Bitcoin’s flat trend amid surging treasury yields signals potential price upheaval

Bitcoin’s flat trend amid surging treasury yields signals potential price upheaval Quick Take

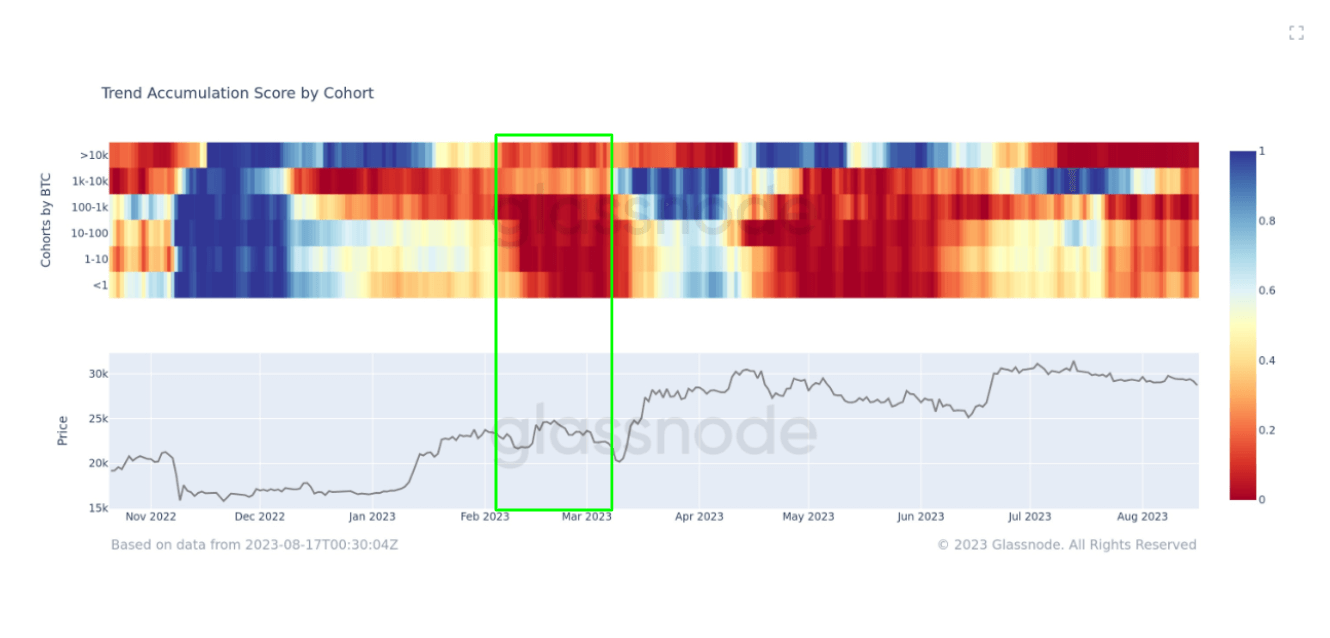

A striking parallel is observed in the price behavior of Bitcoin during the banking collapse in March 2023 and the current market conditions. Before the banking downfall, Bitcoin’s price remained relatively dormant, oscillating in the narrow band of $23,000 to $25,000. The collapse of SVB triggered a fall, pushing Bitcoin below the $20,000 threshold.

Fast forward to today, and a similar scenario appears to be unfolding. Despite slipping below $29,000, Bitcoin’s price still manifests a flat trend underpinned by historically low volatility. Against the backdrop of this placidity, treasury yields are experiencing a surge. While it is a tad early to predict a precise outcome, these factors suggest a brewing change in Bitcoin’s price direction.

This juxtaposition underlines the interconnectedness of crypto assets with traditional banking scenarios and broader market dynamics. It’s a testament to the fact that while Bitcoin operates on decentralized principles, its price movements are not entirely immune to systemic financial events.