Here’s why Elon Musk’s simple Twitter bio change rocketed Bitcoin up 18%

Here’s why Elon Musk’s simple Twitter bio change rocketed Bitcoin up 18% Here’s why Elon Musk’s simple Twitter bio change rocketed Bitcoin up 18%

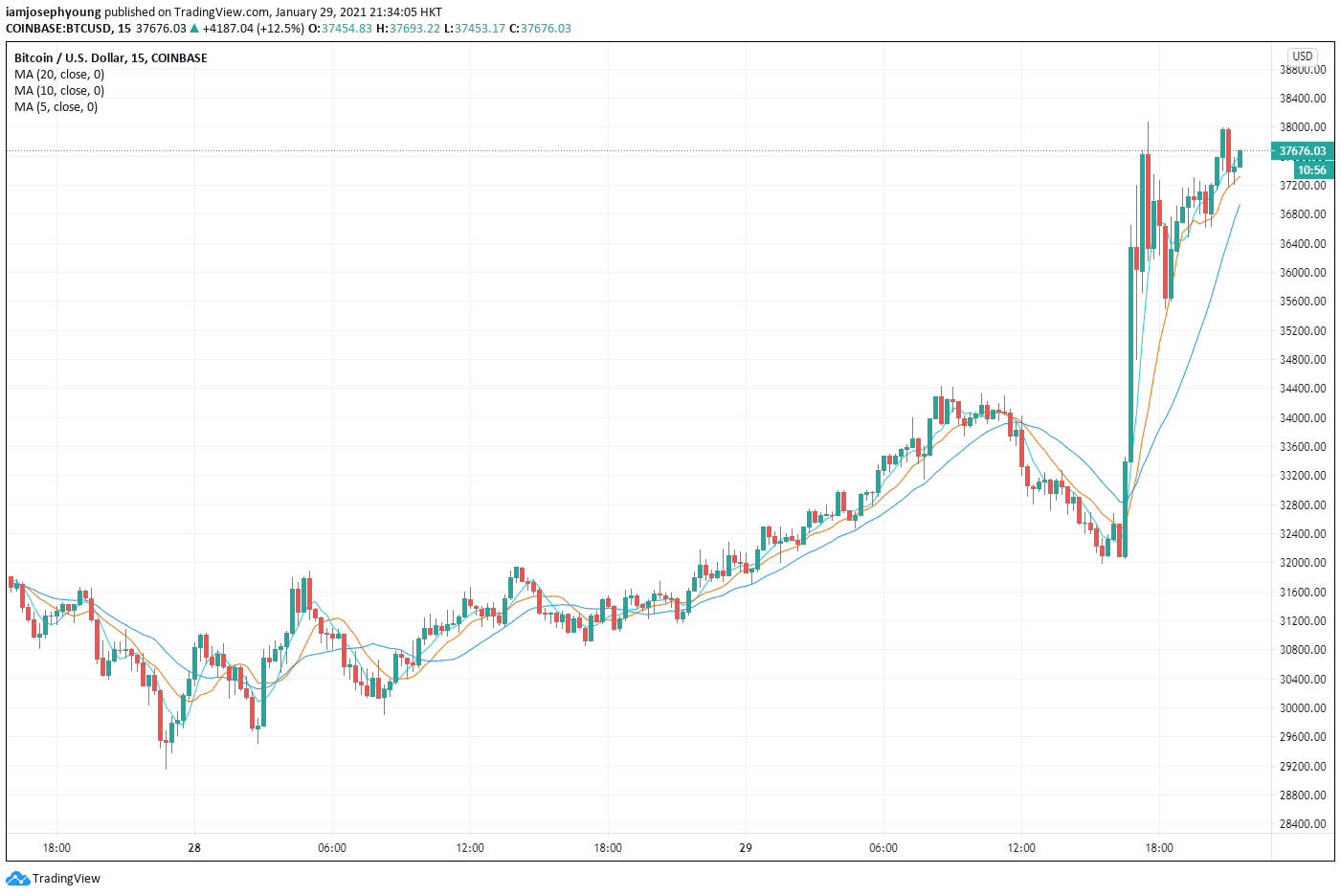

The price of Bitcoin surged 18% after Elon Musk, the CEO of Tesla and SpaceX, added “Bitcoin” to his Twitter bio.

Why would Bitcoin rally this hard off of a Twitter bio change?

Musk adding Bitcoin to his bio carries more significance than many can imagine.

First, Musk is the richest man in the world, above Amazon CEO Jeff Bezos.

Second, there are rumors that a high-net-worth individual purchased a large amount of Bitcoin on Coinbase over the past week.

The premium of Bitcoin on Coinbase skyrocketed, indicating a large buy order hit the market. Some speculate that this is likely a person with a large chunk of capital, pointing towards Elon.

There was also a high level of sell-side pressure on Bitcoin before the rally. The funding rate of major Bitcoin futures exchanges was neutral or slightly lower than the average 0.01%.

The term funding rate refers to a mechanism futures exchanges utilize to achieve balance in the market. If the funding rate is negative, then it means the majority of the market is short-selling Bitcoin.

If this happens, the market is at risk of a short squeeze, which means the cascading liquidation of short contracts, causing the price of Bitcoin to surge.

The combination of the excitement around Musk’s tweet and a short squeeze likely caused the price of Bitcoin to rally strongly.

As I wrote in the Alpha Alarm newsletter:

“There have been chatters that Musk might be the one accumulating Bitcoin on Coinbase over the past week. Coinbase saw high premium compared to Binance throughout the past week. Bitcoin was trading about $200 higher on Coinbase at peak times. This suggests that a high-net-worth investor was buying a significant amount of Bitcoin. Musk’s profile change likely caused FOMO, leading people to think that Musk was the one bidding on Coinbase.”

What happens next?

Pseudonymous cryptocurrency traders say that the market sentiment has clearly shifted in the near term.

A trader known as “Pentoshi” said that the “great beartinction event” is nearing, as the market sentiment becomes bullish once again. He said:

“Nothing disgusts me more in life than a dirty filthy bear in a bull market. The great beartinction event is upon us in which they will be sent to permanent hibernation. The positive nature of markets will prevail. Up only, infinite bid.”

The Bitcoin options market also saw a big expiry, which could alleviate significant selling pressure from the market in the near term.

Bitcoin Market Data

At the time of press 1:39 pm UTC on Jan. 30, 2021, Bitcoin is ranked #1 by market cap and the price is down 8.85% over the past 24 hours. Bitcoin has a market capitalization of $632.42 billion with a 24-hour trading volume of $86.53 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:39 pm UTC on Jan. 30, 2021, the total crypto market is valued at at $999.75 billion with a 24-hour volume of $174.18 billion. Bitcoin dominance is currently at 63.18%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass