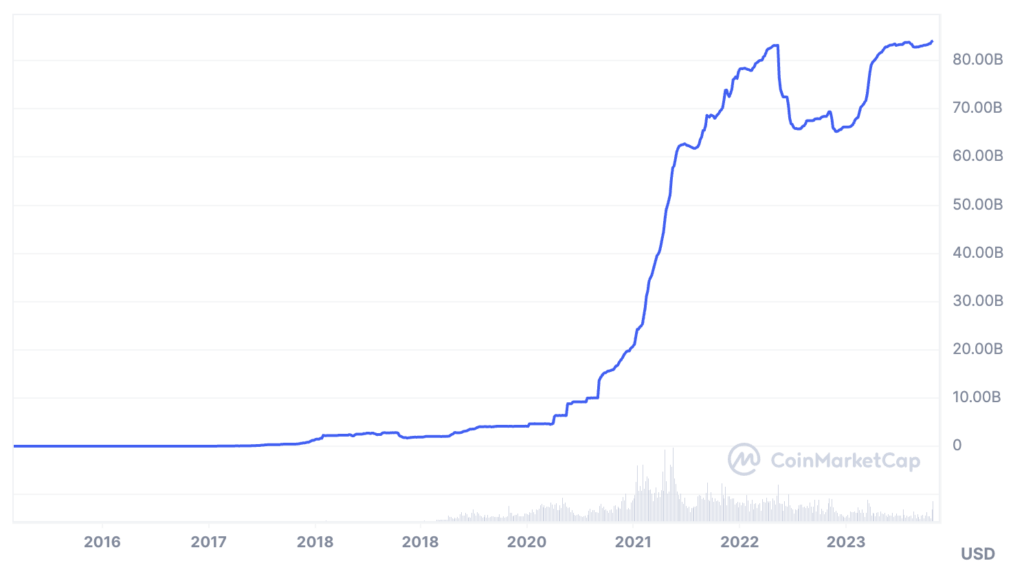

Tether supply reaches unprecedented $84 billion amid ETF-driven Bitcoin rally

Tether supply reaches unprecedented $84 billion amid ETF-driven Bitcoin rally Tether supply reaches unprecedented $84 billion amid ETF-driven Bitcoin rally

Tether's USDT has emerged as a major winner among stablecoins, with its market share nearing 70%.

AI GENERATED IMAGE VIA DALL-E 3

Tether’s (USDT) stablecoin supply has reached an unprecedented milestone, surpassing $84 billion for the first time.

Data from CryptoSlate shows that USDT market capitalization has increased by around $1 billion during the last seven days amid the current market rally fueled by optimism surrounding the possibility of a Bitcoin (BTC) spot exchange-traded fund (ETF).

Tether’s CEO Paolo Ardoino marked the milestone with a terse “84B $USDt” post on social media platform X.

USDT faced significant challenges last year as its market capitalization dropped to $66 billion amidst a severe market downturn and the collapse of crypto firms such as FTX and Three Arrows Capital. During this period, questions arose about the stability of its reserves, with concerns that it might be vulnerable to the broader market turmoil.

Why Tether supply is rising

However, Tether weathered this storm and has managed to increase its token supply by approximately $18 billion this year. This growth can be attributed to the current favorable market environment and issues faced by its rivals, including Binance USD (BUSD) and USD Coin (USDC).

Earlier in the year, the New York Department of Financial Services (NYDFS) directed BUSD issuer Paxos to cease additional minting of the stablecoin. Later, the U.S. Securities and Exchange Commission (SEC) classified BUSD as a security in its lawsuit against Binance.

As a result, many crypto investors turned away from BUSD, causing its supply to plummet from its peak of $22 billion in November 2022 to approximately $2 billion as of press time.

Conversely, USDC encountered difficulties in March when it was revealed to have exposure to the U.S. banking crisis.

The issuer, Circle, disclosed that it held a portion of USDC reserves at the now-failed crypto-friendly bank, Silicon Valley Bank. Following this revelation, USDC briefly depegged to as low as $0.87 before recovering.

However, its circulation has steadily declined despite the improving market conditions.

These events helped to propel USDT to the forefront of the market, with its market dominance now surging to nearly 70%, according to DeFillama data.