Coinbase’s strategic positioning fuels massive 256% YTD stock surge

Coinbase’s strategic positioning fuels massive 256% YTD stock surge Coinbase’s strategic positioning fuels massive 256% YTD stock surge

Investor confidence skyrockets as Coinbase's stock price leaps, driven by regulatory adherence and custody role for ETFs.

Quick Take

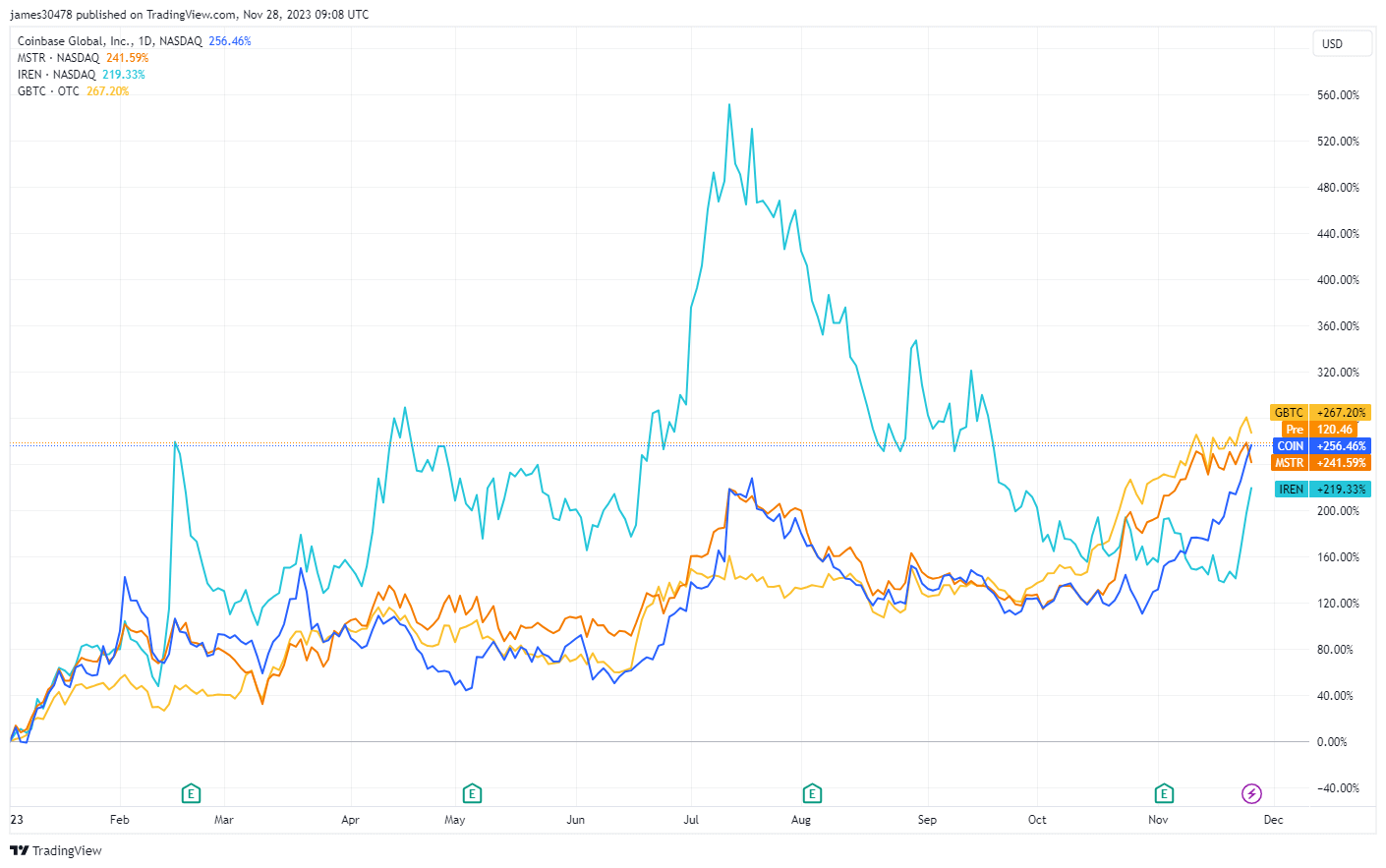

Coinbase has recorded a remarkable surge in its share price, with a 61% uptick within the past month and a 256% increase on a Year-to-Date (YTD) basis. It stands second within crypto equities only to Grayscale Bitcoin Trust (GBTC), up 267% YTD.

Key factors driving COIN’s performance may relate to its public listing on the US stock exchange, which compels it to meet stringent US regulatory standards. This has fortified investor confidence in its operational transparency and compliance.

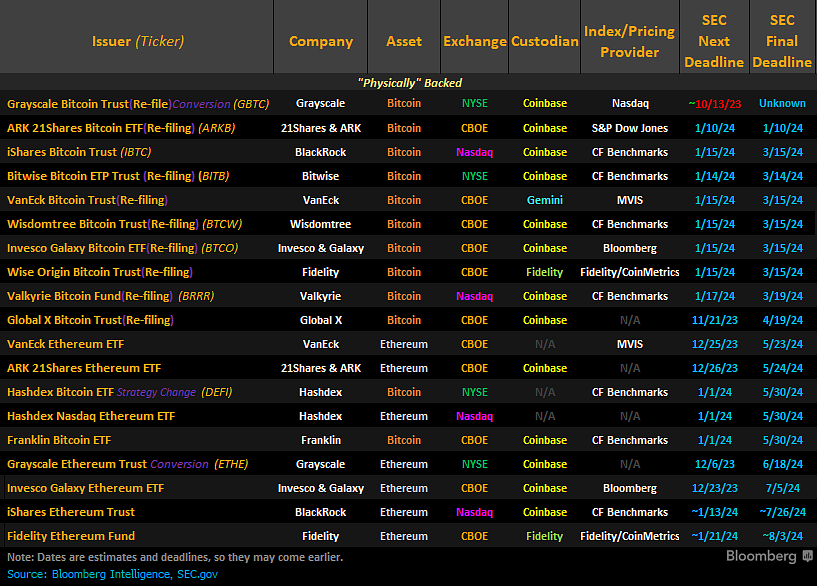

Further solidifying its market position is Coinbase’s critical role as the primary custodian for potential spot Exchange-Traded Funds (ETFs), as noted by James Seyffart, an ETF analyst at Bloomberg.

Conversely, Binance, the leading exchange in spot volume, faces an uncertain future due to regulatory concerns and the recent resignation of its CEO, Changpeng Zhao (CZ), which may further consolidate Coinbase’s competitive advantage. Furthermore, Binance is noticeably losing substantial ground in the futures and derivatives market. This loss, however, is not to Coinbase but to another American exchange, CME. This trend suggests a notable decline in interest and volume.

CoinGlass

CoinGlass

Farside Investors

Farside Investors