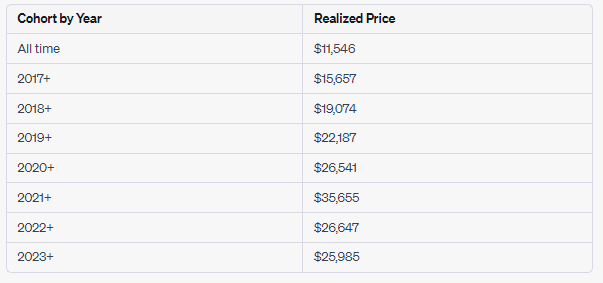

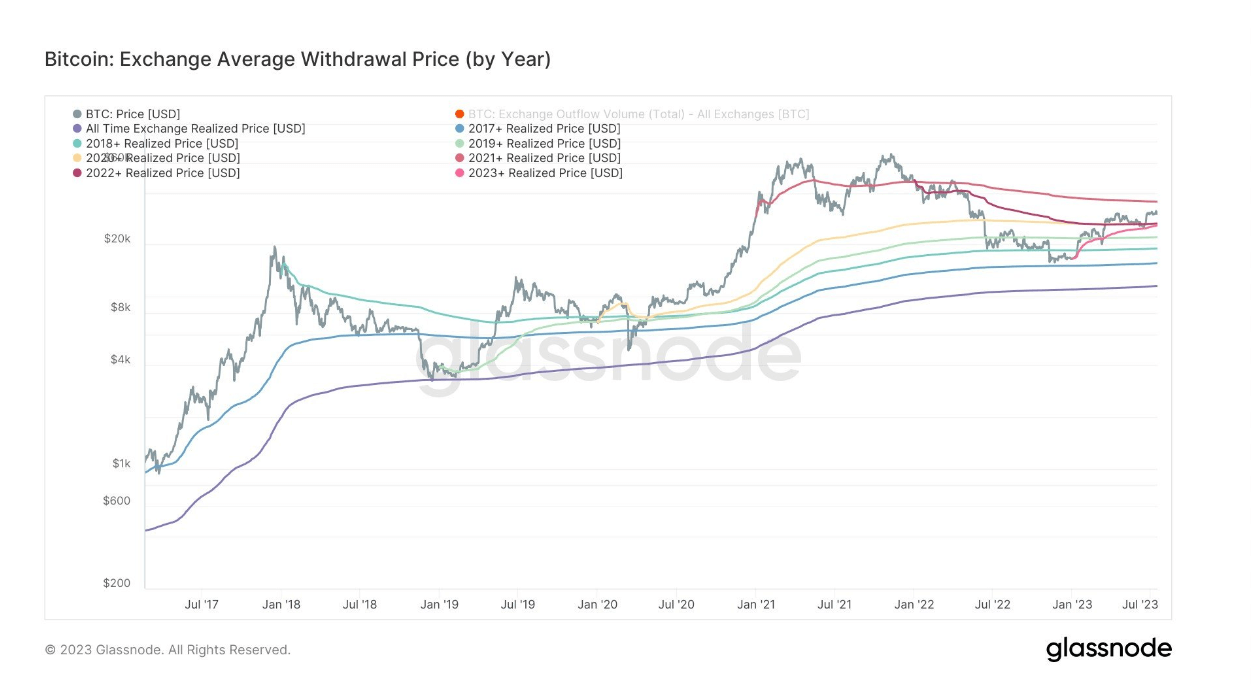

Bitcoin realized prices by cohort indicate DCA strategies in progress

Bitcoin realized prices by cohort indicate DCA strategies in progress Quick Take

Bitcoin’s consolidation at the $30,000 mark does not put many investor cohorts in a loss situation, as the dollar-cost averaging (DCA) strategy continues to be implemented.

Dollar-cost averaging is the concept of purchasing an asset on a regular basis without prejudice to the market value at the time of the trade. Dollar-cost average strategies look to reduce risk and gain exposure to an asset over time instead of attempting to time the market.

Investors who entered the market in 2021 faced a high-cost basis of $48,000. However, after two and a half years of consistent buying, these investors have managed to reduce their cost basis down to $35,500.

While all other cohorts are currently in profit.