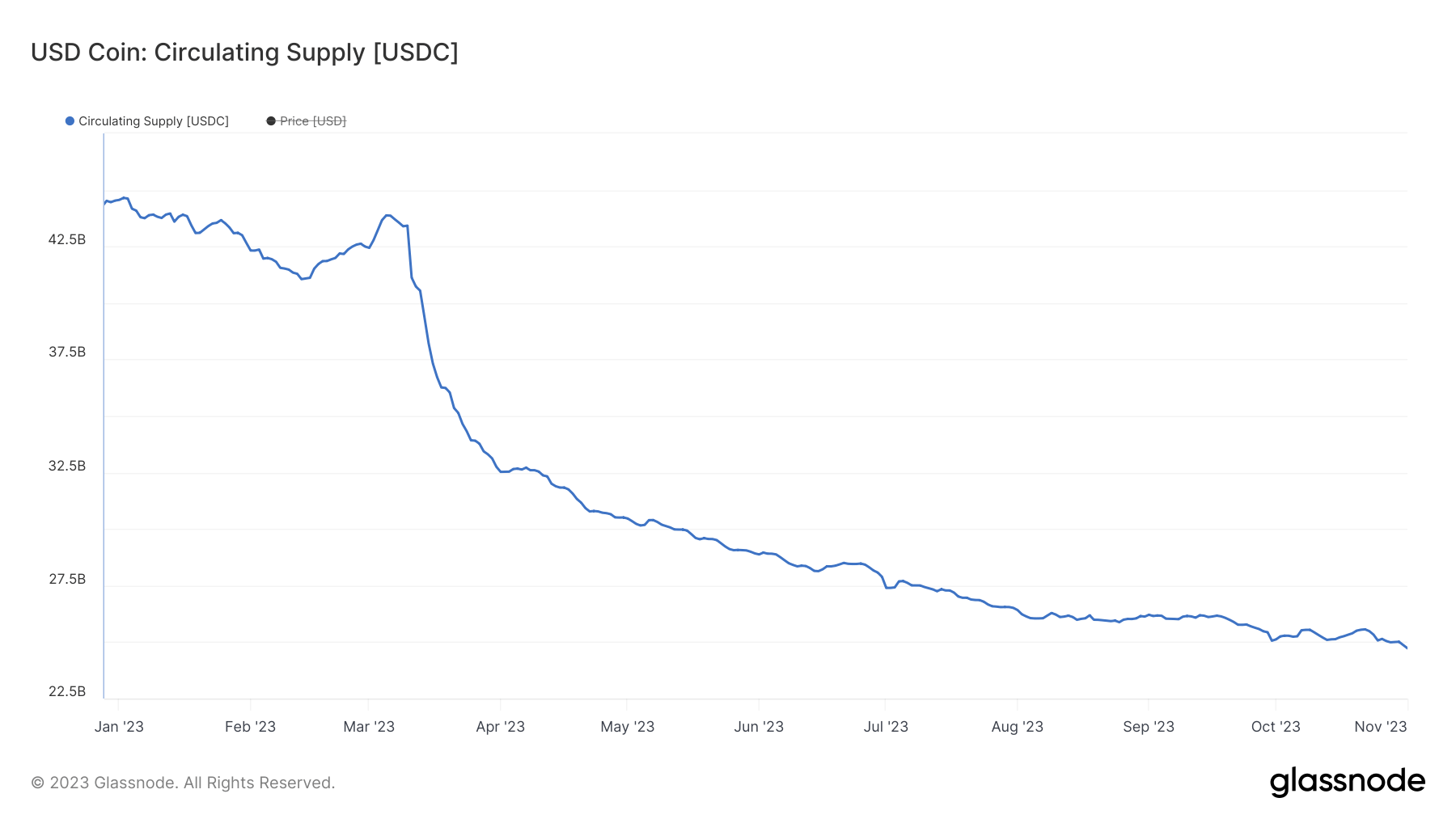

USDC’s circulating supply falls below 25 billion after Circle curbs minting services for retail customers

USDC’s circulating supply falls below 25 billion after Circle curbs minting services for retail customers USDC’s circulating supply falls below 25 billion after Circle curbs minting services for retail customers

Tether's USDT appears to benefit from the decline with it its supply approaching 85 billion.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

USD Coin, the second-largest stablecoin, has seen its circulating supply decline below 25 billion for the first since 2021 after its issuer, Circle, curbed minting services for retail users.

“In September 2021, we sunset a customer app and are now offboarding those legacy, individual consumer accounts,” Circle said in an Oct. 31 statement shared on X (formerly Twitter). “Account holders may continue to redeem USDC via Circle through November 30.”

Jeremy Allaire, Circle CEO, further chimed in that this development does not affect business or institutional accounts with the issuer. He added:

“There is nothing new here. We haven’t allowed individuals to open Circle accounts in years, and have been institution only for years as well. We have tremendous retail partners all around the world, including our strategic partner Coinbase who offers excellent retail access to USDC without fees and always 1:1.”

USDC falling supply

The news negatively impacted USDC supply, which fell to under 25 billion, its lowest level since 2021.

Data from CryptoSlate shows that USDC supply has declined by more than 300 million during the last three days, as it is currently at 24.7 billion as of press time. On Oct. 30, its supply stood at 25.04 billion.

This continues a trend that began earlier in the year when USDC encountered difficulties after it was revealed to have exposure to the U.S. banking crisis.

At the time, Circle said it held some of its USDC reserves at the now-failed crypto-friendly bank, Silicon Valley Bank. Following this revelation, USDC briefly depegged to as low as $0.87 before recovering.

However, its circulation has steadily declined despite the improving market conditions.

Meanwhile, USDC’s declining supply contrasts with plans by the stablecoin issuer to increase availability and expand into new blockchains.

Over the past year, the issuer has deployed USDC on Ethereum layer2 networks like Optimism and Base, bringing its availability to 11 blockchains, including Solana, Arbitrum, Polygon PoS, Tron, and Polkadot.

Tether profits

Meanwhile, USDC’s struggle appears to benefit Tether’s USDT, which is racing to an unprecedented market capitalization high of $85 billion less than a week after it touched an all-time high of $84 billion.

Data from CryptoSlate shows that USDT’s supply is currently at 84.88 billion, and the company’s latest attestation report shows that the firm’s assets exceeded liabilities by roughly $3 billion.

CoinGlass

CoinGlass

Farside Investors

Farside Investors