Ethereum and Solana lead DeFi surge as TVL and DEX activity soar

Ethereum and Solana lead DeFi surge as TVL and DEX activity soar Ethereum and Solana lead DeFi surge as TVL and DEX activity soar

Solana's 89.31% TVL growth signals rising star status in DeFi sector, but Ethereum remains the sector's biggest player.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The DeFi sector has experienced a significant increase in both activity and token prices, primarily driven by Bitcoin’s October rally. Central to understanding this landscape is the concept of Total Value Locked (TVL) and decentralized exchange (DEX) volumes, two critical metrics that offer insights into the health and trajectory of DeFi protocols.

TVL, the aggregate value of assets deposited in DeFi protocols, serves as a barometer for sector health and investor sentiment. CryptoSlate analysis found an interesting growth pattern across various chains. Ethereum, the frontrunner with $25.336 billion in TVL, has seen a 31.14% increase over the past month, cementing its dominant position in the DeFi space. Solana, though lower in overall TVL, showed the highest growth rate at 89.31%. Notably, all chains recorded positive growth over the month, indicating a robust expansion across the sector.

The number of active users on these chains offers additional insights. Despite its lower TVL, Tron boasts a significantly larger active user base of 1.69 million, which could result from a more retail-oriented user landscape. Conversely, Ethereum’s lower active user count than its TVL might indicate a higher engagement of institutional or sophisticated, high-net-worth investors.

The market cap to TVL ratio is another critical metric, shedding light on the market’s perception of a chain’s value. Ethereum’s ratio of 9.72 suggests a mature market. In contrast, Solana’s higher ratio of 43.49 indicates either potential growth opportunities or an undervalued ecosystem, warranting closer investor scrutiny.

| Name | Protocols | Active Users | 1D Change | 7D Change | 1M Change | TVL | Stablecoins | 24h Volume | 24h Fees | Market Cap to TVL ratio |

|---|---|---|---|---|---|---|---|---|---|---|

| 1.Ethereum | 946 | 304,493 | -0.12% | +6.50% | +31.14% | $25.473b | $64.929b | $1.718b | $7.27m | 9.63 |

| 2.Tron | 26 | 1.69m | -1.34% | +5.04% | +25.14% | $8.291b | $47.455b | $11.33m | $1.66m | 1.13 |

| 3. BSC | 663 | 945,060 | +0.22% | +1.70% | +12.58% | $2.996b | $4.992b | $429.32m | $348,294 | 12.62 |

| 4.Arbitrum | 481 | 133,870 | -0.38% | +10.90% | +25.21% | $2.095b | $1.844b | $925.94m | 0.66 | |

| 5.Polygon | 488 | +1.28% | +8.10% | +21.93% | $852.6m | $1.17b | $369m | $87,858 | 10.06 | |

| 6.Optimism | 197 | 91,508 | -0.12% | +11.94% | +25.87% | $739.39m | $576.85m | $109.27m | 2.11 | |

| 7.Avalanche | 344 | 33,880 | -1.04% | +12.63% | +28.18% | $615.82m | $1.07b | $140.2m | $36,244 | 9.73 |

| 8.Solana | 115 | -1.55% | +23.58% | +89.31% | $530.8m | $1.513b | $425.62m | $108,773 | 42.62 |

Table showing the TVL, active users, volume, and market cap to TVL ratio for the 8 largest L1 chains on Nov. 14, 2023 (Source: DeFi Llama)

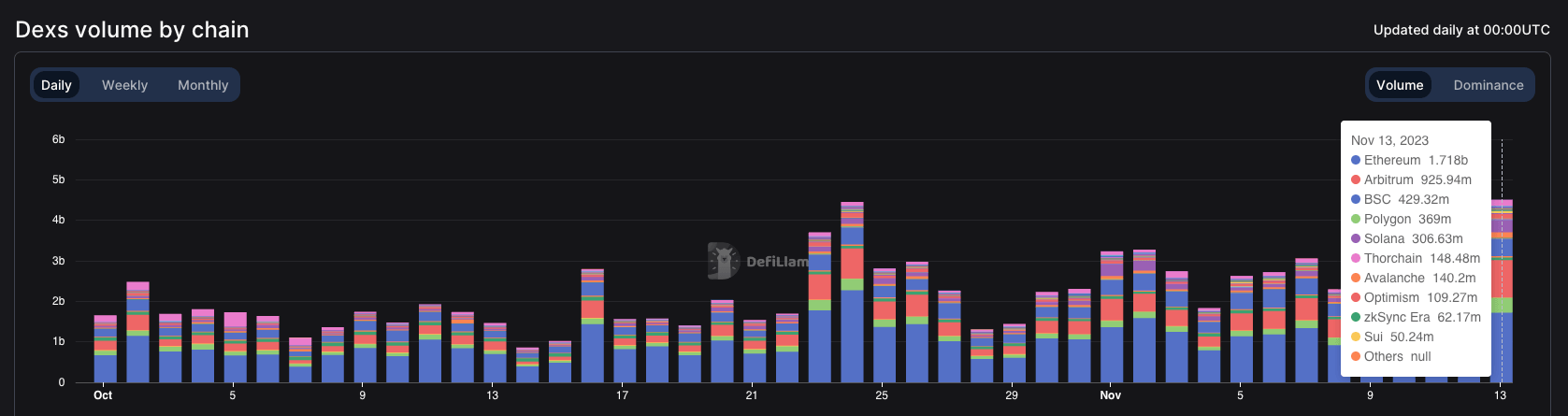

DEX volumes provide a lens into the trading activity within these ecosystems. Ethereum leads with a 24-hour volume of $1.718 billion, accounting for a substantial portion of the total market. The rapid growth in DEX volumes on platforms like Solana and Polygon, with increases of 81.35% and 86.32%, respectively, reflects growing user adoption and confidence.

| Name | Weekly change | Volume (24h) | Volume (7d) | TVL | % of total | Cumulative volume |

|---|---|---|---|---|---|---|

| 1. Ethereum | +27.29% | $1.718b | $10.65b | 5.941b | 37.12% | $1.888t |

| 2. Arbitrum | +58.15% | $925.94m | $4.415b | 1.127b | 20.00% | $138.902b |

| 3. BSC | +7.54% | $429.32m | $2.752b | 1.577b | 9.27% | $757.4b |

| 4. Solana | +81.35% | $425.62m | $2.571b | 185.78m | 9.19% | $54.616b |

| 5. Polygon | +86.32% | $369m | $1.711b | 0 | 7.97% | $101.421b |

Table showing trading volumes and total value locked for decentralized exchanges (DEXs) across the five largest L1 chains on Nov. 14, 2023 (Source: DeFi Llama)

The observed trends in TVL, active users, and DEX volumes show a market booming with activity. Ethereum continues to lead, both in terms of TVL and DEX volume, signaling strong investor confidence and market dominance.

However, the rapid growth of newer platforms like Solana and Polygon suggests a diversifying landscape, with different chains catering to varied user needs and investment profiles. The market cap to TVL ratios further confirms the growth potential of lower market cap chains, with Solana and Polygon positioning themselves for future growth.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass