Asia’s Bitcoin supply soars amid shifting regulatory landscapes

Asia’s Bitcoin supply soars amid shifting regulatory landscapes Asia’s Bitcoin supply soars amid shifting regulatory landscapes

Bitcoin supply held by entities in Asia increased by 9.9% in 2023, as the region begins introducing crypto-friendly regulation and U.S. tightens its regulatory stance.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As U.S. regulatory pressures continue to bear down on the cryptocurrency industry, a fresh trend is beginning to take shape, altering the dynamics of Bitcoin’s global demand.

The U.S. political environment seeks to tighten the regulatory noose around the neck of the crypto and mining sectors, causing traders within its borders may be losing faith in Bitcoin’s resilience.

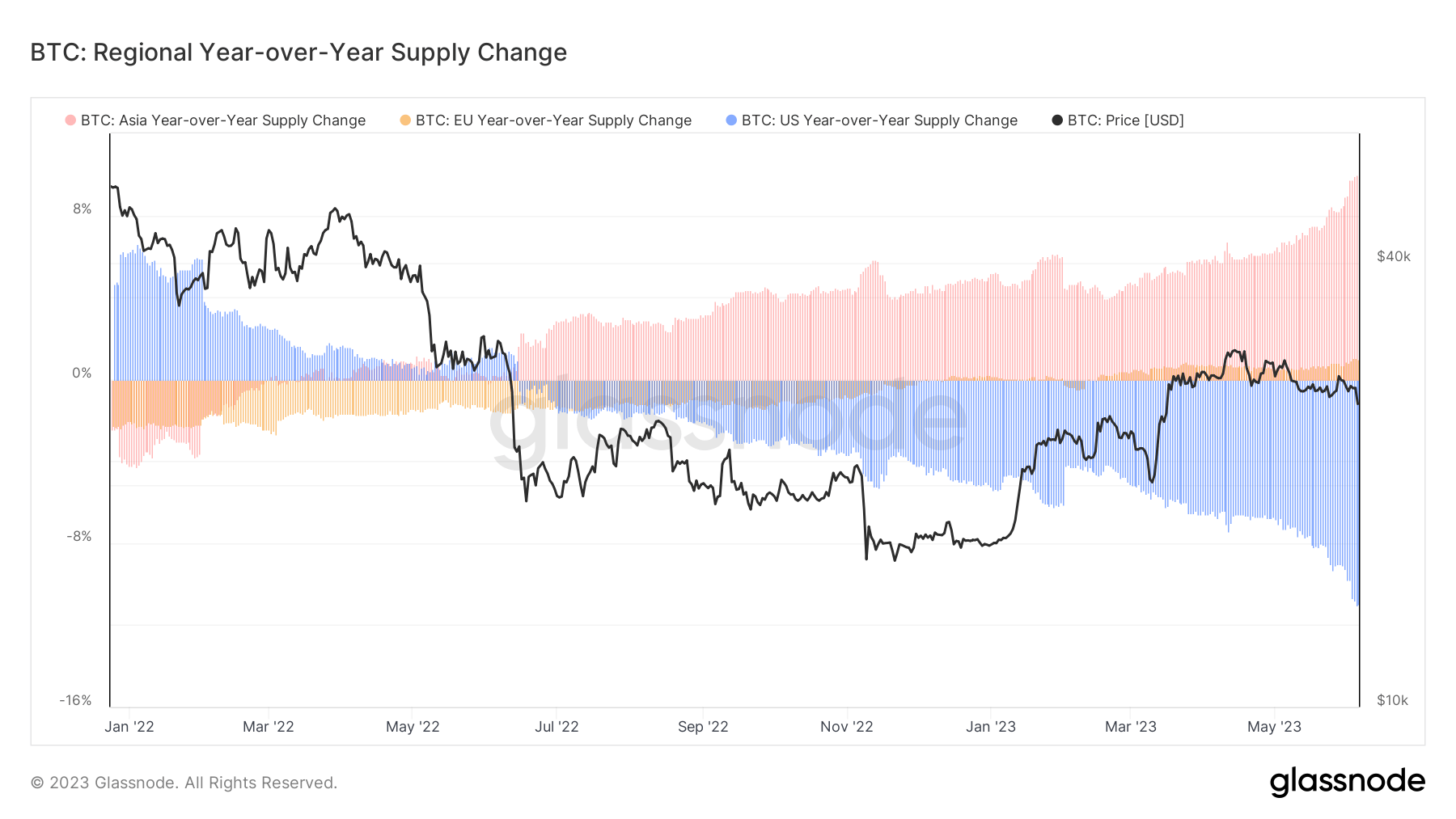

This shift is evident through Glassnode’s Bitcoin year-over-year (YoY) supply change, which tracks the amount of Bitcoin held by regional entities.

CryptoSlate analysis found that the Bitcoin supply in the U.S. experienced an 11% YoY dip since June 2022.

Contrarily, the Asian crypto market showed a surge in Bitcoin supply. According to data from Glassnode, entities operating during Asian trading hours have increased their Bitcoin holdings by 9.9% since June last year, marking an all-time high.

Asia’s attraction to Bitcoin sparked questions about the possible driving factors behind this shift.

As previously reported on CryptoSlate, mounting regulatory heat in the U.S. led traders to pivot away from Bitcoin and Ethereum, turning instead to the perceived safety of stablecoins. This defensive move by traders demonstrates the tangible impact that regulation, or the threat of it, can exert on the behavior and decisions of cryptocurrency market participants. The risk of potential compliance-related penalties and clampdowns can incentivize a safer play, sometimes at the cost of high-yield investments.

While U.S. regulations cast a shadow on the crypto market, Asia has been experiencing a more positive wave of regulatory changes.

As reported by CryptoSlate, Hong Kong’s Securities and Futures Commission (SFC) has paved the way for a more crypto-friendly environment, signaling the licensing of over eight crypto companies by year-end and easing regulatory requirements for crypto exchanges.

In response to these accommodating changes, some crypto entities, such as CoinEx, have strategically leveraged Hong Kong’s crypto-friendly rules.

Meanwhile, Bitget has committed to investing $100 million to bolster Asia’s Web3 ecosystem. Furthermore, mounting speculation about a Central Asian country’s potential Bitcoin treasury holding reflects a shifting regional sentiment towards Bitcoin.

Farside Investors

Farside Investors

CoinGlass

CoinGlass