Crypto scams and exploits in May led to $60M loss: CertiK

Crypto scams and exploits in May led to $60M loss: CertiK Crypto scams and exploits in May led to $60M loss: CertiK

Crypto scams in May pushed the total amount stolen in the industry close to $500 million year-to-date.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto-related exploits, hacks, and scams in May resulted in nearly $60 million in losses, according to blockchain security firm Certik.

On May 31, CertiK confirmed that malicious players in the industry stole $59.8 million through exit scams, flash loan attacks, and DeFi protocol exploits. This brought the total year-to-date malicious losses to $489.57 million.

In April, Certik reported total malicious losses of $103 million, making May’s figure a significant reduction over the previous month.

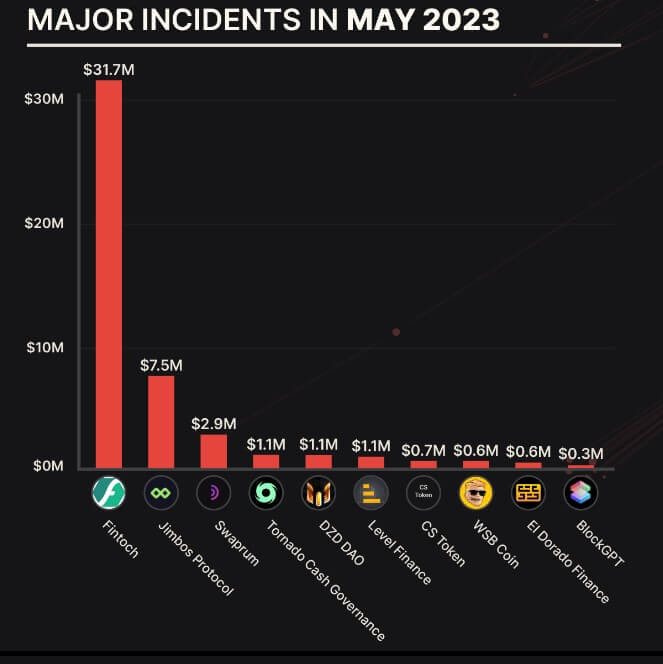

Recent major attacks

On-chain Dectective ZachXBT reported an exit scam by crypto investment platform Morgan DF Fintoch, which allegedly stole $31.6 million. CryptoSlate reported that the company made several fake claims and used a paid actor as its CEO.

The Jimbos protocol’s $7.5 million flash loan exploit lost 4,000 Ethereum (ETH) on May 28. The team said it was now working with law enforcement agencies after its 10% bounty offer to return stolen funds was ignored.

Other notable incidents include The Tornado Cash (TORN) governance attack, which led to a significant drop in the token price, and the Deus DAO burn function exploit, resulting in a $6.5 million loss.

Additionally, copycat meme coins remain a problem. One such case was the launch of a token imitating $PSYOP. The token’s creator, eth_ben, accused @3orovik of taking the PSYOP name, adding that users could not distinguish the two tokens.

Hackers are still relying on mixers to move their ill-gotten funds. As of May 31, Peckshield reported that malicious players transferred 956 ETH and 8,410 BNB into Tornado Cash, while 450 BNB were sent to Fixed Float.

CryptoQuant

CryptoQuant