Analysts clash over future of Bitcoin ETFs as institutional interest lags

Analysts clash over future of Bitcoin ETFs as institutional interest lags Quick Take

Jim Bianco, head of Bianco Research, has been a vocal critic of the Bitcoin ETFs due to their centralization concerns.

Bianco recently said:

“A spot ETF is NOT, repeat not, decentralized!”

He also believes that the main investors in these ETFs are

“Orange FOMO poker chips for paper-handed small-time traders (degens).”

Despite Bitcoin trading at roughly $63,000 as of press time — up from $49,000 at the ETF launch — Bianco believes these holders are sitting close to breaking even and could become big sellers if the flagship crypto’s value enters a downtrend.

In the last 11 trading sessions, BTC ETFs experienced outflows on 8 trading days, according to Farside data, yet the price has been ranging between $60,000 and $67,000.

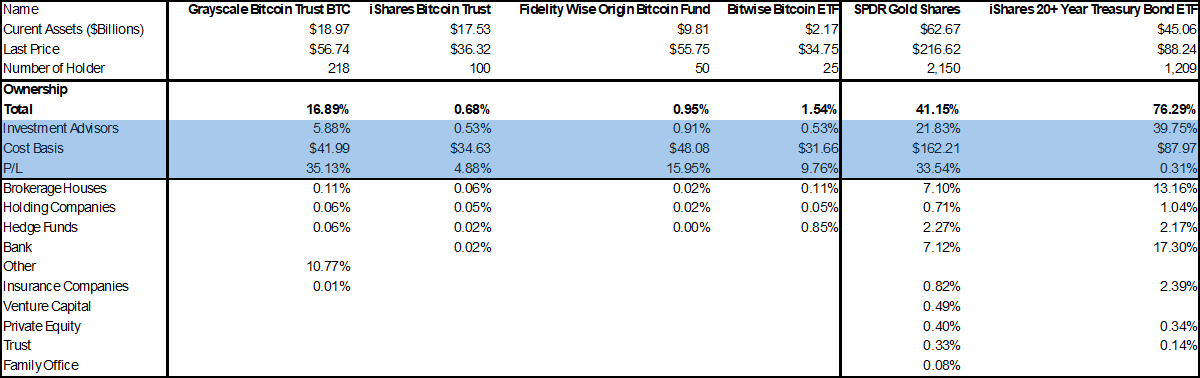

Data from Citibank, shared by Bianco, shows that Investment Advisors account for about 35% of all ETFs. However, they hold less than 1% of the new spot Bitcoin ETFs like BlackRock’s IBIT, Fidelity’s FBTC, and Bitwise’s BITB.

This is in stark contrast to the SPDR gold shares ETF (GLD), which has a 22% allocation by Investment Advisors, and the iShares 20+ year treasury bond ETF (TLT) with a 40% allocation.

Bloomberg ETF analyst Eric Balchunas offered a counterpoint, noting that the majority of 13F filings, which reveal institutional holdings, have yet to roll in. He expects over 500 advisors to report owning shares of one of the spot BTC ETFs by May 15, which would break records for a new fund’s first three months.

Balchunas argues that advisors move slower than retail investors, and while current holdings are mostly small, the ETFs could reach 40% advisor ownership over time, like the futures Bitcoin ETF BITO.

As the new Bitcoin spot ETFs find their footing, the tug-of-war between institutional and retail demand will shape their trajectories and test Bianco’s “orange FOMO” thesis.