Introduction to Genesis Vision (GVT) – A Decentralized Platform for Trust Management

Introduction to Genesis Vision (GVT) – A Decentralized Platform for Trust Management Introduction to Genesis Vision (GVT) – A Decentralized Platform for Trust Management

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Institutional interest in distributed ledger technology has increased dramatically recently, with major Wall Street players, hedge funds, and venture capital now entering the market on a large scale. As a result, a range of platforms has launched that are aiming to bridge the gap between traditional financial markets and the blockchain ecosystem, providing services that emulate those available in the incumbent market paradigm.

Genesis Vision is one such platform. Launched in November 2017 after a successful ICO, Genesis Vision intends to create a service via which managers, brokers, traders, exchanges, and other financial instruments can access a diverse range of assets via one interface.

The Genesis Vision project appears to be focused on the trust management market, bringing professional asset management to the blockchain ecosystem. Since launch, Genesis Vision’s native token (GVT) has experienced steady growth and is currently sitting at $21 despite current negative market sentiment.

What is Genesis Vision?

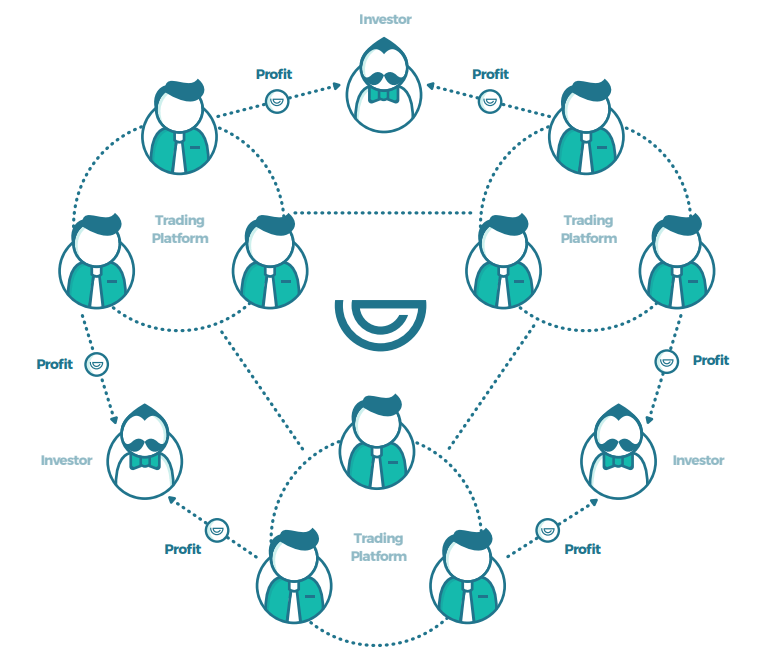

Genesis Vision’s project outline appears ambitious, as uniting all of the disparate elements of the private trust fund management market onto one platform is a complex task. The basic outline of the project presented in the Genesis Vision whitepaper gives a clear breakdown of how the team plans on streamlining and globalizing the current asset management market and bringing it onto the blockchain.

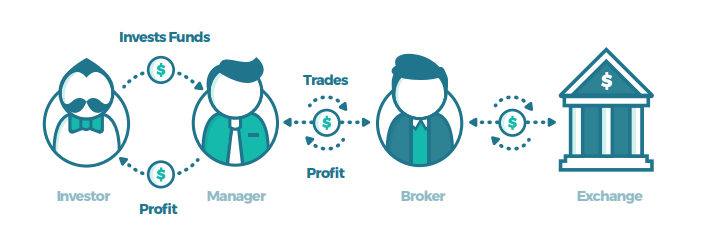

The Genesis Vision team are currently developing a platform that will allow private trust fund managers to promote their services to investors, who can browse the trading strategies offered by private trust management funds. Managers interact with brokers via the Genesis Vision platform who, in turn, connect with exchanges.

Rolling all of these elements together into one platform offers some advantages that address issues present in the current private trust management market. Traditional asset management systems are mostly opaque to investors, who receive only statistical information regarding their investment that cannot be independently verified, which creates the opportunity for tampering and fraud.

Genesis Vision CEO and founder Ruslan Kamenskiy highlighted the need for innovation in the trust management sector during an interview with CryptoSlate:

We find that the current state of the trust management market is very lackluster and archaic. One thing that current market desperately needs is transparency, and we find the blockchain and smart contract technology to be a perfect solution for this issue. Moreover, by creating an open and fair marketplace of fund managers, we allow our investors to invest in pure skill, rather than marketing.

Genesis Vision’s solution leverages the highly transparent nature of distributed ledger technology and immutable smart contracts to deliver highly efficient, transparent trust fund management. Investors can access managers from around the world as well as verifiable, transparent trading and profit statistics, while private managers and funds can attract more investors and benefit from fair competition.

How Genesis Vision Works

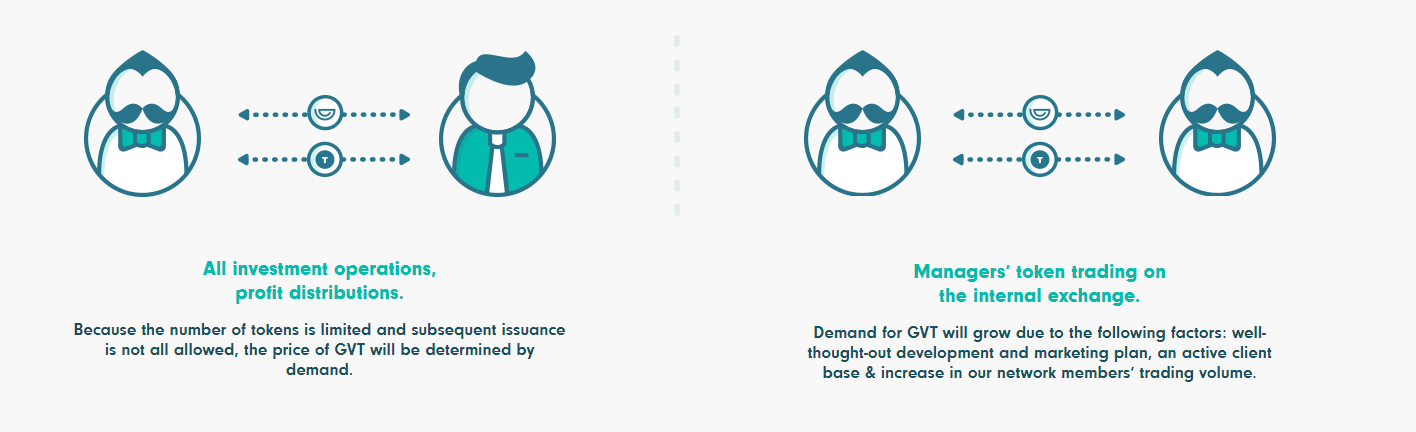

Genesis Vision uses ERC20 standard “Genesis Vision Tokens” on the Ethereum blockchain as a utility token, which is used for all investment operations, profit distributions, and, importantly, “manager token” trading. Manager tokens are a vital element of the Genesis Vision project — each manager using Genesis Vision can issue their own cryptocurrency, which is purchased by investors.

Manager coins are an asset that can be transferred or sold at any point in time on the Genesis Vision internal exchange. The GVT/manager coin model offered by Genesis Vision provides substantial justification for the creation of a new cryptocurrency — investors can buy, sell, and trade tokenized investments in managed funds within the platform itself, but the fungible nature of the manager token means it’s possible for investors to convert them into GVT at any point and trade them on external exchanges.

Allowing investors to invest in private asset management offers a distinct advantage over traditional models in that it eliminates the financial intermediaries that currently exploit them through management fees, which often exceed 20%.

Genesis Vision’s internal exchange presents investors with a range of advantages — Kamenskiy describes a “gamified” trading environment that allows traders to minimize their risk profile:

“There are multiple benefits to having an internal exchange. To list just a few: it adds gamification to the trading process, without being a necessary component of investment, and it also provides investors with additional risk leverages.”

Technical Teardown

Genesis Vision manages virtually every aspect of its technical architecture via Ethereum smart contracts. Investor, broker, exchange, and fund registration in addition to manager account creation, manager coin issuance, profit distribution, and module integration are all governed by transparent, publicly auditable smart contracts.

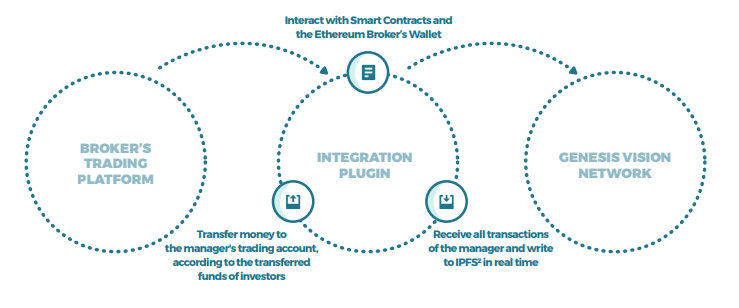

Investors interact with the Genesis Vision platform via mobile and web applications, while brokers need only install an integration plug-in for the trading platform they use. Traders can apply as a Genesis Vision manager and, once approved, enter the list of Genesis Vision manager. A smart contract then issues 1,000 manager coins for each manager, which then become available for investors to purchase, at which point the first reporting period — determined by the manager on registration — begins.

During the reporting period, each manager can trade on their preferred trading platform, with trading history uploaded by the Genesis Vision plug-in in real time in IPFS. At the end of each reporting period, the integration plug-in calculates and distributes profits then begins a new reporting period.

The technical architecture of Genesis Vision’s trading history control is one of the more exciting elements of the platform.

To verify manager trading history without disrupting or divulging a manager’s unique trading strategy, the Genesis Vision platform generates a unique crypto-key for the manager and encrypts all data collected via the trading platform integration plugin during the reporting period. At the end of the reporting period, a key for decryption is published, allowing investors to validate trading performance data.

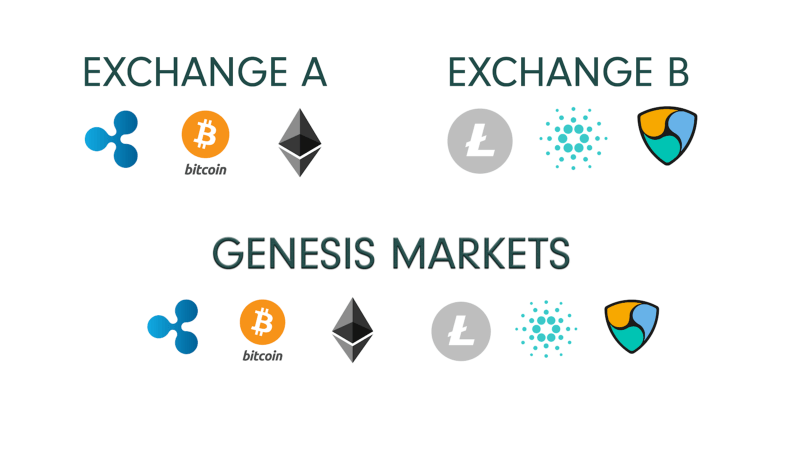

Genesis Markets

Genesis Vision has recently announced the launch of Genesis Markets, a new project that will aggregate market depth and order books from a number of different cryptocurrency exchanges. Interestingly, the Genesis Vision project will also aggregate all trading instruments, offering traders a comprehensive platform that covers a broad spectrum of trading pairs, order types, and tools.

Genesis Markets also enhances the overall level of liquidity available to traders, making it possible for traders to purchase or sell crypto at the best price possible. The Genesis Markets platform is set to go live on the 1st of April and is being developed primarily to enhance the trust management aspect of the Genesis Vision project.

Genesis Markets also enhances the overall level of liquidity available to traders, making it possible for traders to purchase or sell crypto at the best price possible. The Genesis Markets platform is set to go live on the 1st of April and is being developed primarily to enhance the trust management aspect of the Genesis Vision project.

Kamenskiy explained the evolution of the Genesis Markets platform in an interview with CryptoSlate:

Genesis Markets were originally created merely for a single reason of solving various infrastructure issues for the Genesis Vision platform. For example, letting customers to use our proprietary broker platform, if they don’t have an account with any of our partnered brokers/exchanges. But the team quickly understood that by developing the idea GV could also solve a number of current cryptomarket problems by aggregating multiple data from multiple sources.

GVT trades primarily on Binance, which accounts for over 99% of all trade volume, boasting around $9 million in daily volume for the GVT/BTC trading pair.

Conclusion

There are a number of asset management platforms entering the cryptocurrency market, but Genesis Vision offers both investors and managers an exciting concept that integrates a unique tokenized model.

Many blockchain platforms that attempt to tokenize the asset management sector don’t provide justification for a unique token — the Genesis Vision project, however, presents a strong argument for tokenization by minimizing intermediary fees via the internal Genesis Vision exchange.

With a beta launch of the Genesis Vision blockchain platform and web-based client application expected by Q3 2018, Genesis Vision stands out as one of the most interesting blockchain projects poised to attract new interest from brokers and asset managers from traditional markets this year.

For more information on Genesis Vision, including its market cap, price, and founders, please see our Genesis Vision coin profile or watch the video below.