CME sees over 100k BTC in open interest amidst rising institutional interest

CME sees over 100k BTC in open interest amidst rising institutional interest Quick Take

The interest in Bitcoin is on an upward trajectory, a trend palpable in the recent data analysis. One aspect that has drawn media attention, including CryptoSlate, is the potential approval of a Bitcoin spot Exchange Traded Fund (ETF). This development could act as a springboard, propelling Bitcoin into the mainstream financial ecosystem by providing a regulated and simplified method of investment.

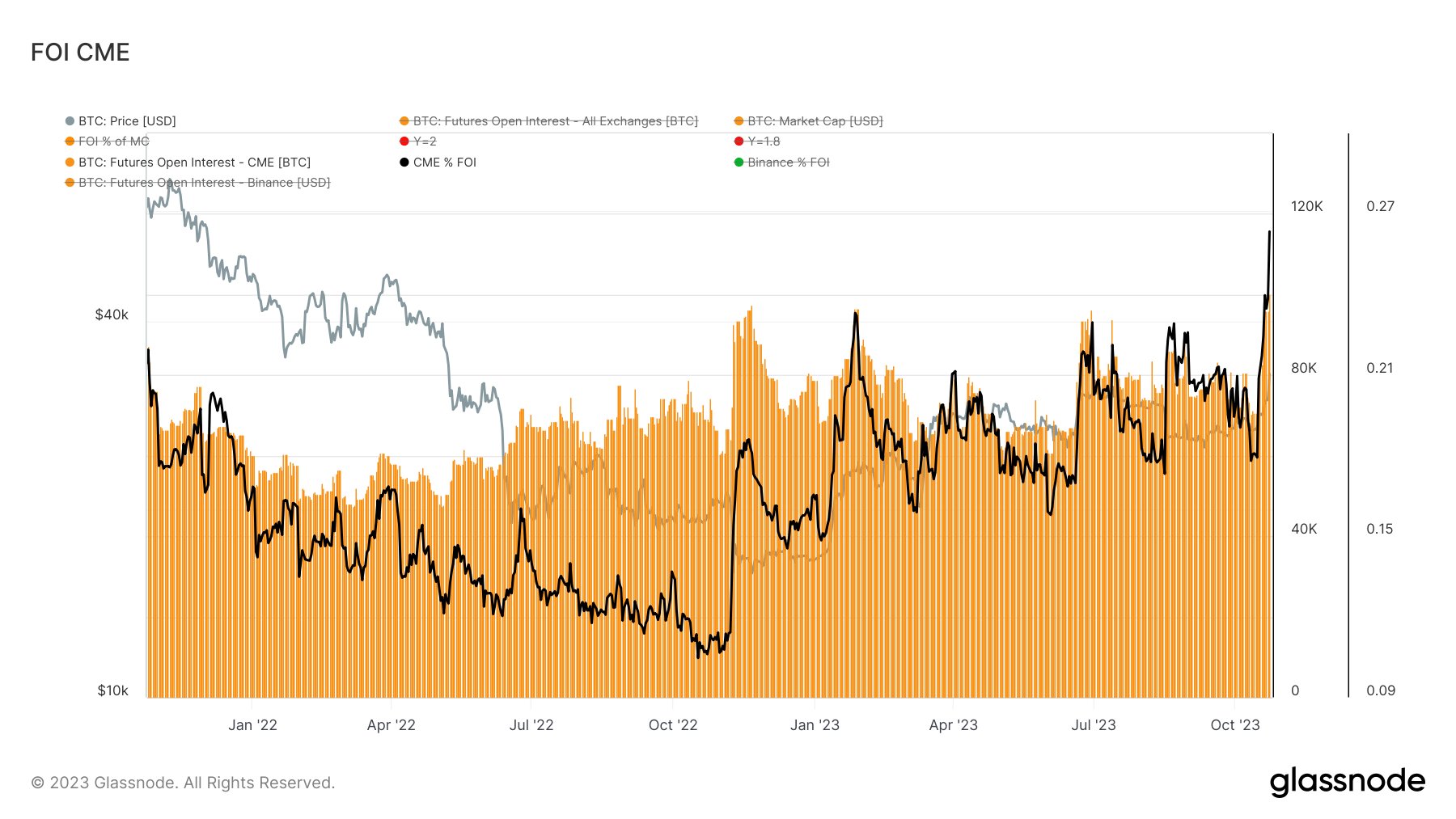

The Chicago Mercantile Exchange (CME), a favorite platform among institutions, has seen its open interest exceed 100,000 Bitcoin, which is approximately equivalent to $3.1 billion. Approximately 27% of the total open interest now resides with CME, marking the highest level ever recorded.

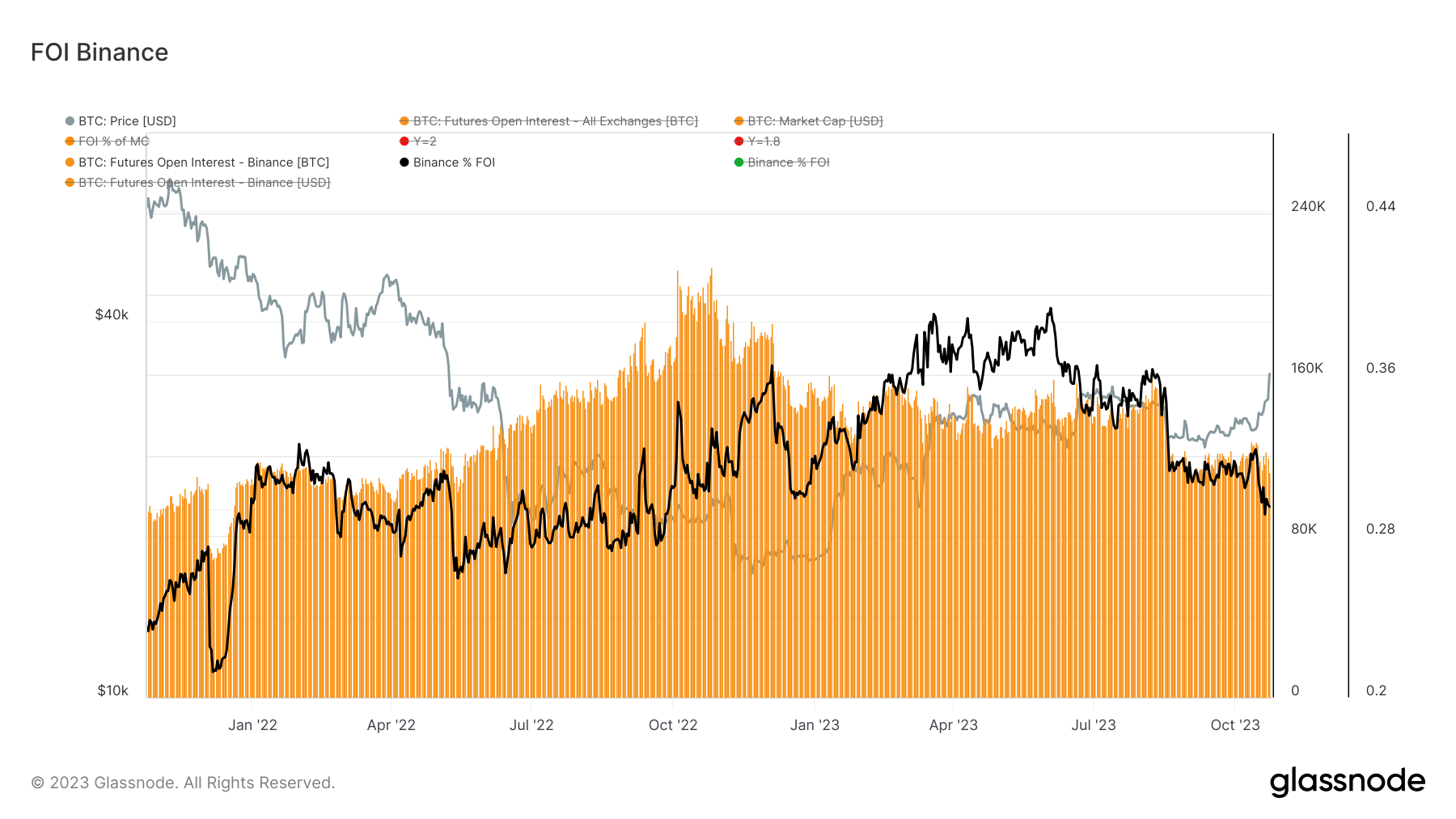

On the other hand, Binance holds an open interest of about 112,000 Bitcoin, accounting for just under 30% of the market, a figure nearing its lowest point for the year to date. An exciting disparity is beginning to emerge between Binance and CME.