Coinbase market share dips as smaller exchanges gain ground – Kaiko

Coinbase market share dips as smaller exchanges gain ground – Kaiko Coinbase market share dips as smaller exchanges gain ground – Kaiko

Despite the decline, the top three US crypto exchanges by volume now control nearly 90% of the market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Coinbase has seen a sharp decline in market share as smaller exchanges gained ground recent months, according to a Sept. 9 report by research firm Kaiko.

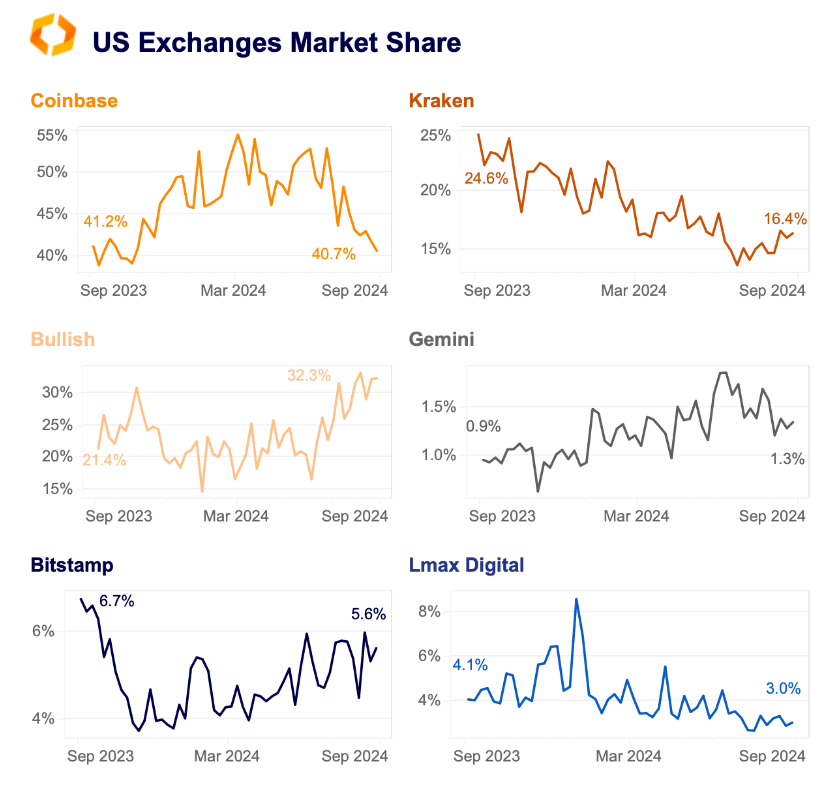

Coinbase dominated more than half of the US crypto market share earlier this year, peaking at almost 55% in March. However, its market share has since fallen to 41% in early September, down from 53% in June.

The biggest beneficiary of this shift has been Bullish, whose market share nearly doubled from 17% to 33% over the same period. Unlike Coinbase, which mainly serves retail investors, Bullish primarily targets institutional clients and trading.

Founded in 2021 as a subsidiary of blockchain firm Block.one, Bullish is backed by PayPal co-founder Peter Thiel. The firm recently made headlines for its purchase of crypto-focused media outlet Coindesk.

Top 3 exchanges dominate

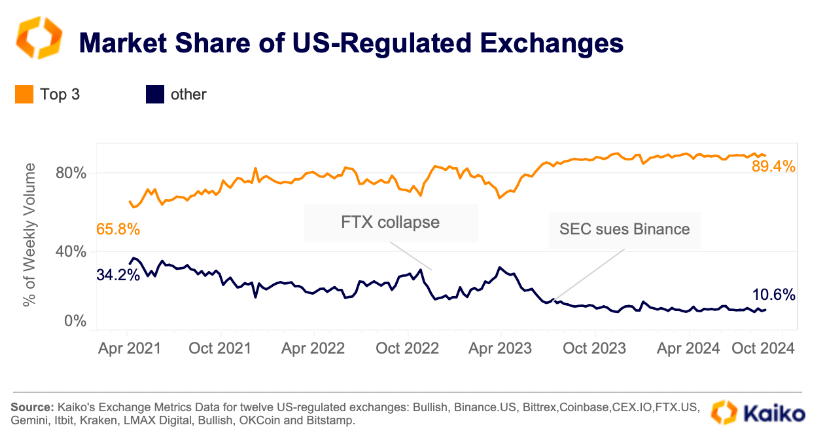

Meanwhile, top US exchanges have significantly expanded their market share since 2021. According to Kaiko, the three largest exchanges by volume now control nearly 90% of the market, up from 66% in April 2021.

In contrast, smaller exchanges have seen their share shrink from 34% to 11%.

Kaiko explained that this was due to several factors, including stricter regulations, reduced trading activity during the 2022-2023 bear market, and the dominance of major players like Coinbase and Kraken in institutional crypto trading.

In addition, their dominance can also be attributed to the sudden collapse of FTX in 2022 and the regulatory action against Binance.US, which all but led to the firm’s market share collapse.

Shares performance

Coinbase’s declining market share comes as British bank Barclays upgraded its stock COIN from underweight to equal weight.

The financial giant analyst Benjamin Budish noted that Coinbase has matured through product expansion and improved economic prospects.

Budish also pointed out that Coinbase will benefit from a more favorable regulatory environment. With market observers expecting the two US presidential candidates to show increased support for the crypto industry, the Brian Armstrong-led exchange could emerge as a winner in this regulatory shift.

However, the analyst cautioned that uncertainty remains, particularly around the broader economic environment and ongoing regulatory challenges. Notably, the exchange’s unresolved Securities and Exchange Commission (SEC) lawsuit casts a shadow over its operations.

Despite these challenges, Coinbase’s stock has risen by about 5% in early trading today, according to TradingView data. Yet, the company’s year-to-date performance has fallen, with its stock down 10%.

Farside Investors

Farside Investors

CoinGlass

CoinGlass