Bullish signal for Bitcoin as realized price outpaces long-term holder cost

Bullish signal for Bitcoin as realized price outpaces long-term holder cost Quick Take

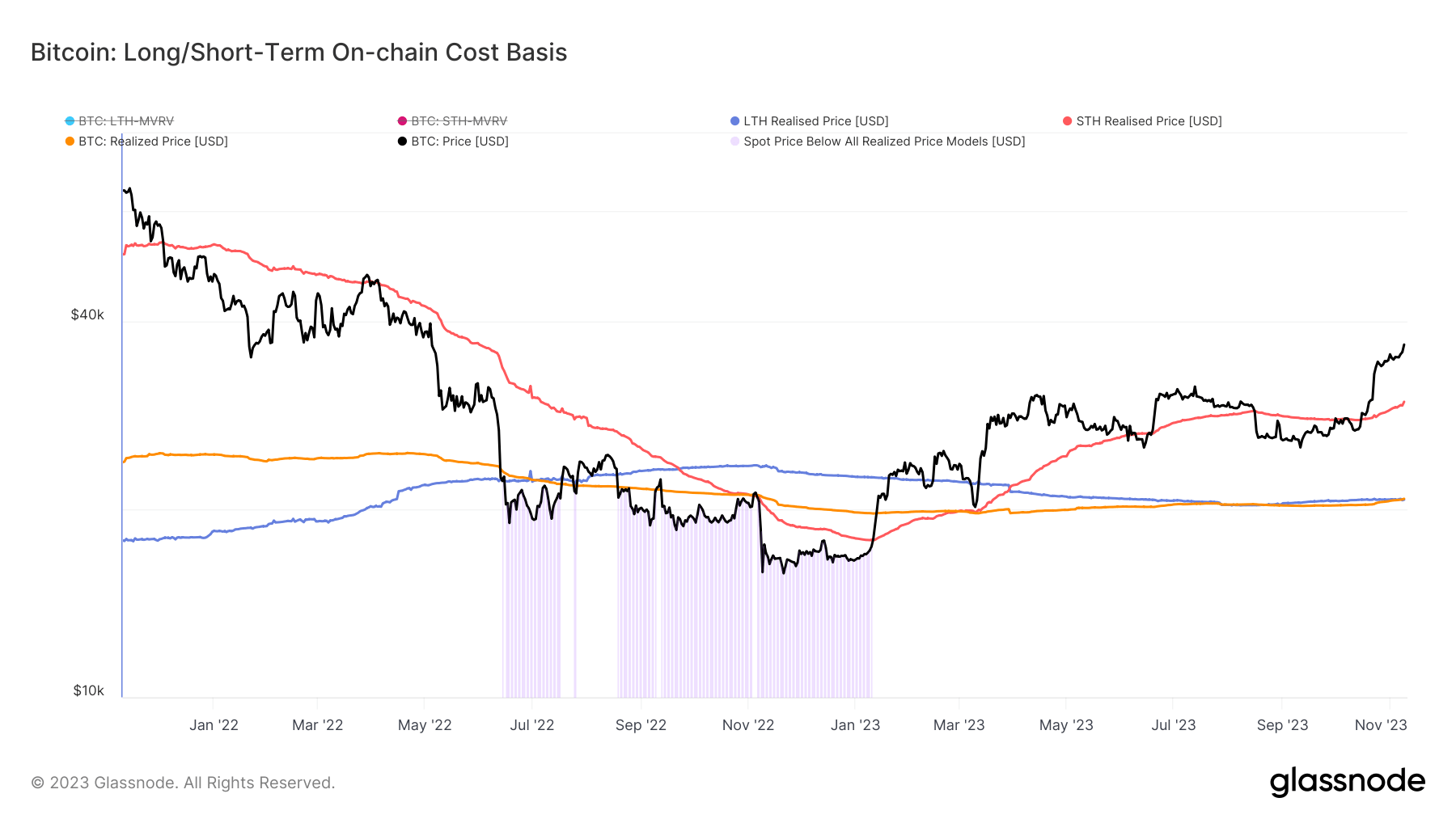

Bitcoin is experiencing a bullish breakout, indicated by the realized price, the average cost at which all existing Bitcoins were last moved, surpassing the realized price for long-term holders (LTHs). The realized price now stands at $20,796, slightly above the LTH realized price of $20,725.

The LTH realized price represents the average acquisition cost of Bitcoins that have been inactive for at least 155 days and are not stored in exchange reserves, signifying coins that are less likely to be sold in the short term.

| Type | Realized Price |

|---|---|

| LTH Realized Price | $20,725 |

| Realized Price | $20,796 |

| STH Realized Price | $29,739 |

Table showing the difference between the realized price for long-term holders, short-term holders, and the total supply on Nov. 10, 2023 (Source: Glassnode)

The previous struggle between these two levels, evident in July’s data, failed to culminate in a breakout. Market watchers are now keenly waiting for a sustained breakout and an uptrend in realized prices.

Furthermore, the realized price for short-term holders (STHs), which signifies the average on-chain acquisition cost for coins moved within the last 155 days and stored outside exchange reserves, has been on a consistent upward trend, currently valued at $29,739. This metric represents the coins most likely to be spent on a given day.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass