Nail in the coffin for 2023 rate cut hopes in light of January inflation report

Nail in the coffin for 2023 rate cut hopes in light of January inflation report Quick Take

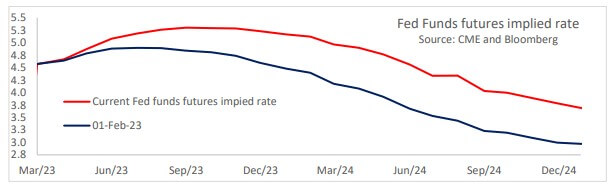

- The change in expectations from the market of the future fed policy during February has been significant. The fed funds rate is expected to peak above 5.25% in the year’s second half — with a slim to no chance of rate cuts this year.

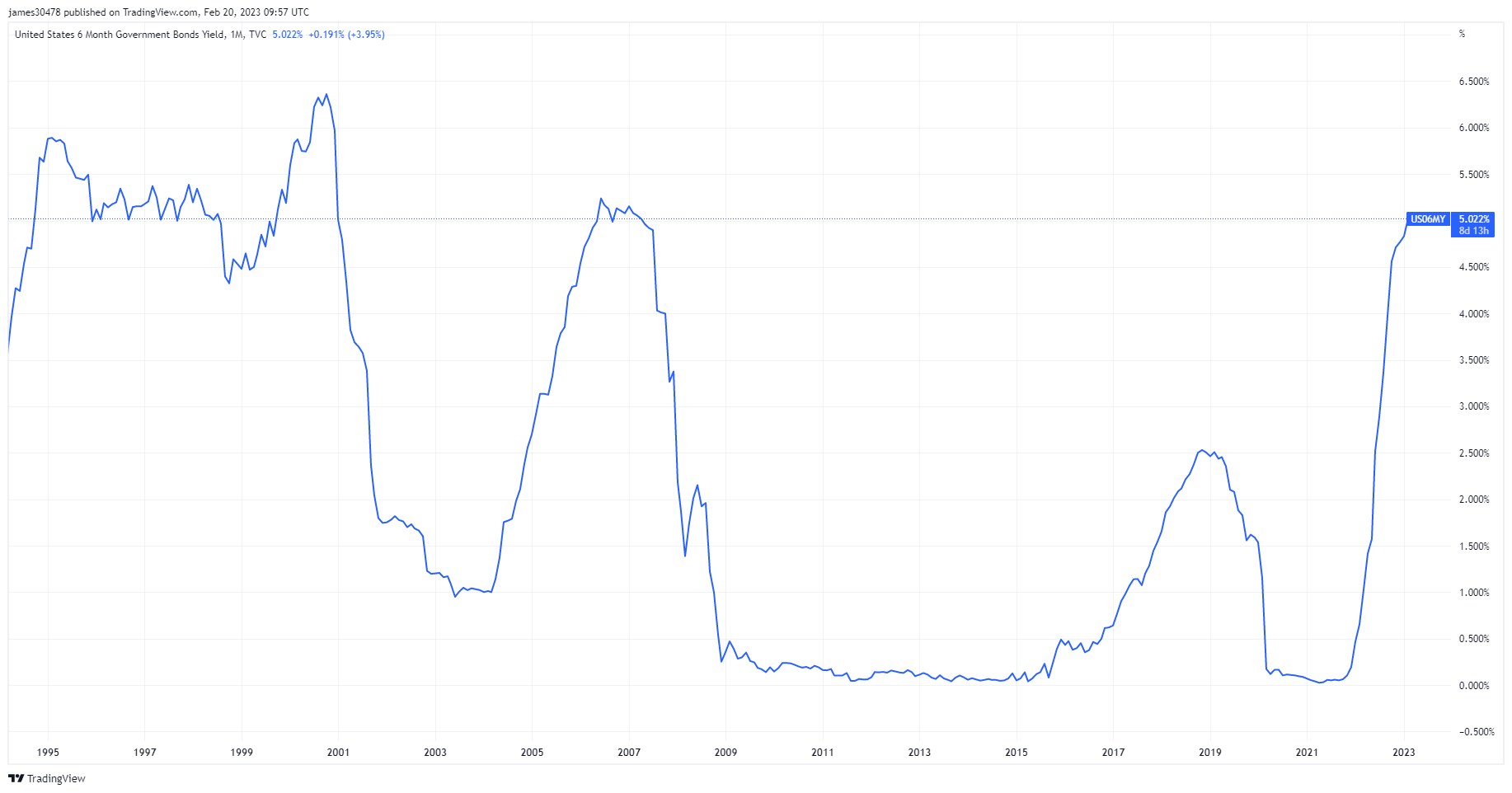

- The six-month treasury bill is yielding more than 5% for the first time since the GFC.

- Retail sales jumped the most since covid due to the introduction of stimulus checks, according to the January inflation report.

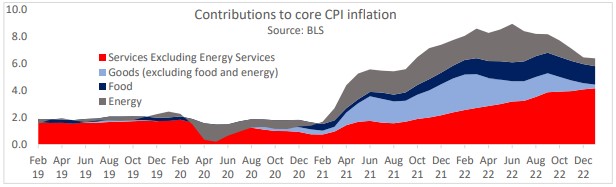

- In addition, the January inflation report showed the pace of declines in good prices is slowing; shelter inflation has yet to be factored in as rent increases still show positive upwards momentum.

- This is followed by a second consecutive monthly increase of .4% in the core index.

CoinGlass

CoinGlass

Farside Investors

Farside Investors