Institutional interest shifts as Bitcoin ETFs attract capital, Ethereum ETFs continue to bleed

Institutional interest shifts as Bitcoin ETFs attract capital, Ethereum ETFs continue to bleed Quick Take

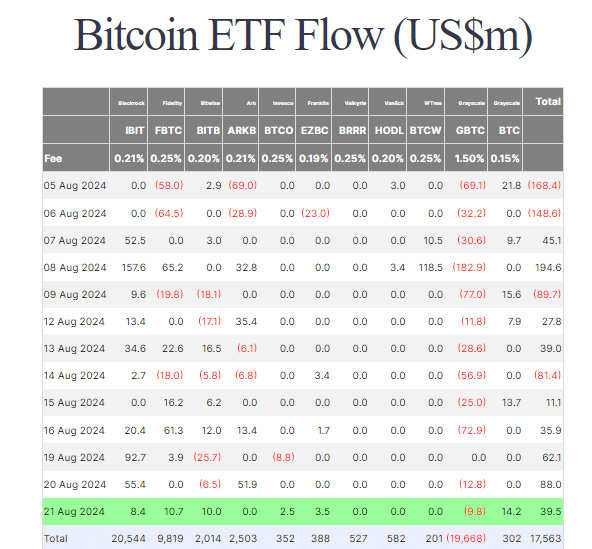

Bitcoin

On Aug.21, Bitcoin ETFs experienced inflows totaling $39.5 million, according to data from Farside. BlackRock’s IBIT saw an $8.4 million inflow, followed by Fidelity’s FBTC, which saw a $10.7 million increase. Bitwise’s BITB and Invesco’s BTCO also contributed, with $10.0 million and $2.5 million in inflows, respectively. Franklin Templeton added $3.5 million, while Grayscale BTC saw a $14.2 million inflow. However, Grayscale’s GBTC ETF experienced a $9.8 million outflow, slightly dampening the overall positive trend. These inflows bring the total assets in Bitcoin ETFs to $17.6 billion.

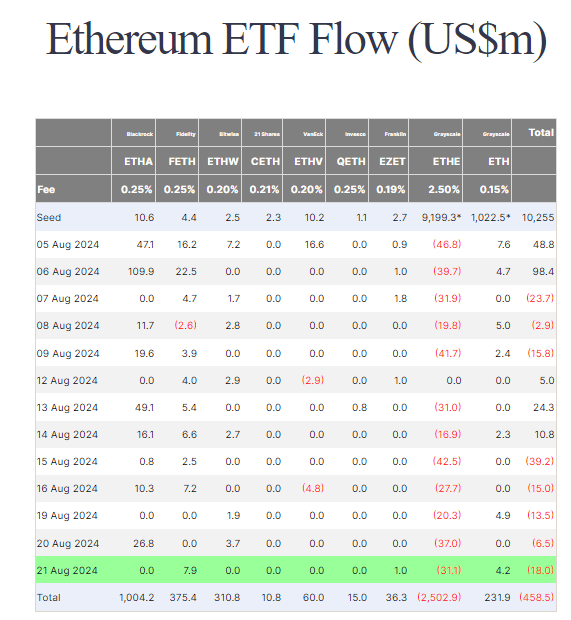

Ethereum

In contrast, Ethereum ETFs continued to struggle, marking their fifth consecutive trading day of outflows. The latest data shows an $18 million outflow, driven by a significant $31.1 million withdrawal from Grayscale’s ETHE. According to Farside data, this brings the total outflows from Ethereum ETFs to a substantial $458.5 million. The ongoing outflows highlight a shift in investor sentiment away from Ethereum, even as Bitcoin continues to attract capital.

Farside Investors

Farside Investors

CoinGlass

CoinGlass