BitMEX open interest is showing signs of rebounding; here’s what this could mean for Bitcoin

BitMEX open interest is showing signs of rebounding; here’s what this could mean for Bitcoin BitMEX open interest is showing signs of rebounding; here’s what this could mean for Bitcoin

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s price action seen throughout the past several days has been rather lackluster, with the benchmark cryptocurrency seeing some choppy trading that has led it to establish a wide range between $5,800 and $6,800.

Interestingly, BitMEX’s open interest has risen in tandem with this turbulence – a sign that traders are growing more interested in entering the markets.

One analyst believes that from a fundamental standpoint this is bullish for BTC in the near-term and his analysis – which has proven to be accurate so far – suggests that the crypto’s rebound from its recent lows is far from over.

Bitcoin open interest on BitMEX begins climbing as bulls and bears reach an impasse

Analysts and investors alike have long looked towards BitMEX’s open interest as an indicator of traders’ involvement within the market, with heightened involvement typically being indicative of imminent volatility.

This was seen throughout early and mid-February, when Bitcoin’s OI on the platform ballooned past $1 billion, with historical precedent showing that this is a historically bearish occurrence.

This once again proved to be true, as the price decline seen in the time following Bitcoin’s OI being at over $1 billion was one of the most intense it has ever seen, with its price cratering from highs of $10,500 to lows of $3,800.

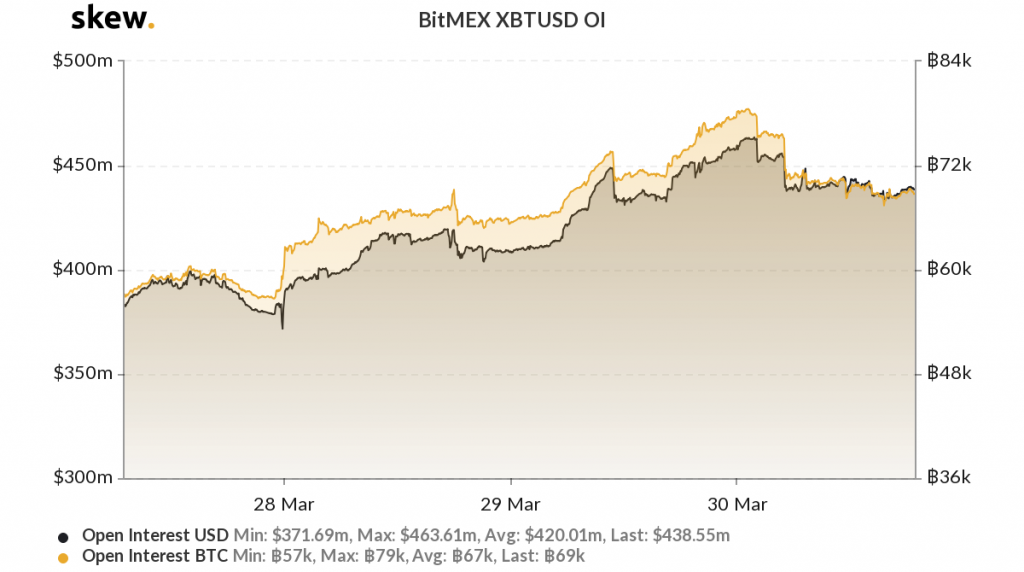

Today, according to data from Skew, BitMEX’s OI tapped highs of nearly $500 million before dropping slightly, which marks a notable climb from multi-day lows of $370 million that were set just two days ago.

This climbing OI is coinciding with some heightened volatility, and it may be a sign that Bitcoin is gearing up for yet another big move.

Does recovering OI favor bulls in the near-term? This analyst thinks so

One popular cryptocurrency analyst who trades under the name “Mac” explained in a recent note that the culmination of Bitcoin’s climbing open interest, negative funding, and positive money flow are all positive short-term signs.

“Open interest up +13K BTC after 27. March expiry. Thoughts: – Daily money flow looking good – Funding + prem still very negative…”

As for how this could influence Bitcoin’s price, Mac noted yesterday that he believes BTC would decline towards $5,800 before seeing a fleeting “scam pump” that leads it up into the $7,000 region.

“Bias: Weak dump ($5800s) into scam pump ($7000s) during this upcoming week.”

Because Bitcoin did drop to $5,800 as he predicted and rebounded there, it is a possibility that it will continue climbing in the near-term until it breaks into the $7,000 region.

Bitcoin Market Data

At the time of press 5:12 pm UTC on Apr. 1, 2020, Bitcoin is ranked #1 by market cap and the price is down 3.19% over the past 24 hours. Bitcoin has a market capitalization of $114.68 billion with a 24-hour trading volume of $33.34 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 5:12 pm UTC on Apr. 1, 2020, the total crypto market is valued at at $176.6 billion with a 24-hour volume of $107.37 billion. Bitcoin dominance is currently at 64.79%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)