Crypto Week in Review: Bitcoin, Ethereum, Ripple and Litecoin Up Double Digits Over Past Week

Photo by Daniele Levis Pelusi on Unsplash

As the week closes, we reflect on some of the maneuvers in the crypto arena that have seemingly placed most major digital currencies in the green after a somewhat shaky start to the week.

The crypto market has jumped from $324 to $397 billion – a $73 billion spike – since Monday, April 16, and some analysts, such as Tom Lee, believe the bull run is not yet over.

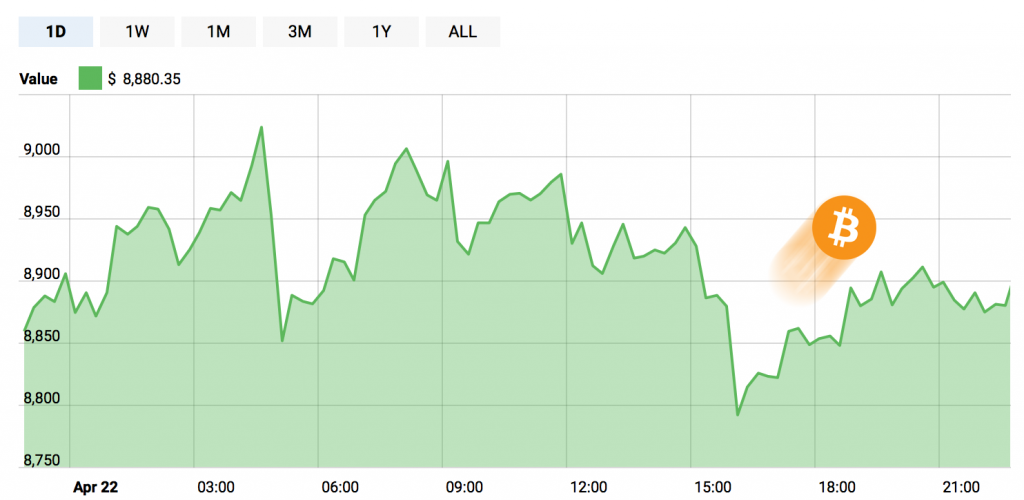

Some Big News for Bitcoin

Bitcoin started the week out at roughly $8,000, but trades for just over $8,900 at press time.

A new report stemming from a Quebec-based government office may have assisted the currency in reaching newfound potential. In the report, the notion of Bitcoin attracting financial crime like money laundering is largely put to sleep.

The document suggests that most criminals who would seek to exploit cryptocurrencies are no longer looking at Bitcoin, as the currency does not present the anonymity it allegedly promises.

Other entities, like Monero, offer far more secrecy to traders than Bitcoin and Ethereum and have become far more dominant in this respect.

However, every Bitcoin transaction is recorded and can be viewed via public ledger. Criminals do not want to attract that kind of attention to themselves and are thus turning the coin away in favor of privacy coins.

This news is potentially bringing new companies to the blockchain table, like financial and technology services group True Potential. The company will soon be the first U.K.-based enterprise to integrate blockchain technology into its in-house trading ledger.

In addition, Cambridge Analytica may have turned more people onto Bitcoin (and cryptocurrency in general) after representatives repealed their decision to enter the digital currency space.

Executives of the now infamous company – still at the center of the Facebook data checks – had previously announced their plan to release a new virtual coin that would allow people to either store or sell their private online data.

While some praised the new currency, others – like independent blockchain contractor Jill Carlson – stated that the decision was one of “false bravado,” and merely an attempt to potentially execute “corporate-level control” over clients and consumers. Plans for this new coin have since been dismissed, though it’s unclear if Cambridge will try another entry into cryptocurrency in the future.

Bitcoin’s Good Vibes Rub Off on Ethereum

Ethereum is also in the green, trading for over $600 at press time after spending several weeks locked in $400 and even $300 territory. The currency rose to its present spot after several resistance breaks between $500 and $570.

Several cryptocurrency exchanges – like the London Block Exchange – have reportedly witnessed massive jumps in Ether trading.

This could largely be attributed to Vitalik Buterin’s consideration of ceasing Ether production at 120 million coins, thereby putting a cap on the currency to enhance market stability. This idea has been widely criticized by both investors and analysts.

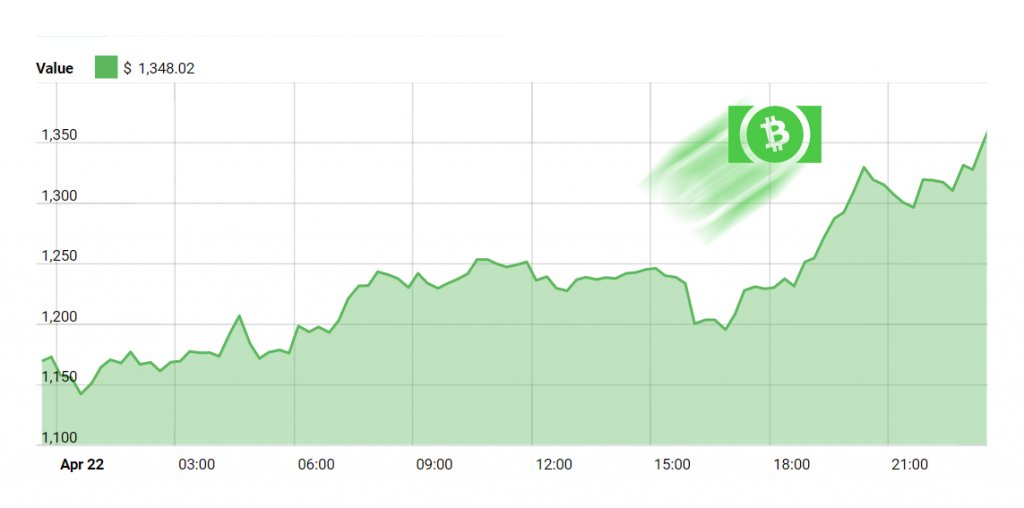

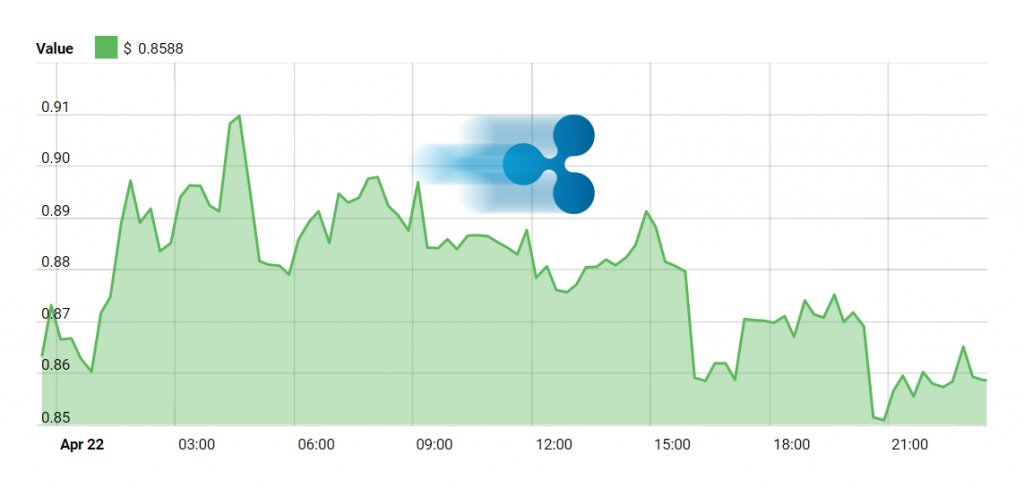

Other Major Cryptos Are Just as Strong

Other serious cryptocurrencies from Ripple to Bitcoin Cash and Litecoin are all doing well, and experiencing bullish trends. Litecoin, however, has seemingly experienced the highest levels of resistance over the last week, exhibiting few changes in its price when compared to competitors like Bitcoin Cash and XRP.

At press time, BCH is trading for over $1,200, while XRP has broken the $0.50 barricade and spiked to $0.86.

Litecoin, on the other hand, while still in the green, currently sits at $146.

This is a $3 drop from yesterday’s $149, and only a few dollars higher than where it stood at the beginning of the week.

Other Coins Join the Bullish Ranks

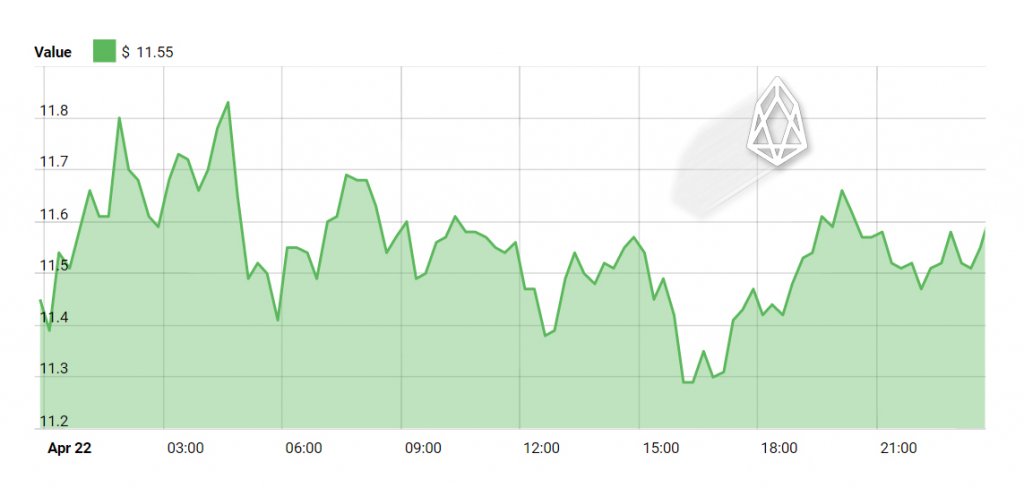

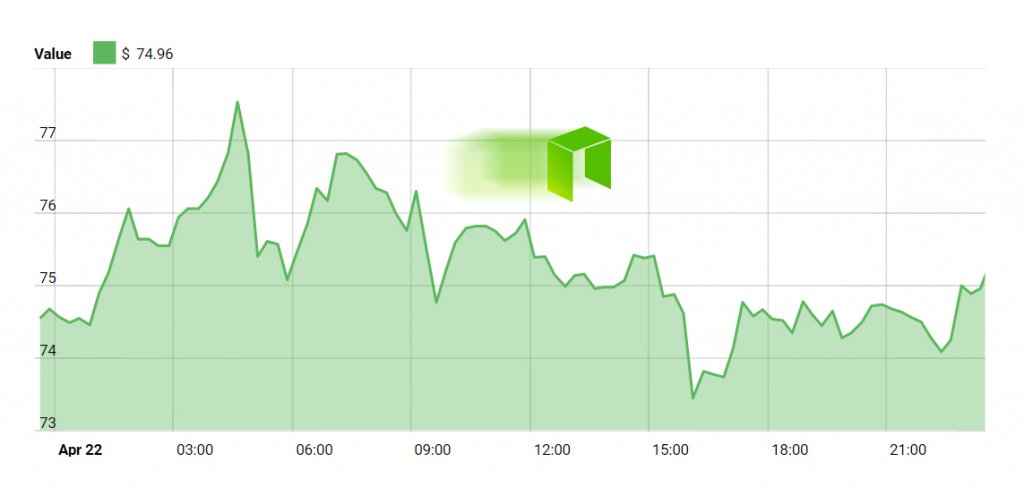

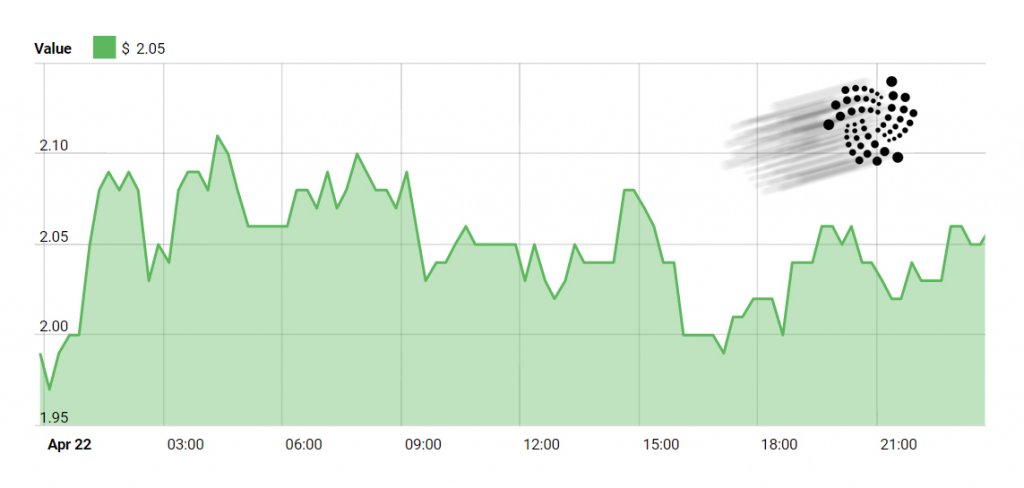

Stellar Lumens (XLM), EOS (EOS), NEO (NEO), Cardano (ADA) and IOTA (MIOTA) have all experienced movement, though some has been more positive in retrospect. While XLM and Cardano have stayed the same (fallen by $0.01, risen by $0.01, etc.), others – like NEO and IOTA – have witnessed massive gains in short periods.

NEO has risen from $64 to $73 at press time, while IOTA has jumped from $1.91 to $2.02 in less than 24 hours.

EOS is also trading for over $11 – a price it wasn’t expected to reach until the year’s end.