Bank of America is treating Bitcoin, Ether as “cash,” will let you purchase crypto with credit cards

Bank of America is treating Bitcoin, Ether as “cash,” will let you purchase crypto with credit cards Bank of America is treating Bitcoin, Ether as “cash,” will let you purchase crypto with credit cards

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

First, they ignore you, then, they fight you, then you win.

The adage cannot hold truer when it comes to the cryptocurrency markets. This year alone, banks like JP Morgan, Goldman Sachs, and even the People’s Bank of China — all anti-crypto at some point — have expressed their interest in offering cryptocurrency services to clients.

While their reasons may range from collecting high processing fees instead of embracing the decentralized ethos of Bitcoin, the developments mark a changing narrative in the digital assets space — as far as traditional markets are concerned.

Now, another American banking giant seems ready to plunge head-first into the crypto-market.

Purchase BTC with BoA credit cards

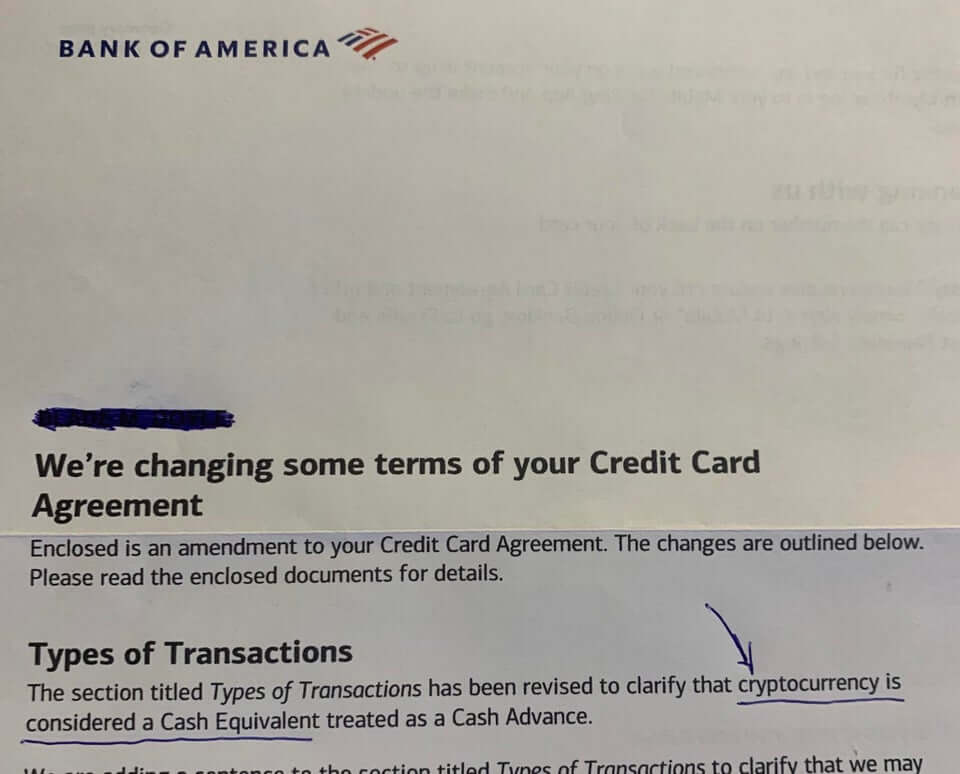

An image posted by a user on the r/Cryptocurrency subreddit showed a Bank of America (BoA) notice stating all cryptocurrency purchases will be treated as a “cash equivalent.”

This applies to all BoA credit card purchases of digital currencies, with no confirmation on how the bank treats debit cards or bank transfers for crypto transactions.

As the image shows; terms and conditions under the “Types of Transactions” have changed to include cryptocurrencies as a “cash equivalent,” that in turn, is will be treated as a “cash advance” on purchases.

Thread commentators noted cash advances attract the highest fees on BoA — about 5 percent on all transfers or a minimum of $10, as noted by Wallethub.

Lack of volatility leading to the decision?

While no official announcements from BoA on their decision to include cryptocurrency under a cash advance exists at press time, the marked lack of market volatility could have contributed to the same — as some commentators noted.

Taxing capital gains worked well when Bitcoin hovered wildly in single trading sessions. However, with the pioneering asset hovering between $9,200 – $9,800 since March, banks may have moved to capture fees on static aspects.

The move marks a step forward in some regards. While the ethos of cryptocurrencies calls for cutting out middlemen and high fees, banks onboarding customers with the latter is perhaps better than the threat of card cancellations or account freezing.

Despite the development, one must be wary to trade cryptocurrencies on credit. They remain a highly-speculative, risky investment with a marked lack of risk management tools on most platforms.

CoinGlass

CoinGlass