Powell’s dovish stance aligns with Federal Reserve’s balance sheet increase

Powell’s dovish stance aligns with Federal Reserve’s balance sheet increase Quick Take

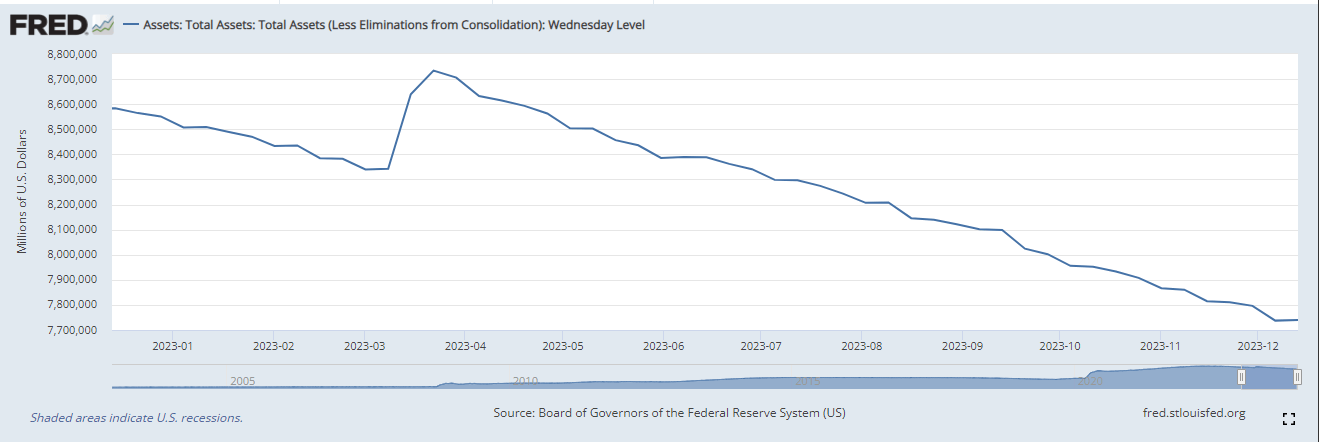

Since March 2022, the Federal Reserve, under the leadership of Chairman Powell, has been executing a quantitative tightening policy. The policy, which involves the sell-off of assets, has witnessed the balance sheet of the Federal Reserve shrink by approximately $1.2 trillion, dropping from $8.9 trillion to $7.7 trillion.

However, a granular analysis of recent data reveals an intriguing turn of events. As per the current week-over-week data, the balance sheet instead exhibits a slight increment, swelling from $7.737 trillion to $7.739 trillion.

While it’s just one week’s data, coupled with Powell’s dovish remarks, it indicates a potential fueling of the inflation fire. This development could substantially hinder reaching the 2% inflation target, further complicating the economic landscape.