Bitcoin transactions plummet by over 50% in a week

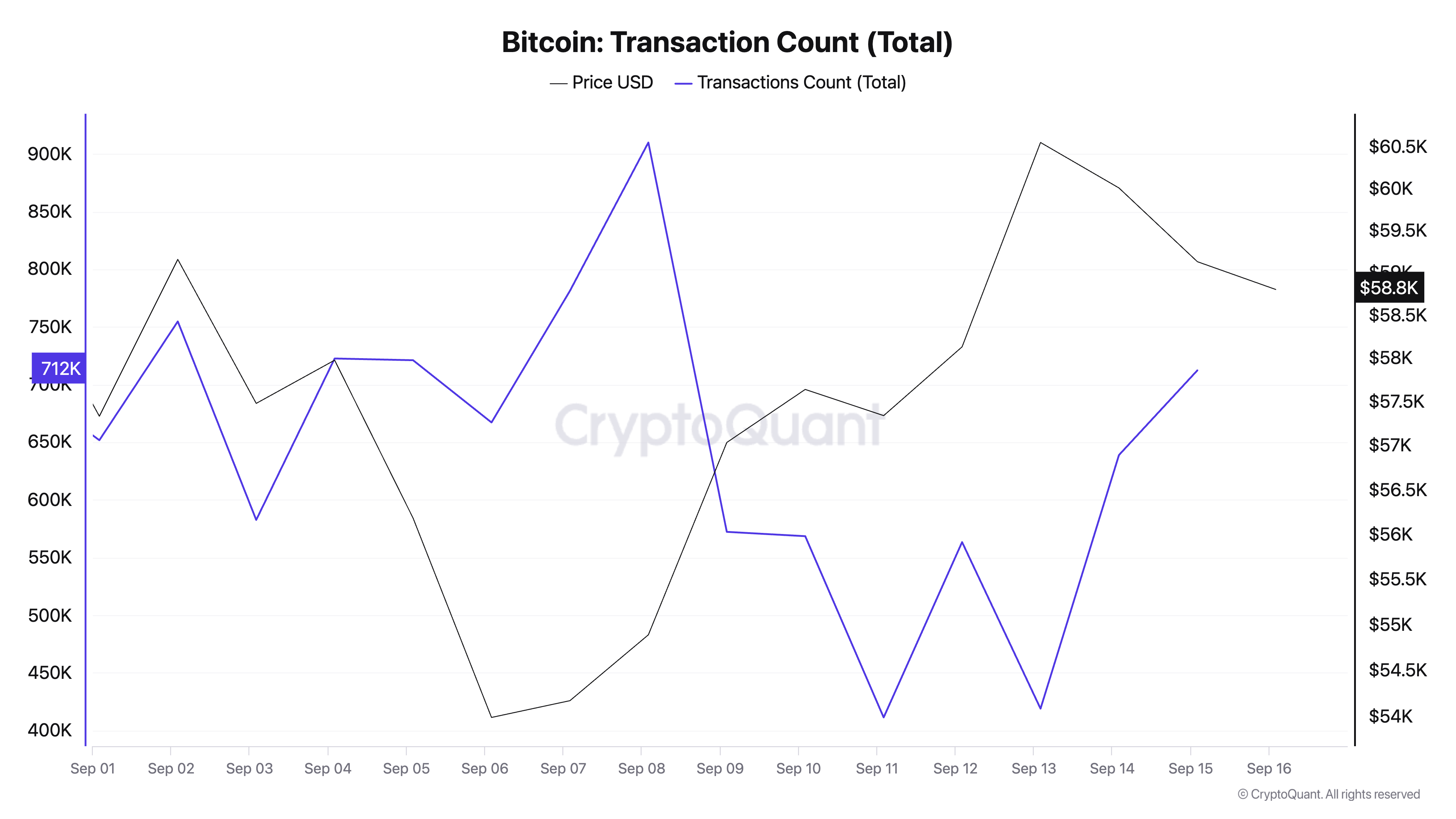

Bitcoin transactions plummet by over 50% in a week There has been a notable drop in the total number of Bitcoin transactions in the past week. Between Sept. 8 and Sept. 11, it decreased from 909,000 to 412,000, showing a market cooldown.

This sharp decline aligns with a noticeable drop in network activity, likely influenced by an overall reduction in trading volume after several days of saturation. However, with the total number of transactions recovering to around 712,000 by Sept. 15, we can see that Bitcoin’s break above $59,000 reignited some stagnant trading volume.

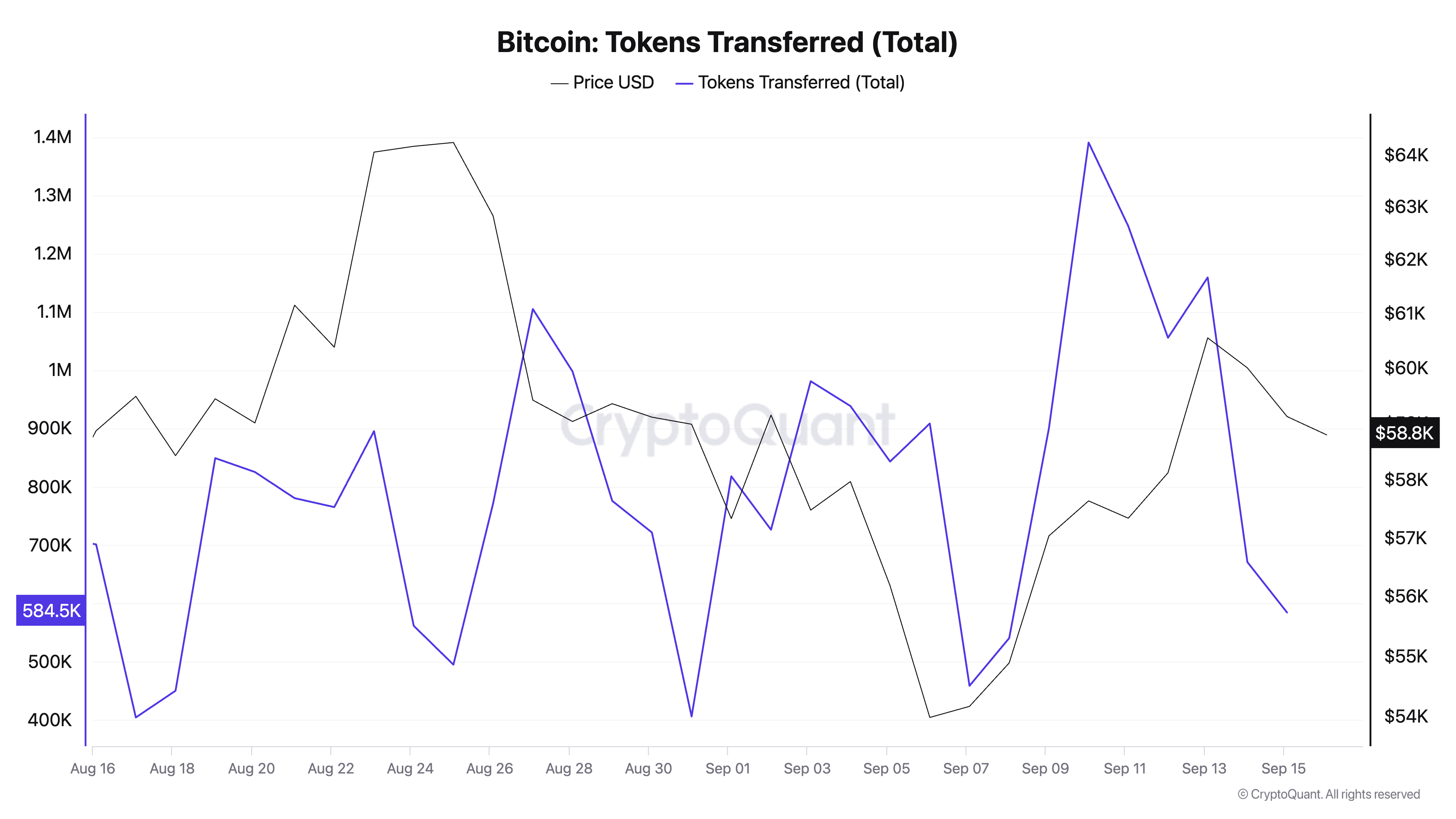

The total number of tokens transferred declined from 1.39 million on Sept. 8 to 548,518 by Sept. 15. This decrease points to a reduction in large-scale transfers, implying a shift from institutional activity or reduced market liquidity. The data suggests a period when market participants were less engaged in high-volume transactions.

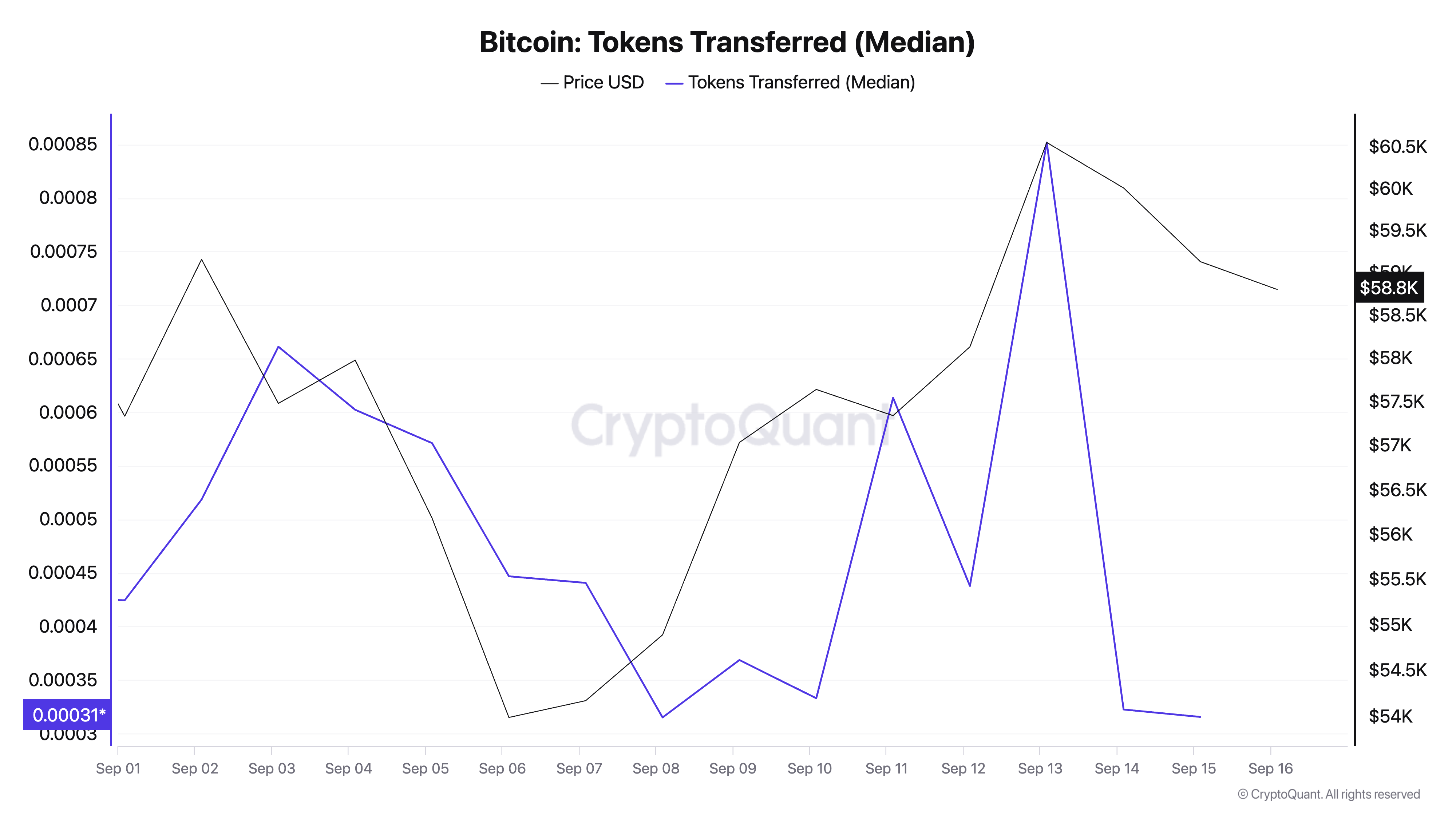

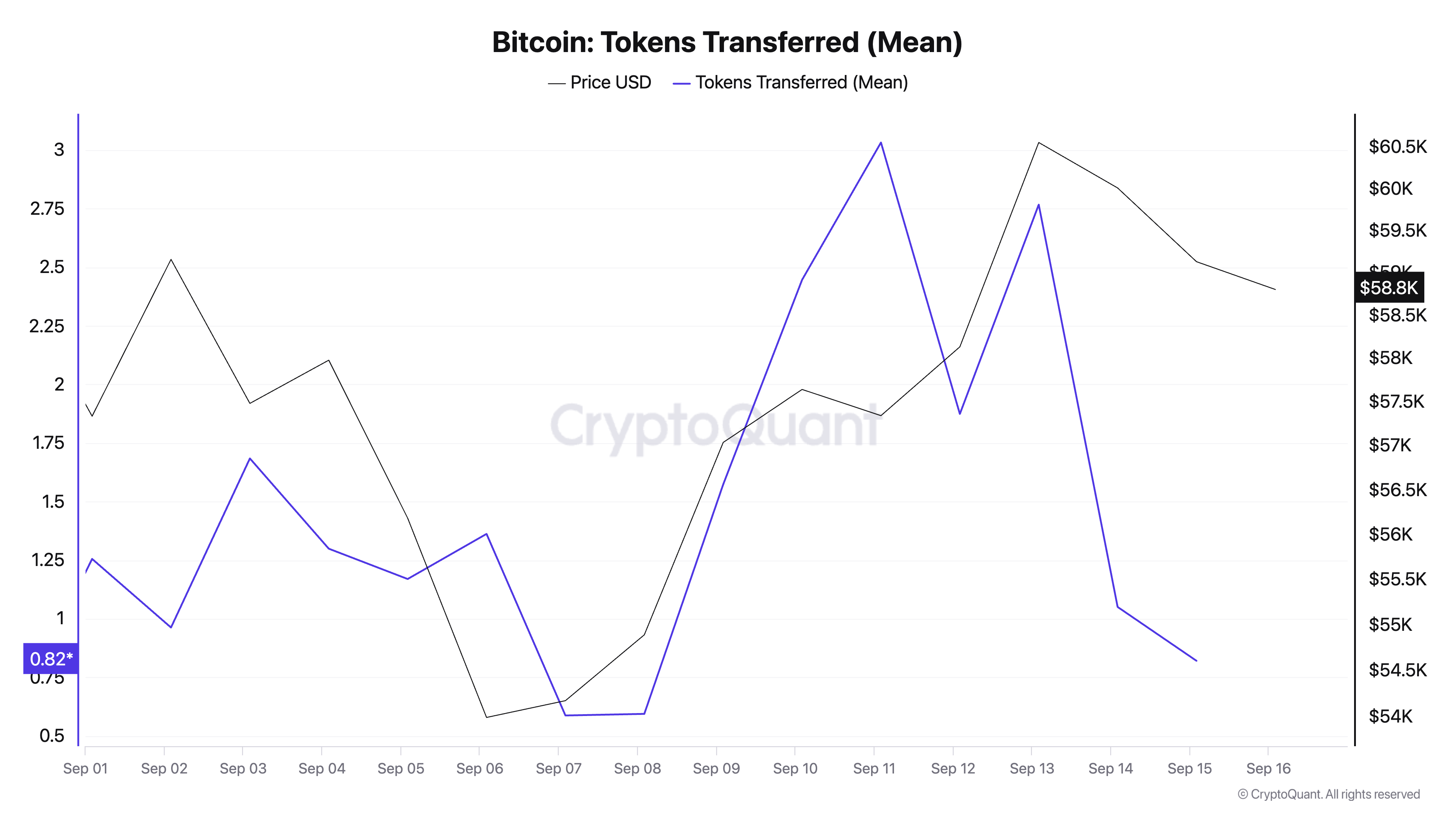

Analyzing the mean and median number of tokens transferred per transaction further confirms this. On Sept. 8, the median was 0.0008 BTC, with a mean of 0.594 BTC. The lower median suggests that while most transactions were small, the market was dominated by a few high-value transfers.

The spike in the mean to 3.032 BTC on Sept. 11 indicates a period of substantial transactions, likely by institutional players or whales. By Sept. 15, the mean dropped to 0.820 BTC, while the median remained low at 0.0003 BTC, signaling a shift back to more typical trading activity and a decrease in large-scale transfers.

Overall, the data highlights a market characterized by intermittent bursts of large transactions, followed by periods of reduced activity, reflecting major players’ influence on sentiment despite consistent activity from retail and small-time traders.

CryptoQuant

CryptoQuant