Aftermath of bizarre Bitcoin crash: BitMEX overtaken by FTX and Deribit in Ethereum futures

Aftermath of bizarre Bitcoin crash: BitMEX overtaken by FTX and Deribit in Ethereum futures Aftermath of bizarre Bitcoin crash: BitMEX overtaken by FTX and Deribit in Ethereum futures

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

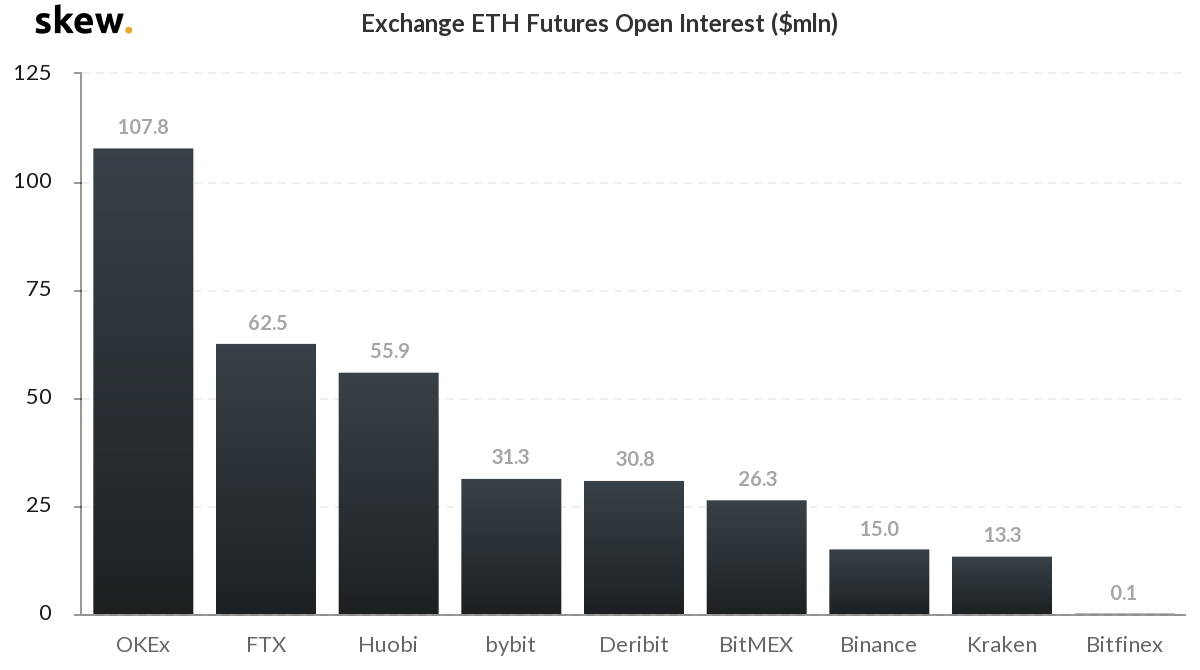

BitMEX, one of the largest cryptocurrency futures exchanges in terms of daily volume, has fallen behind OKEx, FTX, Deribit, Huobi, and Bybit in Ethereum open interest after the overnight Bitcoin drop to $3,600 on March 12.

The exchange was criticized for not using a large part of its insurance fund as $1.2 billion worth of long contracts were liquidated on a single day, within less than 24 hours.

Will BitMEX remain the dominant bitcoin exchange?

Some users were left dissatisfied with BitMEX in the aftermath of the unexpected Bitcoin price crash, as the exchange’s liquidation engine reportedly sold $10 million at a time with a thin order book.

The insurance fund of BitMEX could have been used to prevent auto-deleveraging the positions of users, but the exchange’s insurance fund hit a record high on the day instead.

“BitMEX uses an Insurance Fund to avoid Auto-Deleveraging in traders’ positions. The fund is used to aggress unfilled liquidation orders before they are taken over by the auto-deleveraging system,” reads the BitMEX website.

Possibly due to the controversy around the expansion of BitMEX’s insurance fund while Deribit and Binance injected millions of dollars of corporate funds on March 12, the Ethereum futures open interest of BitMEX fell behind five exchanges.

OKEx has long been the main competitor of BitMEX, especially in the Asian crypto makret. But, Deribit and Bybit have started to gradually eat up the global cryptocurrency futures market share in recent months, proving to be potential competitors in the long-term.

As of March 17, the Ethereum futures open interest of BitMEX remains at around $26.4 million. In comparison, OKEX, FTX, Huobi, Bybit and Deribit each have $107.8 million, $62.6 million, $55.9 million, $31.3 million, and $30.8 million in open interest for the Ethereum futures contract.

BitMEX still remains as the dominant platform for Bitcoin futures trading. Currently, at the time of writing, BitMEX has an open interest of $540 million for Bitcoin futures, nearly as much as Deribit, Huobi, and FTX combined.

Based on the Ethereum futures data alone, it is premature to predict that the dominance BitMEX maintained over the past several years is expected to decline rapidly in the short to medium-term.

However, it may open the market to new alternatives as new generation exchanges fight for the share of the Bitcoin and Ethereum futures market.

What will happen next?

Industry executives have proposed various solutions following Bitcoin’s drop to the $3,000s, which theoretically could have crashed BTC to zero on paper.

Some have said that integrating a circuit breaker across all of crypto could be a viable option, while others have said that exchanges were simply not ready to see a near-50 percent drop on a single day, and need time to strengthen the infrastructure.b

Ethereum Market Data

At the time of press 4:56 pm UTC on Mar. 16, 2020, Ethereum is ranked #2 by market cap and the price is down 9.36% over the past 24 hours. Ethereum has a market capitalization of $12.47 billion with a 24-hour trading volume of $16.43 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 4:56 pm UTC on Mar. 16, 2020, the total crypto market is valued at at $142.85 billion with a 24-hour volume of $155.11 billion. Bitcoin dominance is currently at 64.14%. Learn more about the crypto market ›