Big expiration awaits tomorrow, roughly $7B in notional value for Bitcoin and Ethereum

Big expiration awaits tomorrow, roughly $7B in notional value for Bitcoin and Ethereum Quick Take

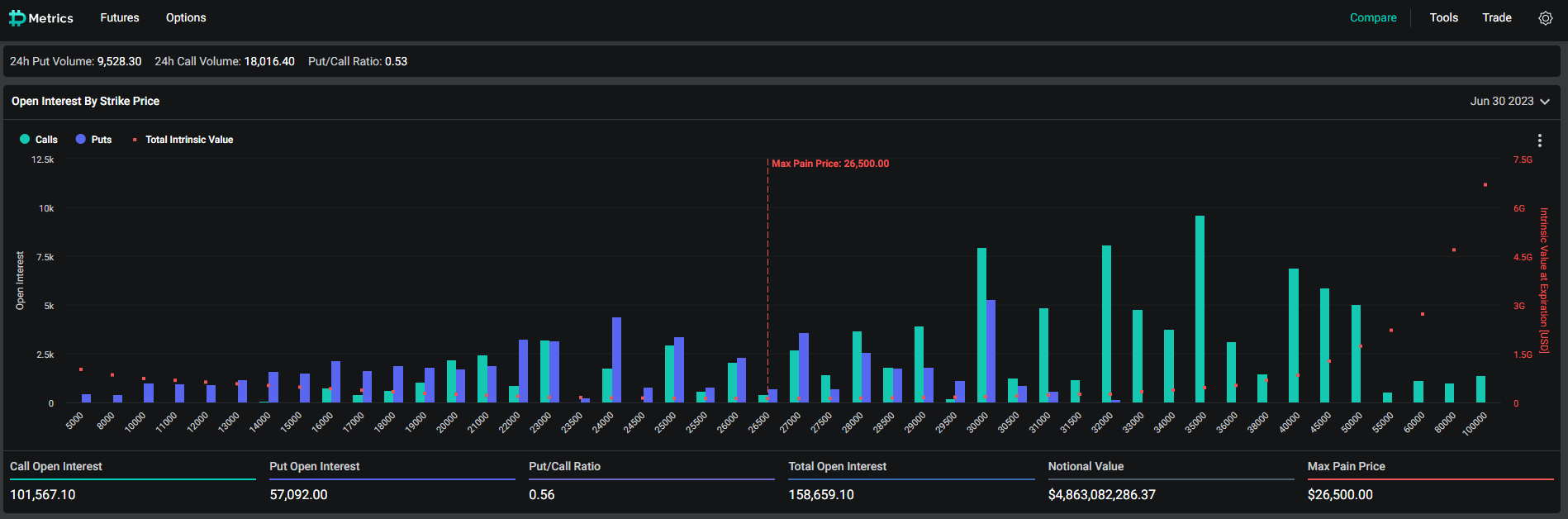

Tomorrow, June 30, marks a significant day in cryptocurrency options, with a colossal expiry on the horizon. Approximately $4.8 billion worth of Bitcoin and $2.3 billion of Ethereum options are poised to expire.

This expiry pertains to nearly 157,000 options contracts, exhibiting a ‘put-to-call ratio’ of 0.56, indicating that more ‘call’ options are open than ‘put’ options. The ‘call’ open interest stands at just over 100,000, while Bitcoin’s ‘put’ open interest lingers at around 57,000.

A ‘put-to-call ratio’ of less than one typically signals bullish market sentiment because it shows that more market participants are betting on a rise in Bitcoin’s price.

As the current number of ‘call’ options open is higher, should the spot price of Bitcoin be above the strike price of these options at the time of expiration, it could potentially lead to a further increase in the price of Bitcoin. This is because option sellers (who have sold these ‘call’ options) may need to purchase Bitcoin to cover their sold positions.

The “max pain price,” representing the price level at which the most significant number of options contracts would become worthless, causing the most substantial financial loss for the option holders, is currently at $26,500. This correlates to a total intrinsic value of $125 million.

The max pain price calculation is based on the quantity and details of open options contracts. This concept operates on the premise that the price will move towards this value, causing maximum financial ‘pain’ or loss to option holders at the expiration time.

Farside Investors

Farside Investors

CoinGlass

CoinGlass