Bitcoin May Get Regulated as a Security In the Philippines

Bitcoin May Get Regulated as a Security In the Philippines Bitcoin May Get Regulated as a Security In the Philippines

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

With all the excitement surrounding Bitcoin’s incredible value increase this year, it’s easy to be blinded by the eye-popping new record highs. However, equally as important and equally as impressive is Bitcoin’s ascension into the mainstream financial markets.

For example, CME Group is preparing its Bitcoin futures’ contract for release this December. That announcement came on the heels of reports that investment juggernaut Goldman Sachs is considering developing a Bitcoin-centered product for its customers. Of course, these advances are in addition to Bitcoin’s increasing integration with mainstream retailers.

Bitcoin’s market expansion continued this week with the Philippines announcing that it’s considering labeling Bitcoin and other cryptocurrencies as a security, which would bring regulatory oversight and expanded crypto-investment opportunities to the country.

Emilio Aquino, the country’s SEC commissioner, announced the move, saying,

“The direction is for us to consider these so-called virtual currencies offerings as possible securities, in which case we will apply the Securities Regulation Code.”

If the Philippines designates cryptocurrencies as securities, this would allow additional investment opportunities for cryptocurrencies, an otherwise famously unstable market that is prone to wild swings in value. Aquino further addressed the government’s role in crypto-markets, indicating that the country’s central bank will oversee the licensing of cryptocurrency exchanges in the country.

The Philippines is following the pattern of several other countries that are conducting thorough reviews of the crypto-marketplace. The pursuit of regulatory oversight by the Philippines and other countries is arguably a response to important trends in the crypto-marketplace.

Bitcoin’s 900%+ Growth in 2017 and the Rise of ICOs

First, Bitcoin’s torrential rise this year has made it an intriguing investment opportunity for all types of investors. This weekend, Bitcoin surpassed $9,000 for the first time; it has increased more than 900% this year. With the stock market at an all-time high, investors can find it difficult to turn a profit from already high stock prices, which makes the crypto-marketplace such an attractive platform.

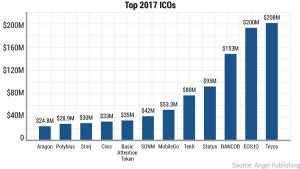

Crypto-investment is often limited to a small handful of mostly established cryptocurrencies. This year has also seen a surge in Initial Coin Offerings (ICOs) that have raised massive amounts of money and have attracted the attention of financial regulators.

ICOs have raised more than $3 billion in 2017, and they have surpassed some models of using capital raised by traditional methods like Initial Public Offerings (IPOs).

In some cases, ICOs can be very similar to stock purchases, where buyers own a portion of the company in which they’re investing.

Other ICOs offer different perks, but the “buy at the beginning” mentality is the same.

However, not all ICOs are the same, and there has been no shortage of controversy surrounding the efficacy and viability of many ICOs. This is perhaps best evidenced by the class action lawsuit leveled against the founders of Tezos, who completed their multimillion-dollar ICO earlier this year.

Essentially, ICOs are predicated on promises, and coin issuers are often unable to deliver on their promises made during the ICO process. Even Ethereum co-founder Vitalik Buterin has weighed in on the subject, and he candidly noted that,

“In the end, the [ICO] market will need to cool down. A lot of projects will fail, and people will lose money.”

Government regulations appear to be, in part, a reaction to these niche ICOs that are attaining significant amounts of money but without any supervision or transparency. For the sake of consumer and investor protection, regulatory oversight may be necessary to help crypto-markets mature and proliferate.

There is a significant difference between highly capitalized cryptocurrencies like Bitcoin and Ethereum and new ICOs, but they will all fall under the same regulatory umbrella. This isn’t necessarily a bad thing.

Governments Embracing Cryptocurrencies

By bringing oversight and accountability to the cryptocurrency market, the Philippines may be a harbinger of similar actions taken by countries that have, so far, been hesitant to embrace cryptocurrencies. Earlier this year China issued an outright ban on ICOs, so the Philippines could be considered a small-scale experiment for larger marketplaces.

Concepts like regulation and oversight are anathema to the very idea of cryptocurrencies. However, since cryptocurrencies have burgeoned well-beyond a niche experiment and have proven to be critical financial vehicles with longstanding staying power, it’s important that investors are protected.

By providing that level of protection, the Philippines may be inspiring growth through restraint and stability. That’s a new concept for cryptocurrencies, but they haven’t flinched at the news — both Bitcoin and Ethereum set new record highs today.

CryptoQuant

CryptoQuant