Decline in Bitcoin margined futures signals market shift towards stable collateral

Decline in Bitcoin margined futures signals market shift towards stable collateral Quick Take

The prospect of Cboe Digital introducing margin futures trading for Bitcoin and Ethereum in 2024 comes at a time of significant evolution in the crypto collateral landscape.

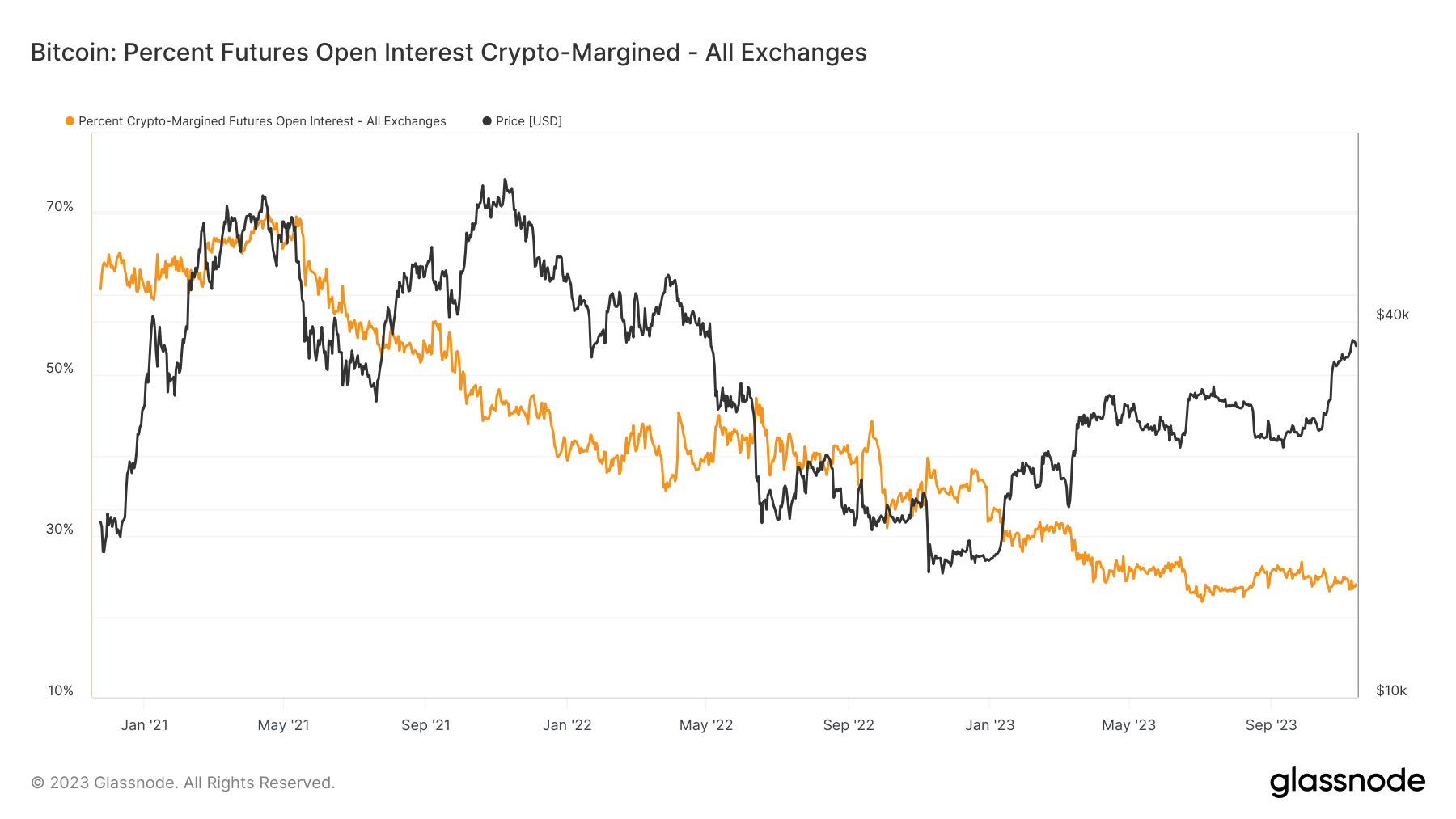

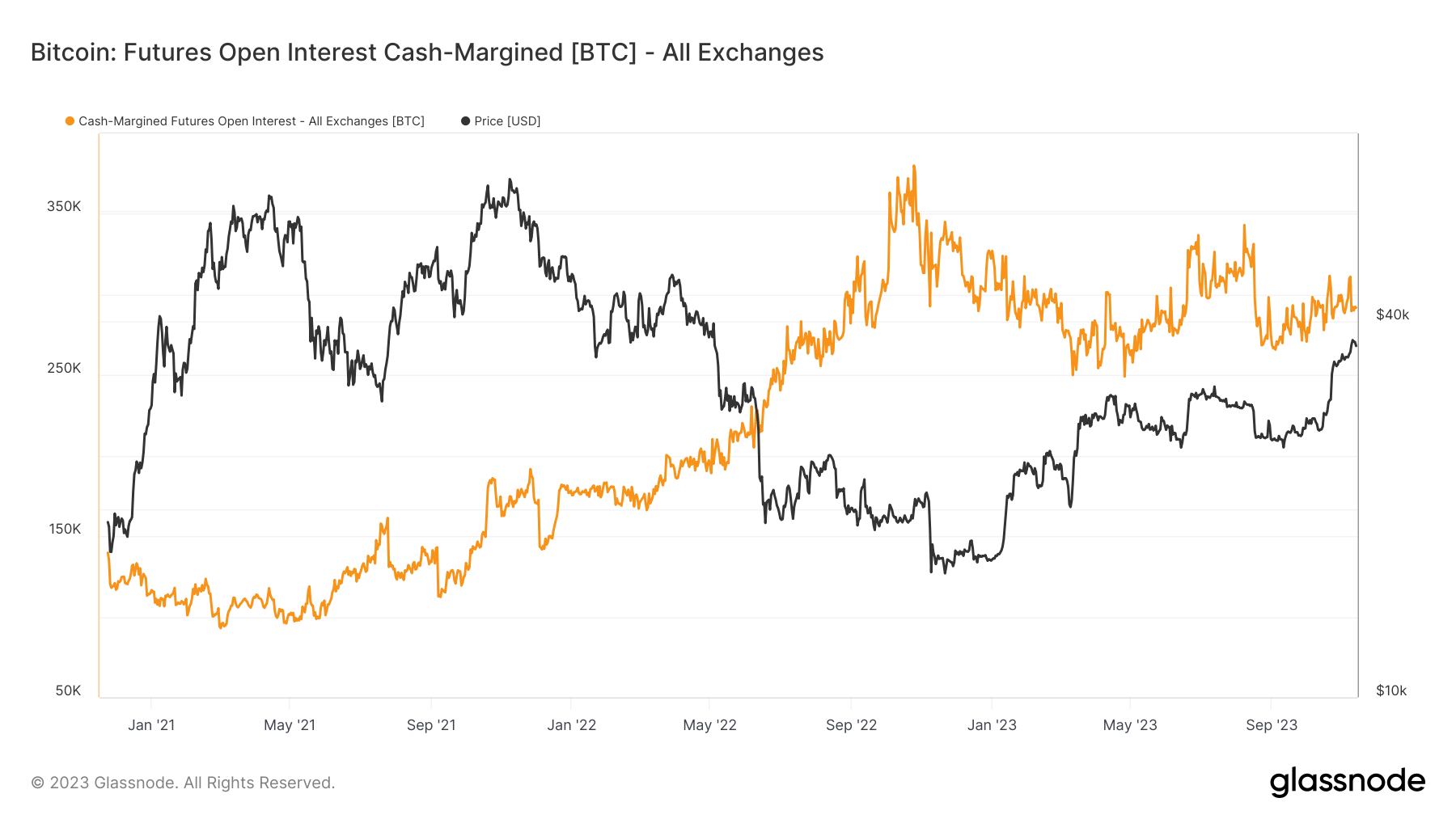

Analyzing the data from Glassnode reveals a steady decline in the number of futures contracts open interest margined in native coins such as BTC over the past three years, plunging from a peak of 225k BTC to a current figure of 92k BTC. In terms of percentage, it has shrunk from 70% of all futures open interest to a mere 24%.

This trend marks an inclination towards using stablecoins or dollars as the favored form of collateral, signaling a shift away from the volatility associated with cryptocurrencies. Bitcoin and cryptocurrencies can be prone to rapid fluctuations in value, which has the potential to exacerbate liquidations and cascades on both upward and downward swings. By contrast, the use of dollars or stablecoins creates a more stable collateral base, reducing the impact of market volatility.

With approximately 400k BTC in open interest in total, it is evident that the crypto futures market is adapting to the needs of both retail and institutional investors. This shift to more stable forms of collateral could be a significant factor in managing market volatility and attracting new entrants into the crypto space.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass