Over $200 million liquidated in crypto market as shorts takes the hit

Over $200 million liquidated in crypto market as shorts takes the hit Quick Take

The digital asset market has just witnessed a significant financial reset as over $214 million was liquidated in just 24 hours, with $166 million pertaining to short positions.

The major player in this shakeout is none other than Bitcoin, shouldering the brunt with $84 million. Simultaneously, Binance has found itself at the heart of these liquidations, counting a substantial $82 million, according to Coinglass.

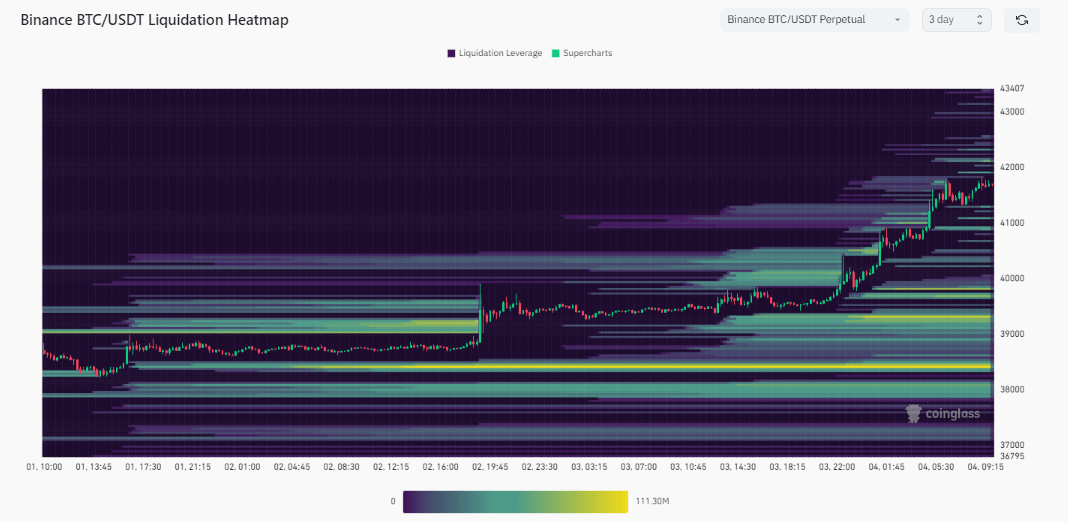

A closer look at the Binance BTC:USDT pair reveals a pressure point of leverage perched precariously above the $42,000 mark, representing approximately $50 million. This sizable overhang of leverage could trigger further price volatility and subsequent liquidations if the market breaches the $42,000 threshold, a scenario that market watchers should monitor closely.

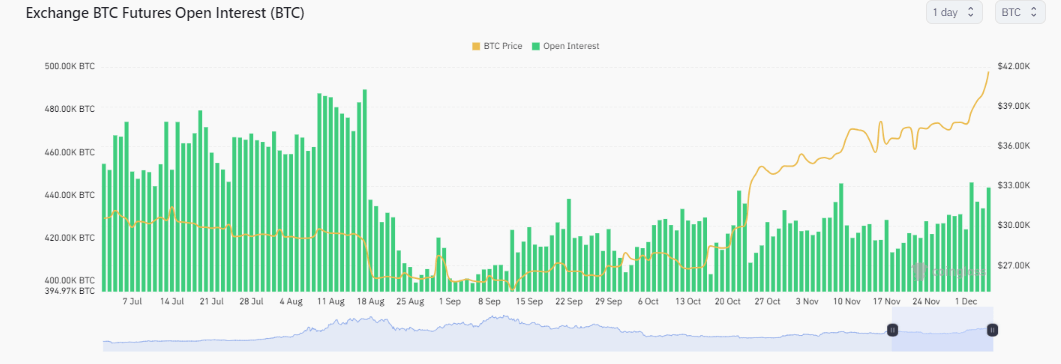

In addition, the total value of funds tied up in open futures contracts, also known as ‘open interest,’ has seen a notable surge, increasing 7% in the past 24 hours. This equates to 467,000 Bitcoin tied up in these contracts. However, despite this recent spike, it falls short when compared to the open interest figures from August, where the open interest was at 480,000 BTC when Bitcoin was trading at around $26,000.

CoinGlass

CoinGlass

Farside Investors

Farside Investors