply dynamics of Bitcoin reveals a telling story of profit and loss convergence, a significant indicator of market fluctuations. Of the approximately 19.3 million Bitcoin in circulation, an estimated 17.3 million are in profit, leaving 1.9 million at a loss. The convergence of supply in profit and loss – where losses supersede profits – serves as a marker for the bottom in Bitcoin cycles. This phenomenon has been observed recurrently during bear markets, particularly in 2015, 2019, 2020, 2021, and 2022.

Presently, the Bitcoin market is navigating one of its most extensive divergence levels, with almost 89% of Bitcoin supply in profit. This is only slightly below the cycle highs when the profit figure hits a stunning 100% – a situation indicative of a market peak where every holder is in profit. This trend analysis underscores the cyclical nature of the digital asset market and the inherent potential for profit and loss convergence, serving as an indicator of market turns.