Factors behind a Wall Street veteran’s forecast that Bitcoin will hit $20,000 in 2020

Factors behind a Wall Street veteran’s forecast that Bitcoin will hit $20,000 in 2020 Factors behind a Wall Street veteran’s forecast that Bitcoin will hit $20,000 in 2020

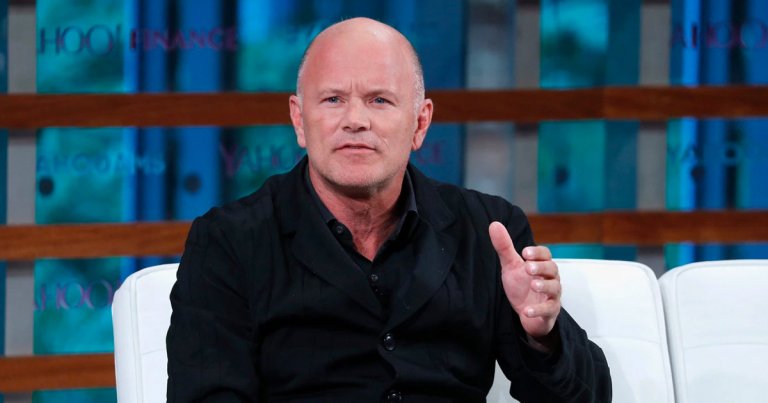

John Lamparski / Getty Images

Bitcoin may be up over 100 percent since the $3,700 lows seen in March, but the cryptocurrency remains far below its all-time high of $20,000 — established in December 2017 at the peak of the last market bubble.

With BTC’s price currently at $8,800, a move to all-time highs seems unlikely, especially considering the uncertainty around COVID-19, but a prominent Wall Street veteran is certain that Bitcoin will rally to $20,000 this year.

Why a Wall Street veteran thinks Bitcoin will hit $20,000 this year

Speaking to CNN on May 12, Michael Novogratz, a former partner at Goldman Sachs, backed his prediction by citing the current macroeconomic environment, which is favoring the growth of an asset growing increasingly scarce like BTC, which just underwent its third halving.

The Galaxy Digital chief executive said:

“We have quantitive easing over quantitative easing all over the world, not just in the U.S. […] On the flip side, Bitcoin’s halving is basically ‘quantitative tightening’. So you have this exclamation point on the story of a scarce asset.”

Reducing "look stupid" risk & a global "fiscal orgy" could see $BTC hit $20K by year-end! Colorful as ever conversation with @novogratz from Galaxy Digital. pic.twitter.com/sqdFZxKiNK

— Julia Chatterley (@jchatterleyCNN) May 12, 2020

Novogratz continued by remarking that it’s “perfect timing” with the world’s central banks debasing their cryptocurrencies while the Bitcoin supply that comes to be sold at market decreases.

No wonder investors are starting to allocate 1-2 percent of their portfolio to BTC, the investor added, referencing the surprising news that legendary hedge fund investor Paul Tudor Jones has started to allocate portions of his personal wealth and professional fund to the cryptocurrency.

As aforementioned, his analysis of these factors in confluence provided him with the sentiment that Bitcoin is still on track to hit $20,000 by year-end.

This forecast has been echoed by other players.

For instance, Dan Morehead — founder of blockchain-focused fund Pantera Capital — wrote in a letter earlier this year:

“Bitcoin may set new highs in the next 12 months. But not overnight. Institutions may take 2-3 months to triage current portfolio issues. 3-6 to research opportunities like distressed debt, crypto, etc. Then, as they begin making allocations, those markets will begin to rise.”

$20,000 could be followed by $50,000

Bitcoin hitting $20,000 from her would already be deemed a great accomplishment by analysts, but the cryptocurrency breaching milestone could be followed by a move to $50,000.

As reported by CryptoSlate, economist Alex Krüger remarked that the day Bitcoin “goes above $20,000 it could go on a wild run to $50,000 in little time.”

This comment was seemingly made in reference to the idea of reflexivity in financial markets — which effectively states that a rally begets a bigger rally and vice-versa.

In the case of cryptocurrency, $20,000 is purportedly the part of the rally at which prospective BTC investors will enter the space and where existing holders will double down, creating that pressure to squeeze prices even higher.

Bitcoin Market Data

At the time of press 9:43 am UTC on May. 14, 2020, Bitcoin is ranked #1 by market cap and the price is up 6.17% over the past 24 hours. Bitcoin has a market capitalization of $173.6 billion with a 24-hour trading volume of $48.77 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:43 am UTC on May. 14, 2020, the total crypto market is valued at at $257.38 billion with a 24-hour volume of $154.45 billion. Bitcoin dominance is currently at 67.40%. Learn more about the crypto market ›

CoinGlass

CoinGlass  Arkham Intelligence

Arkham Intelligence