Bitcoin ETFs mark first positive inflow in 2 weeks though BlackRock sees 3rd outflow

Bitcoin ETFs mark first positive inflow in 2 weeks though BlackRock sees 3rd outflow Quick Take

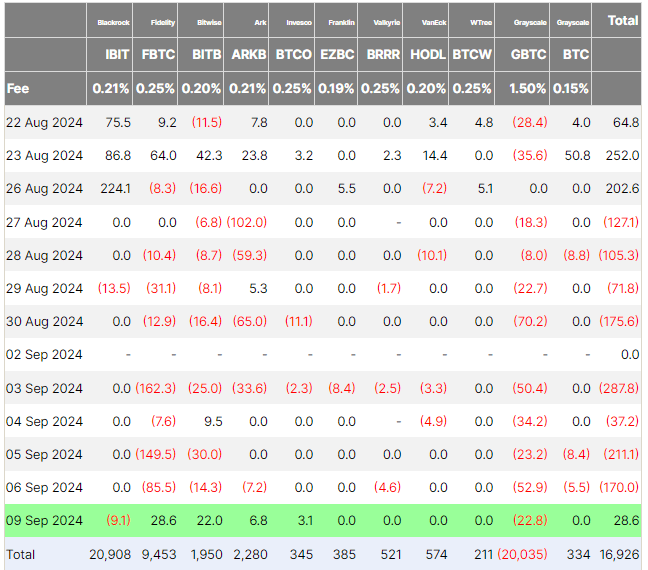

Farside data indicates that Bitcoin ETFs have seen a shift, with a $28.6 million inflow marking the first positive inflow since Aug. 26, following eight consecutive trading days of outflows. However, not all issuers experienced inflows. BlackRock’s IBIT reported a $9.1 million outflow, making it the third outflow, with the last one occurring on Aug. 29. Grayscale’s GBTC also saw an outflow of $22.8 million.

On the other hand, several issuers saw inflows. Fidelity’s FBTC reported a $28.6 million inflow, its first since Aug. 23. Bitwise’s BITB recorded a $22.0 million inflow, while ARK’s ARKB and Invesco’s BTCO saw inflows of $6.8 million and $3.1 million, respectively. This brings the total Bitcoin ETF inflows to $16.9 billion.

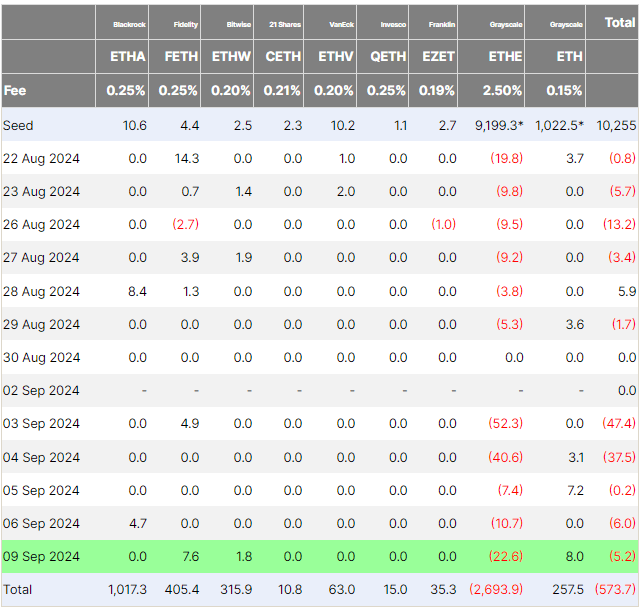

Ethereum ETFs experienced a contrasting trend, with a $5.2 million overall outflow. Grayscale’s ETHE led the outflows with $22.6 million. However, inflows were noted from Fidelity’s FETH at $7.6 million, Bitwise’s ETHW at $1.8 million, and Grayscale’s ETH at $8.0 million. Ethereum ETF outflows have now totaled $573.7 million, according to Farside data.

CoinGlass

CoinGlass