Deribit experiences substantial capital inflows, the largest since Luna debacle

Deribit experiences substantial capital inflows, the largest since Luna debacle Quick Take

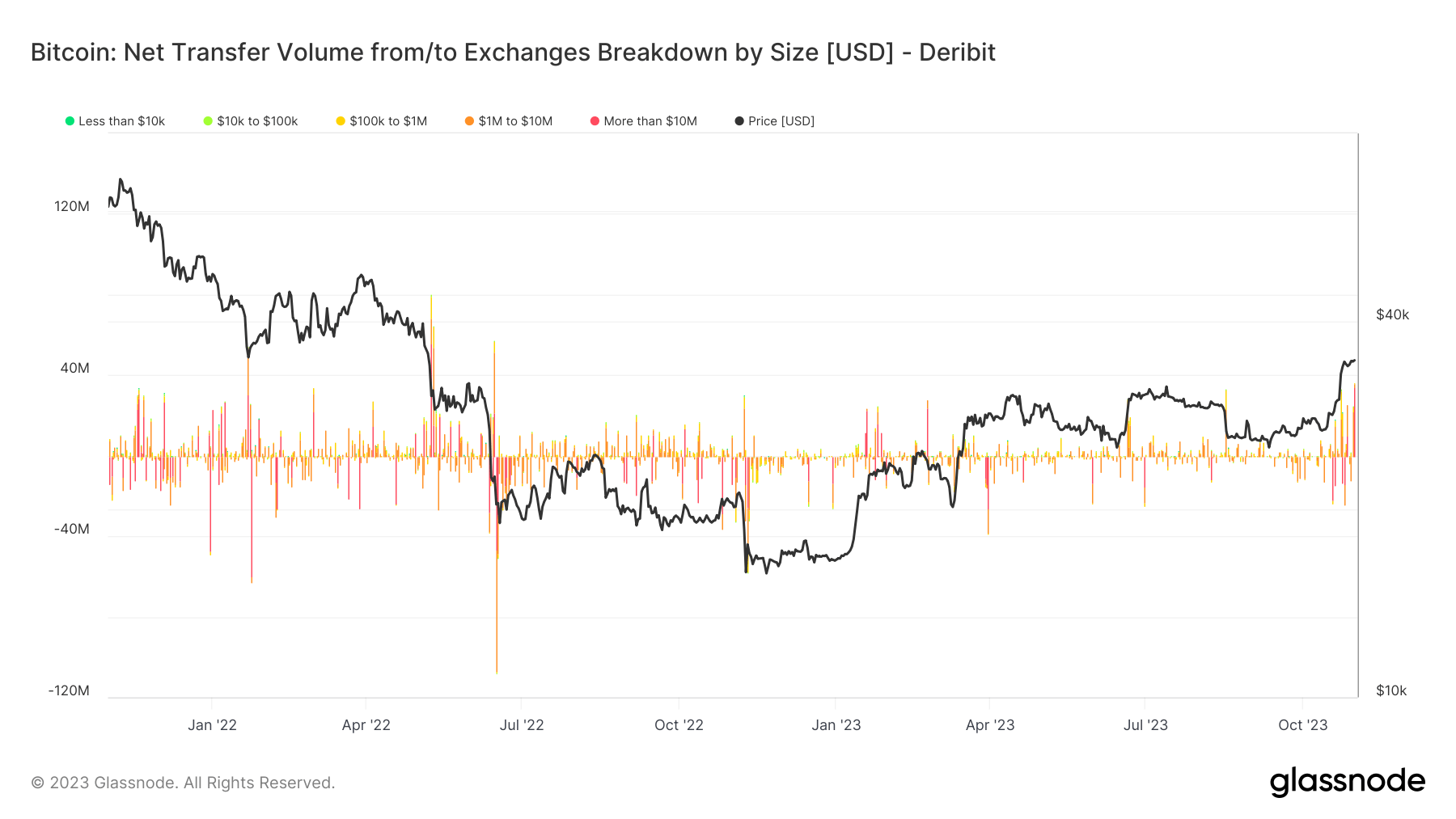

The crypto landscape recently highlighted an intriguing pattern in capital inflow, with crypto exchanges Deribit and Crypto.com registering their largest inflows this year. In particular, Deribit recorded a significant inflow of around $34M yesterday, Oct. 31, a development underpinned by large withdrawals by so-called ‘crypto whales.’

This is not an isolated event. A similar narrative unfolded at Crypto.com, another key player in the crypto exchange domain. Although these inflows might seem minimal in the grand scope of crypto transactions, they herald a broader trend of massive inflows and outflows at respective exchanges, underscoring the fluidity and dynamism intrinsic to the crypto market.

Notably, these sizable inflows constitute the most substantial since the Luna debacle in June 2022, pinpointing an intriguing trajectory for crypto exchange movements in the post-Luna era.

As evident from recent data, the aggregate activity of both inflows and outflows on Deribit has started to escalate significantly more than anything witnessed in the past year.