Bitcoin surges above $60,000 following jobs report

Bitcoin surges above $60,000 following jobs report Quick Take

Trading Economics data shows that the unemployment rate edged up to 3.9% in April, surpassing expectations of holding steady at 3.8%. Unemployment has been below 4% since February 2022. However, this uptick was offset by a still-robust increase of 175,000 in non-farm payrolls, though below the forecast of 243,000 new jobs.

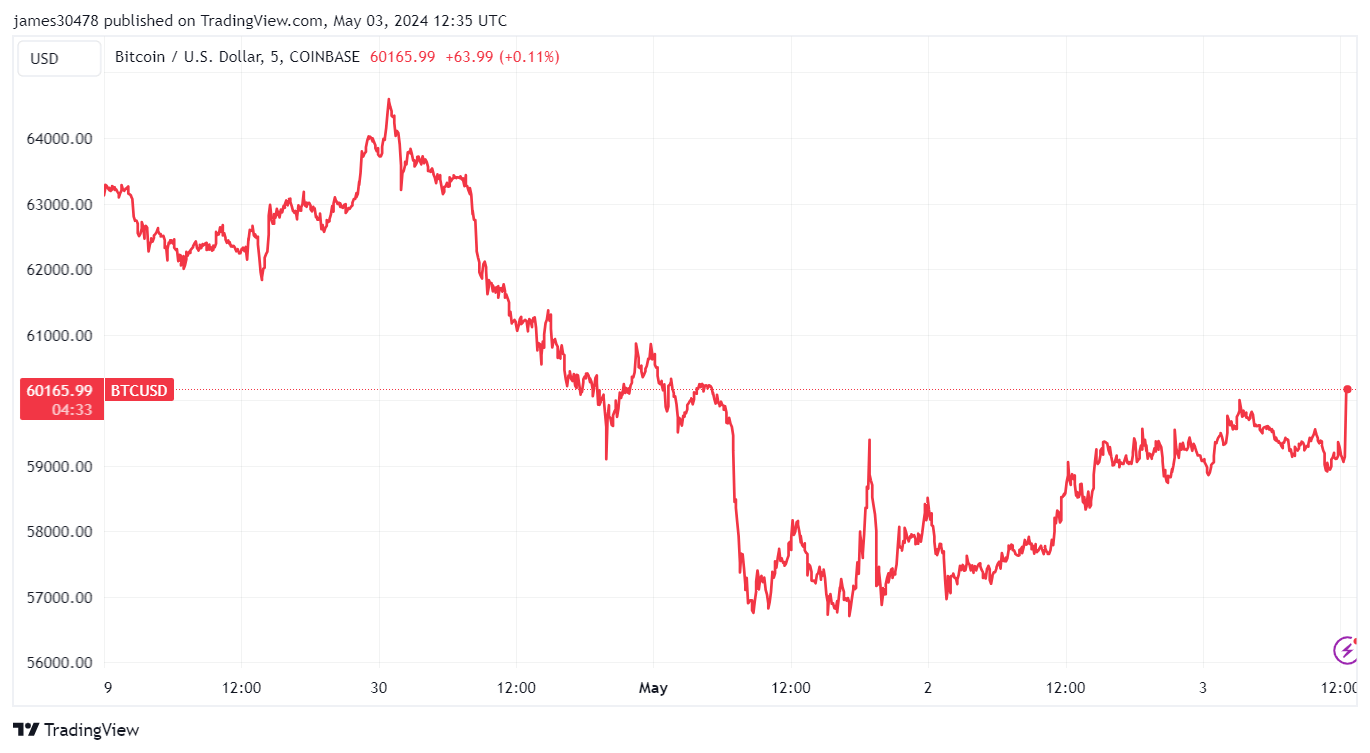

Despite the slightly higher unemployment rate, markets appeared to react positively to the data release. Bitcoin, often viewed as a barometer of risk appetite, rallied over $60,000 level. The U.S. dollar, as tracked by the DXY index, retreated to around 104.6.

The mixed employment figures could reinforce the narrative of a potential soft landing for the economy, calming fears of an excessive labor market slowdown.

According to the CME Fed Watch tool, the Fed funds futures now anticipate two 25 basis points rate cuts in 2024, up from the previous expectation of just one cut.