Over 92% of Bitcoin supply now profitable as price soars past $47,000

Over 92% of Bitcoin supply now profitable as price soars past $47,000 Quick Take

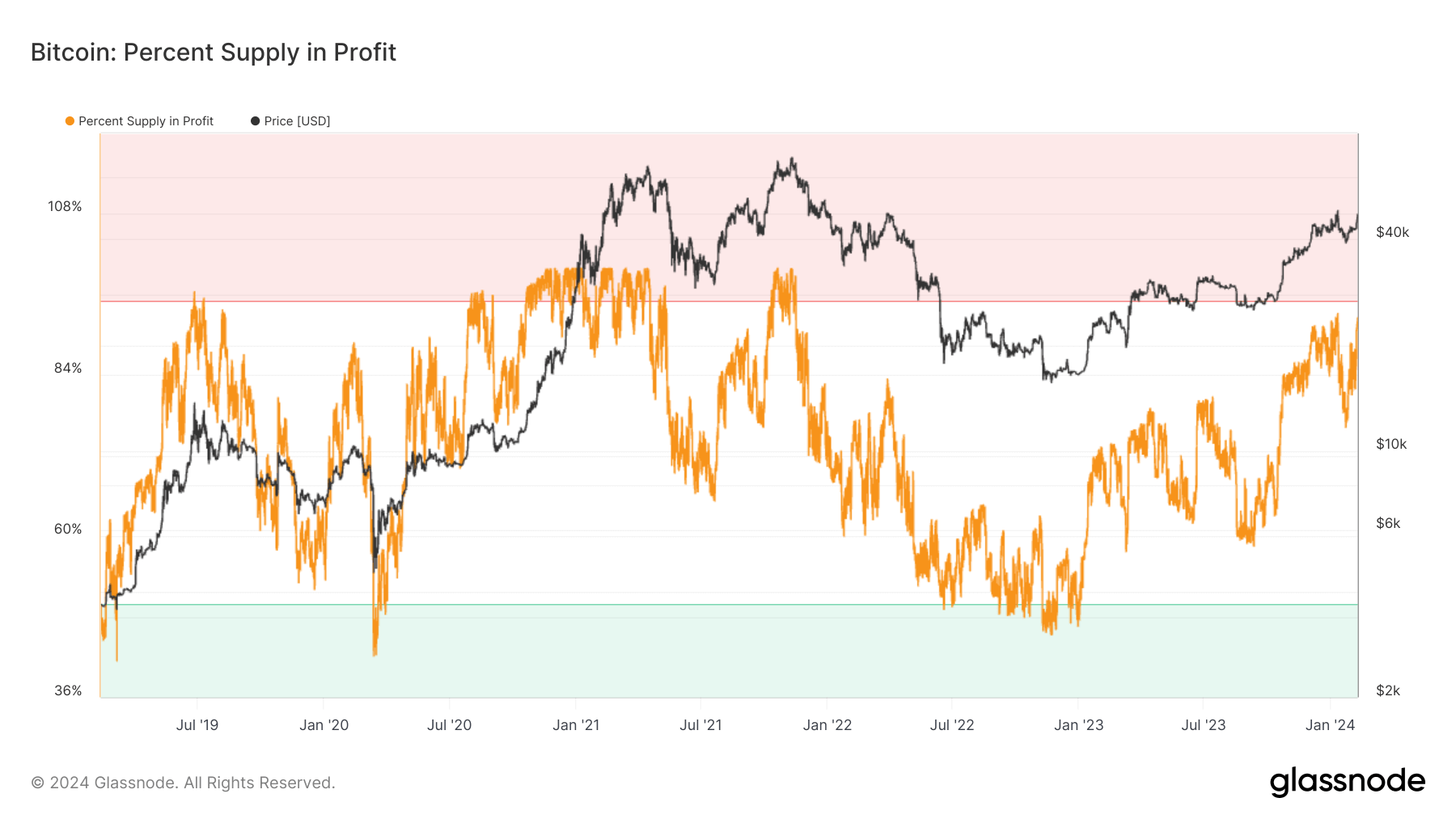

Bitcoin’s recent surge past $47,000 is accompanied by a notable development — over 92.5% of its circulating supply is now in profit. The figure represents the percentage of existing coins whose price at their last movement was lower than the current price.

Interestingly, during Bitcoin’s previous peak at $49,000, just above 93% of the supply was in profit, reflecting a correlation between the digital currency’s price increase and the percentage of its supply in profit.

Historical data offers another intriguing perspective. When over 95% of Bitcoin’s supply was in profit, it has typically indicated a local top in the price. The last instance was in November 2021, when Bitcoin reached its all-time high of $69,000.

Conversely, when less than 50% of its supply was in profit, it usually pointed to a price floor. The most recent occurrences were during the FTX collapse in November 2022 and the COVID-19 pandemic’s market impact in March 2020.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass