The shifting tides in global currency and asset markets

The shifting tides in global currency and asset markets Quick Take

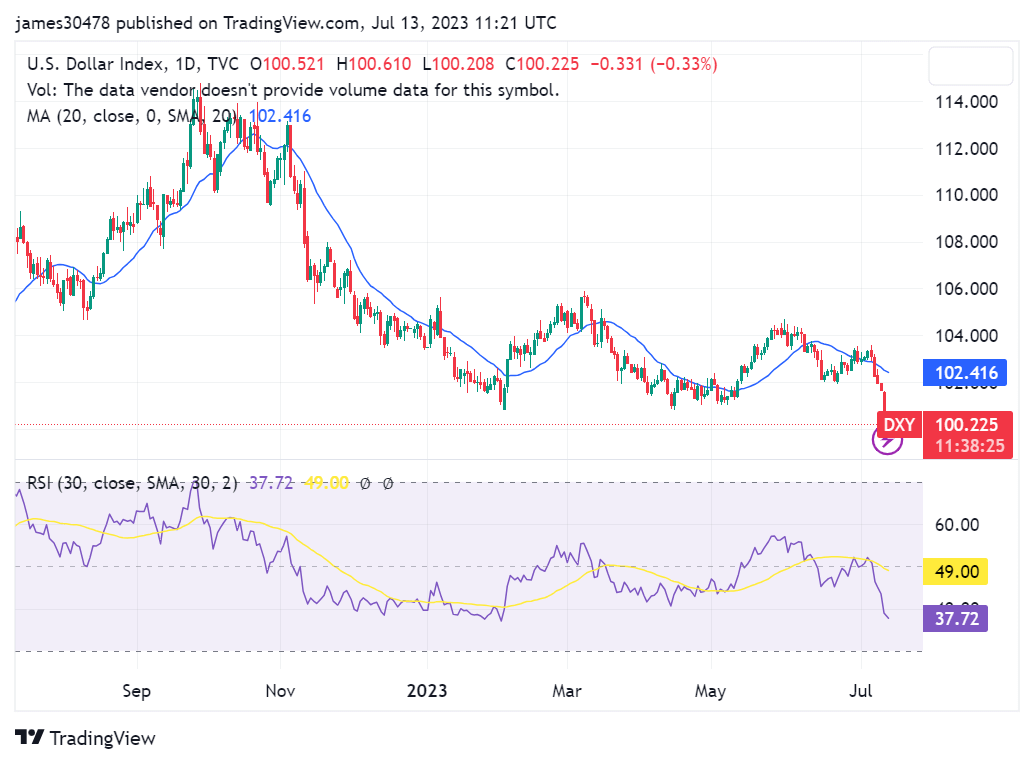

The U.S. Dollar Index (DXY) has been experiencing a downward trend, edging almost below 100 for the first time since its significant rise in April 2022. A year prior, in May 2021, the DXY index had sunk as low as 90, only to climb to an impressive high of 114 by October 2022.

This sharp increase resulted from the Federal Reserve’s decision to raise interest rates rapidly and significantly, marking the highest hike in a four-decade span. The immediate consequence was a substantial dip in risk assets.

Despite this, inflation is presently on a disinflationary trajectory. Market forecasts are predicting another modest increase of 25 basis points from the Federal Reserve, nudging rates to a range of 5.25 – 5.50%.

In the foreign exchange markets, major currencies such as the British Pound (GBP), Japanese Yen (JPY), and Euro (EUR) are rallying. The GBP has made a significant leap to hit the $1.30 mark. Conversely, the JPYUSD exchange rate has dropped below 140¥.

This shift is paving the way for risk-on assets to rally, a trend already noticeable in U.S. equities.

Nevertheless, Bitcoin maintains its distinct lack of correlation to U.S. equities. Furthermore, Bitcoin has also shown its lowest correlation to gold, as per the 30-day moving average (30DMA). Therefore, it appears that Bitcoin’s time to shine may have to wait a little longer.

Farside Investors

Farside Investors

CoinGlass

CoinGlass