Bitcoin fails to break $41,000 even as ‘green’ crypto mining gains traction. What’s next?

Bitcoin fails to break $41,000 even as ‘green’ crypto mining gains traction. What’s next? Bitcoin fails to break $41,000 even as ‘green’ crypto mining gains traction. What’s next?

The world's largest cryptocurrency by marketcap is down nearly 40% from its all-time highs. And even good news isn't helping price.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin price crossed the $40,000 region for the first time in the last two weeks as Tesla CEO Elon Musk joined the chorus for green alternatives for crypto mining.

Musk tweeted last week that Tesla will start accepting Bitcoin as payment once again after 50% of the miners move to greener alternatives for Bitcoin mining.

Power consumption has been a controversial topic in recent times, attracting criticism from several quarters and creating bad press for Bitcoin.

This is inaccurate. Tesla only sold ~10% of holdings to confirm BTC could be liquidated easily without moving market.

When there’s confirmation of reasonable (~50%) clean energy usage by miners with positive future trend, Tesla will resume allowing Bitcoin transactions.

— Elon Musk, the 2nd (@elonmusk) June 13, 2021

A glimmer of hope for bulls is that of BTC options data: Models show the market predicts a 30% chance of Bitcoin breaking the $50,000 mark in the last week of July.

“After a volatile week, Bitcoin has bounced back and is trading close to $39,500 on the spot. Market sentiment remains cautious as traders continue to pay a premium for downside protection on the monthly and quarterly maturities,” said Pankaj Balani, CEO of Delta Exchange in a statement.

“Overall, the signs are bullish for the short-term, but we don’t see the same for longer maturities,” he added.

So what’s next for Bitcoin?

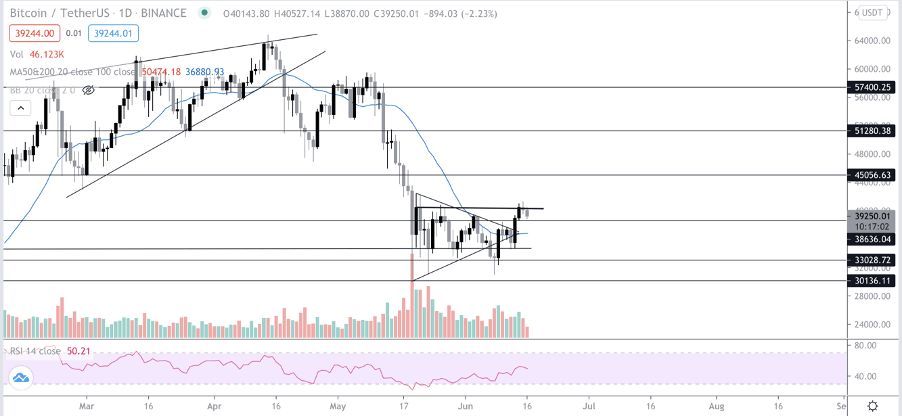

Bitcoin price ran into resistance once again and struggled to break it. The price was able to close above the 20 moving average—a popular technical indicator used by the traders to determine the market trend—which is generally a favorable sign for the upcoming days.

However, $40,300 continued to act as a strong resistance and failed to break. The 200MA which is around the same region as the $40,300 resistance also is acting as a barrier for upward price movement.

Once the price is able to climb above that price level and close, a positive price rally is expected.

However, On the bearish side, $38,700 is decent support and should hold in case of a drop-down to that range. The market continues to be indecisive as of now.

What’s next for Ethereum?

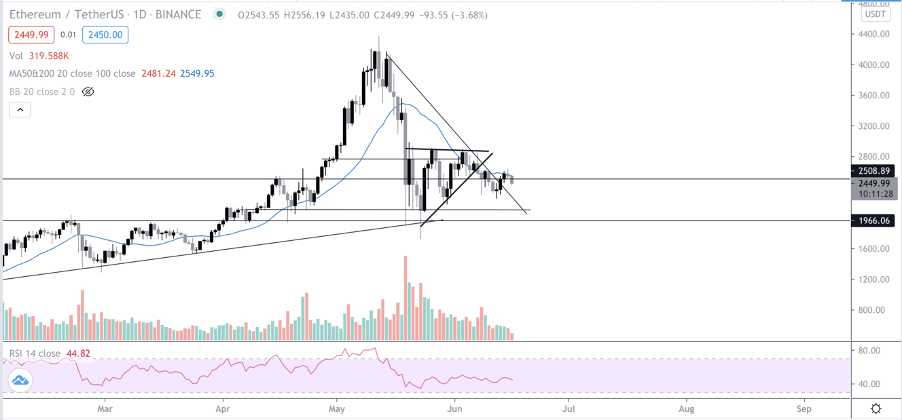

ETH still is stuck under the 20MA and has failed to flip it in recent attempts. The volume is on the decline while the price is going up. This is generally considered a bearish scenario by the traders.

The relative strength index (RSI) is also flat on the daily time frame indicating a slow momentum in price action.