BCG, Bitget, and Foresight Ventures report says real crypto expansion is coming

BCG, Bitget, and Foresight Ventures report says real crypto expansion is coming BCG, Bitget, and Foresight Ventures report says real crypto expansion is coming

A joint report from BCG, Bitget and Foresight Ventures revealed that crypto is still at the beginning of the adoption curve and it will expand exponentially, especially in APAC and LatAm.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A joint report by Boston Consulting Group (BCG), Bitget, and Foresight Ventures showed that crypto is at its very early stages of adoption and will expand more, especially in Latin America (LatAm) and the Asia Pacific (APAC) regions.

The report titled “What Does the Future Hold for Crypto Exchanges?” examines the growth trajectory of cyrpto adoption and regions with the highest adoption potential. According to the authors, the global crypto trading market cap reached $54 trillion in 2021, with significant potential to grow further.

Crypto is here to stay

The analysis argues that crypto adoption is still at its very early stages. BCG estimates that around 0.3% of individual wealth is held as a crypto asset, as opposed to 25% preserved as equities and stocks. The gap in between presents significant room for growth.

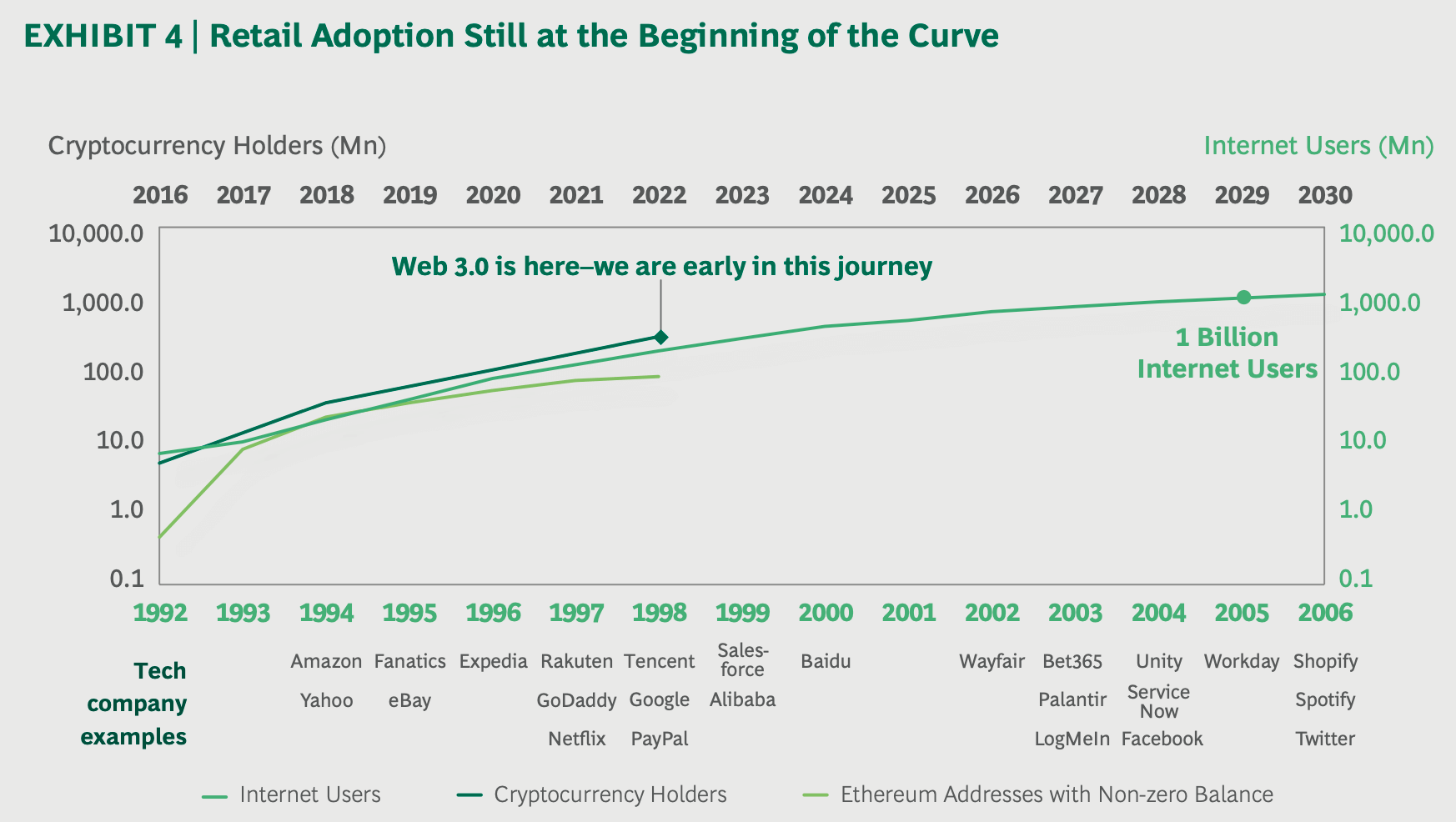

The report considers the adoption rate of the internet in the 90s, takes the number of crypto holders as a proxy for Web3 users, and concludes that the actual adoption surge is yet to come:

“…if the trendline of crypto adoption continues, the total number of crypto users is likely to reach 1 billion by 2030.”

Another study by Blockware also reached the same conclusion regarding the upcoming surge in adoption.

Instituitonal adoption

The authors also conclude that the institutional interest in crypto is growing, with Venture Capitals and Hedge Funds most interested.

As institutional players doubled their investments to $70 billion last year, the report also states that the “actual crypto holdings will be several times higher following token appreciation since the investments.”

One of the significant reasons for institutional interest in crypto is Bitcoin‘s high performance as an inflation hedge. The report says that the S&P returned 29% in 2021, compared to 62% from Bitcoin.

LatAm and APAC

The report points to LatAm and advanced APAC economies as regions with the most tremendous potential for crypto growth.

In 2021, emerging economies and advanced APAC countries had accounted for one-third of global spot trading volumes and around 40% of global derivative trading volumes. From 2022 onwards, the report expects these regions through derivatives markets.

LatAm

Currently, Latin America accounts for 1% of global spot and derivatives trading values, with great potential to grow. Binance is the dominant exchange in the region, and the regulatory framework is crypto-friendy.

The report states that LatAm’s primary market Brazil also has the highest crypto derivative potential in the region. Moreover, off-shore platforms dominate the local crypto derivatives market. Therefore, the report concludes that “off-shore players should move to onshore” to take advantage of the gap.

APAC

The southern regions of Asia Pacific, such as Vietnam, Thailand, and India, account for 2-3% of the global crypto trading. Like LatAm, most local exchanges are concerned about unclear regulations and stay clear from derivates. However, the demand for derivatives is high. The authors expect regional regulators to adjust to the demand and allow local exchanges to grow.

In the northern regions of APAC, which account for 30% of global trading value, Korea stands out as having the highest growth potential. Again, the derivatives market is dominated by off-shore platforms, while Korea carries enormous potential for derivatives platforms to pick up. As soon as the regulations loosen, the same potential growth will also appear in Korea.

Other findings

According to the report, increasing institutional participation, the rapid development of web3, and increasing crypto adoption in emerging markets are the three most effective macro factors that improve crypto adoption.

The report also concludes that the crypto ecosystem is consistently maturing at a good rate. The number of crypto applications was about 800 in 2017. This number reached up to 10,000 as of July 2022.

Institutional trading volume has also surged to 68% as of the beginning of 2022, from 20% in early 2018.

In 2021, the top five crypto exchanges (Binance, Okex, Coinbase, FTX, and Kucoin) accounted for 70% of the spot trading volume and 90% of the derivative trading volume. The report estimates that the top five exchanges will account for 65-75% of global spot trading, considering policymakers’ recent focus on the crypto sphere.

Region-specific estimations on shares of derivative trading indicate that the top five exchanges will take 80-90% in emerging markets and 70-80% in developed economies due to tighter regulatory frameworks.

CoinGlass

CoinGlass

Farside Investors

Farside Investors