Bitcoin boasts safe-haven characteristics during economic uncertainty: Galaxy

Bitcoin boasts safe-haven characteristics during economic uncertainty: Galaxy Bitcoin boasts safe-haven characteristics during economic uncertainty: Galaxy

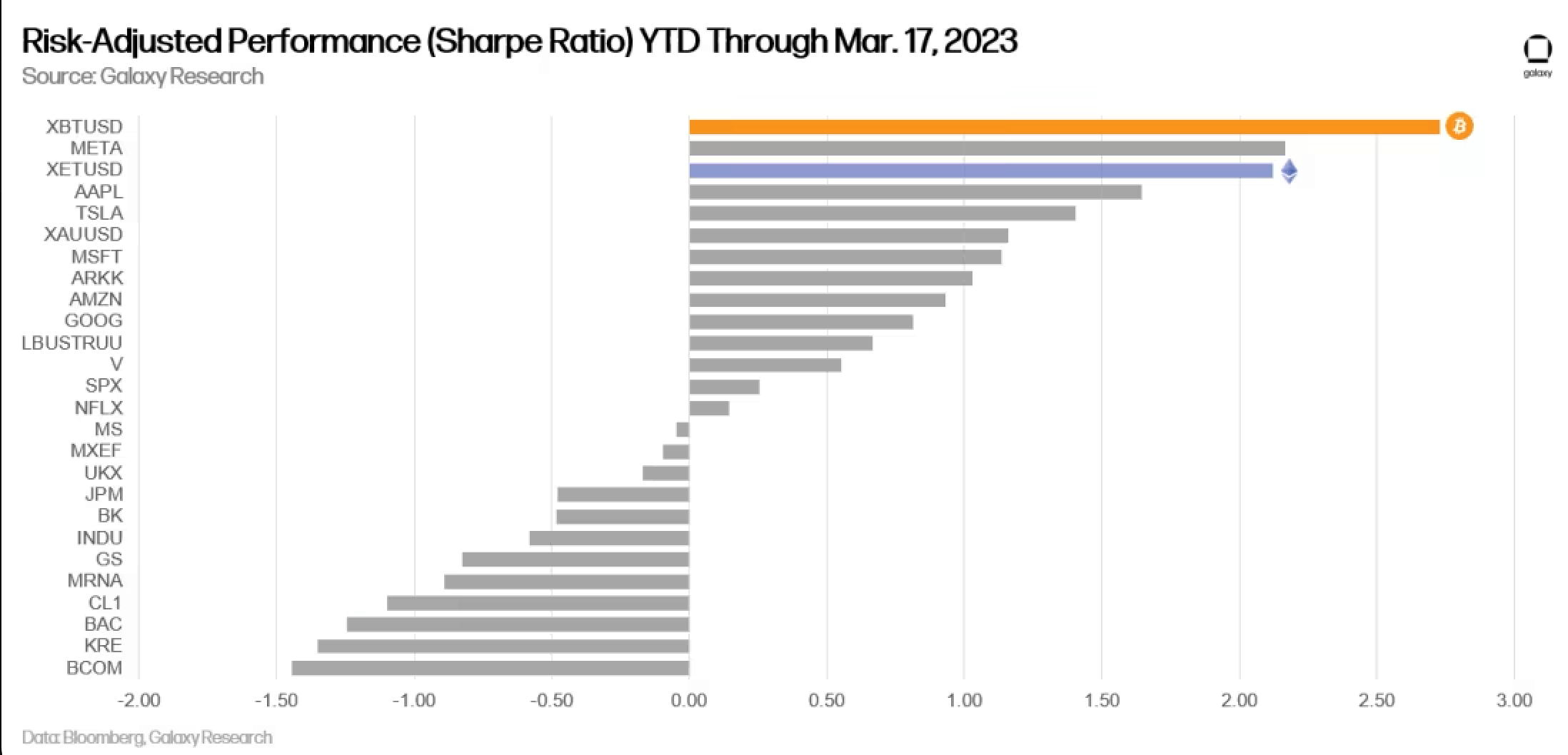

Bitcoin has been the top-performing asset of 2023 when measuring risk-adjusted performance (Sharpe ratio).

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

According to new data from the digital asset management company Galaxy, Bitcoin (BTC) is the best-performing asset of the year compared to equities, fixed-income securities, indices, and commodities on a risk-adjusted basis.

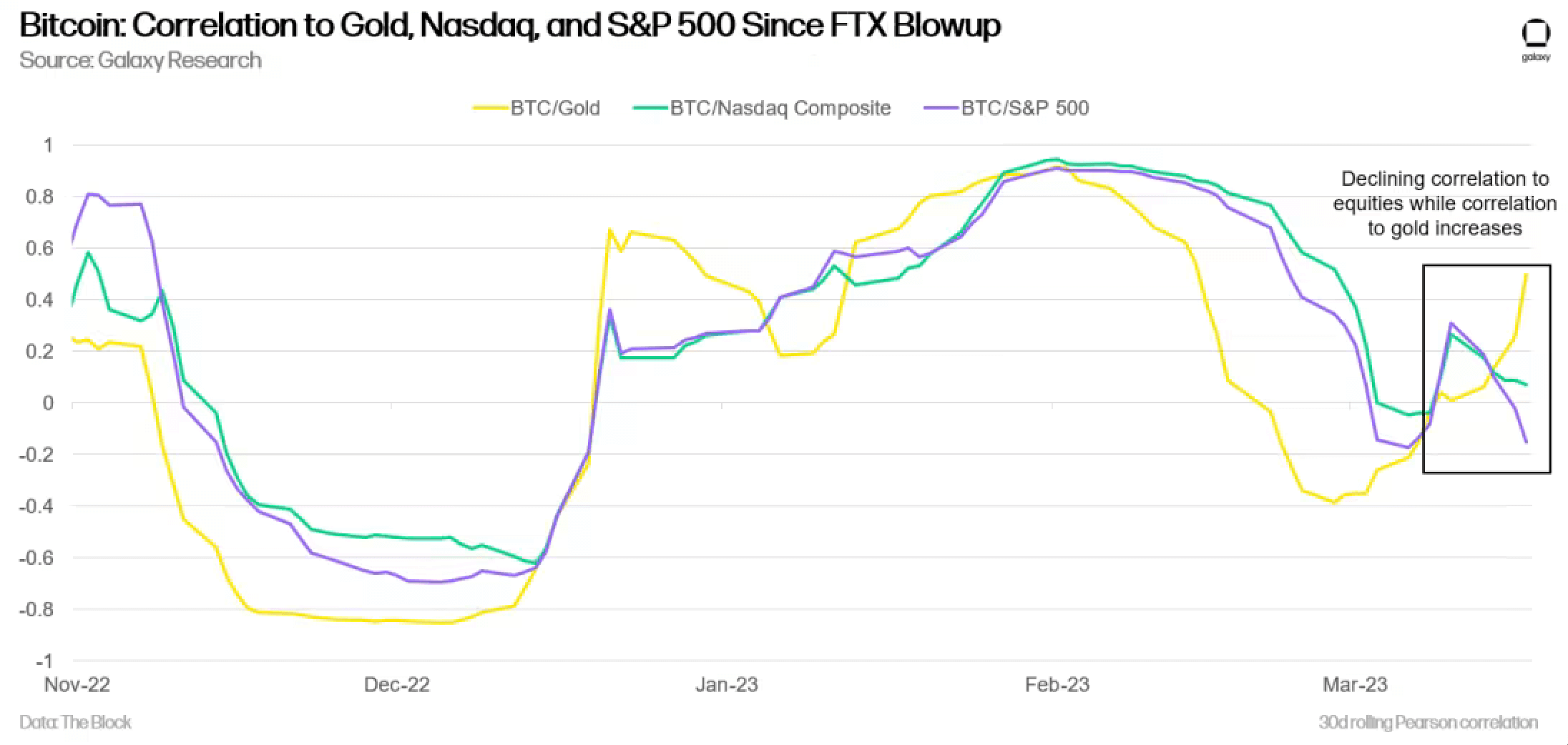

The newly released data corresponds to gold increasing and equities decreasing. It explains how the volatility of Bitcoin is on a multi-year downward trend, and that futures open interest and perpetual swap funding rates suggest the rally is not based purely on speculation.

On-chain data shows ongoing accumulation, longer holding times, and growing ownership dispersion. The upcoming 4th halving is expected to precede a longer-term bullish advance.

Bitcoin performance as compared to other assets

Bitcoin has been the top-performing asset of 2023 when measuring risk-adjusted performance (Sharpe ratio) compared to equities, fixed-income securities, indices, and commodities. It has consistently been one of the best performers across various timeframes, with the exception of the one-year timeframe.

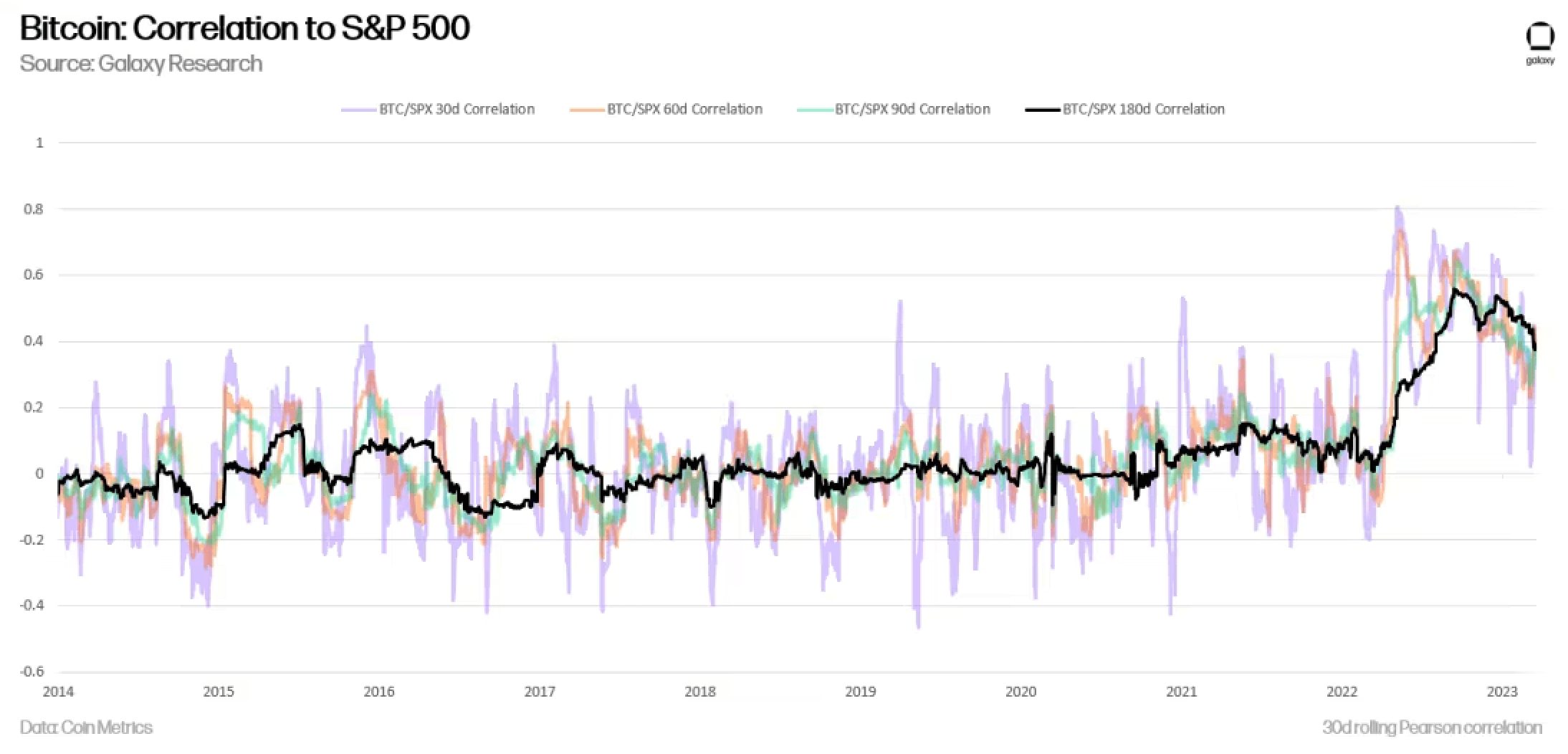

Bitcoin’s correlation with equities has been high over the past 18 months but has recently decreased. Meanwhile, its correlation with gold has increased significantly — particularly since the banking crisis.

These correlations indicate that Bitcoin has exhibited safe-haven characteristics in the current economic climate — demonstrating the value of Bitcoin’s fundamental characteristics.

Notable future supply events

There are two upcoming supply events for Bitcoin — one bullish and one potentially bearish. The 4th halving — set for April 2024 — is expected to bring the inflation rate below 1%, historically leading to subsequent bull runs. Galaxy notes that the drop in new daily issuance may be less impactful than expected.

Furthermore, the Mt. Gox bankruptcy trustee holds 141,686 BTC — which it said recently it does not plan to sell. The largest creditor —the Mt. Gox Investment Fund — opted to receive early payment in approximately 70% BTC and 30% cash and does not plan to sell the BTC it receives.

The early distribution date is expected September and it’s expected that most BTC will not be sold upon distribution. There may be second-order impacts in BTC lending markets if creditors look to lend their BTC either off-chain or on-chain via converting to WBTC, according to Galaxy.

Read the full Galaxy report.

Farside Investors

Farside Investors

CoinGlass

CoinGlass