CryptoSlate Daily wMarket Update: Bullish market sentiment sends Bitcoin briefly above $24,000

CryptoSlate Daily wMarket Update: Bullish market sentiment sends Bitcoin briefly above $24,000 CryptoSlate Daily wMarket Update: Bullish market sentiment sends Bitcoin briefly above $24,000

The wMarket Update condenses the most important price movements in the crypto markets over the reporting period, published 07:45 ET on weekdays.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

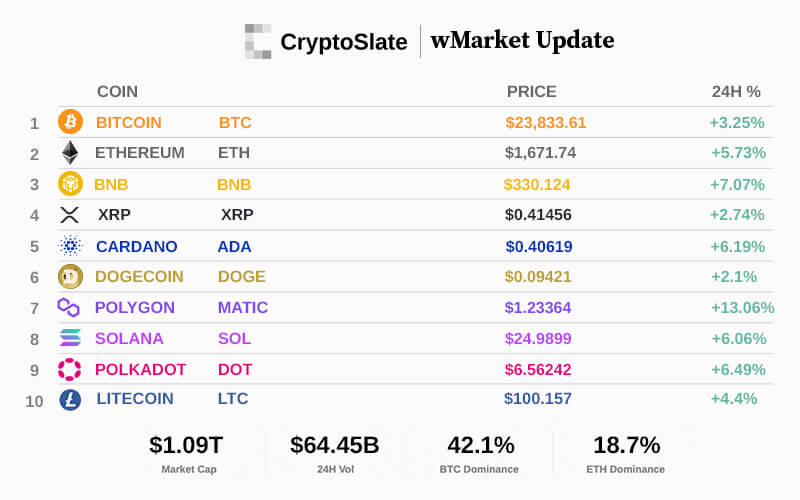

The cryptocurrency market cap saw a net inflow of around $40 billion over the last 24 hours and currently stands at $1.09 trillion — up 4.22% from $1.05 trillion.

Over the reporting period, Bitcoin and Ethereum’s market cap increased by 3.17% and 5.69% to $459.17 billion and $204.59 billion, respectively.

The top 10 crypto assets posted gains over the reporting period — Polygon and BNB recorded the highest increases of 13.06% and 7.07%, respectively. Other assets like Ethereum, Solana, Polkadot, and Cardano posted gains higher than 5%.

Over the last 24 hours, the market cap of Tether (USDT) marginally rose to $67.82 billion, while that of USD Coin (USDC) fell to $42.30 billion. On the other hand, the market cap of BinanceUSD (BUSD) remains unchanged at $16.10 billion.

Bitcoin

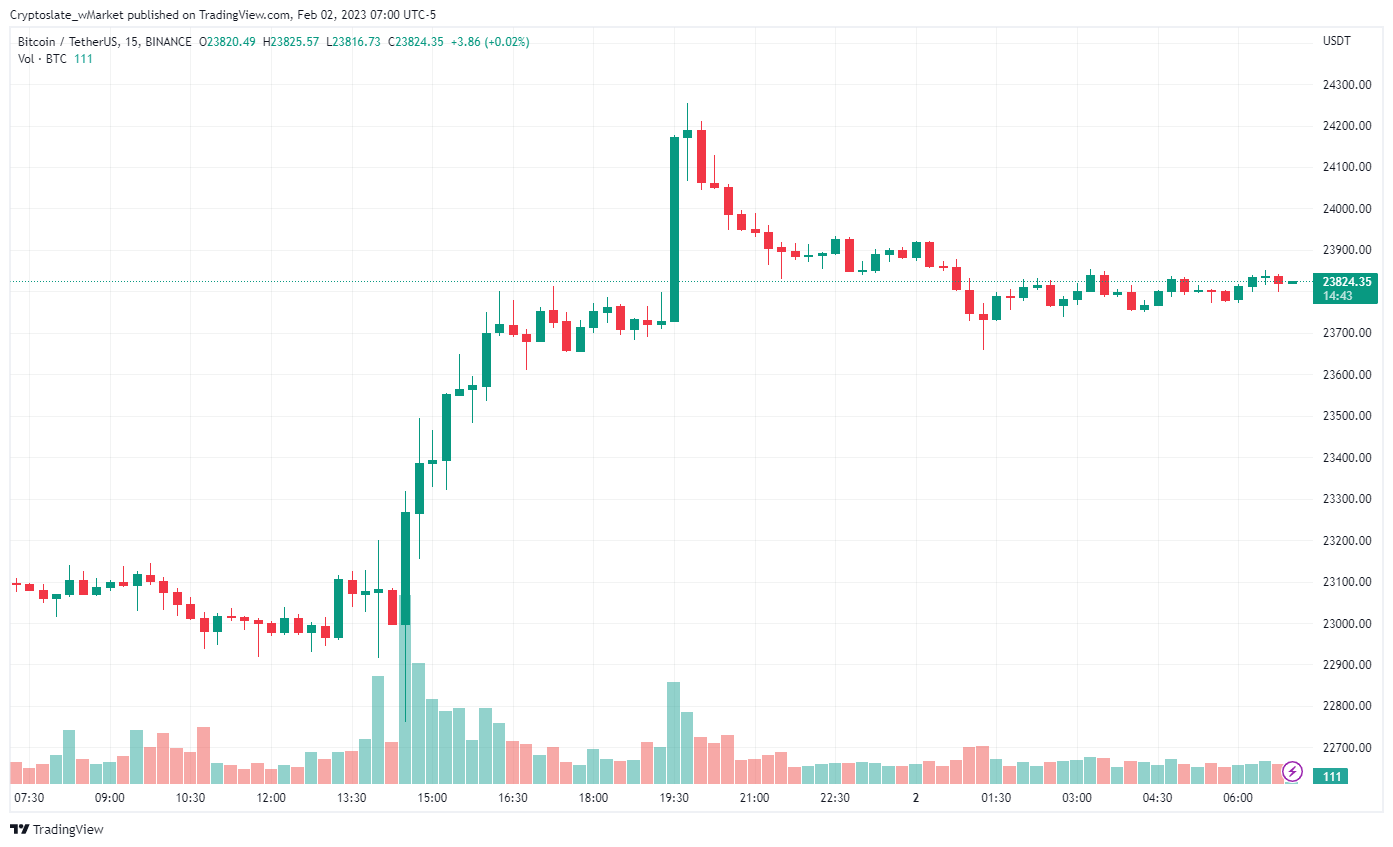

Over the last 24 hours, Bitcoin gained 3.25% to trade at $23,833 as of 07:00 ET. Its market dominance fell to 42.1% from 42.5%.

After the Feds hiked interest rates by 25 basis points, bullish sentiments took over the market, and Bitcoin traded above the $24,000 level for the first time since August 2022 before retracing to its current level.

Ethereum

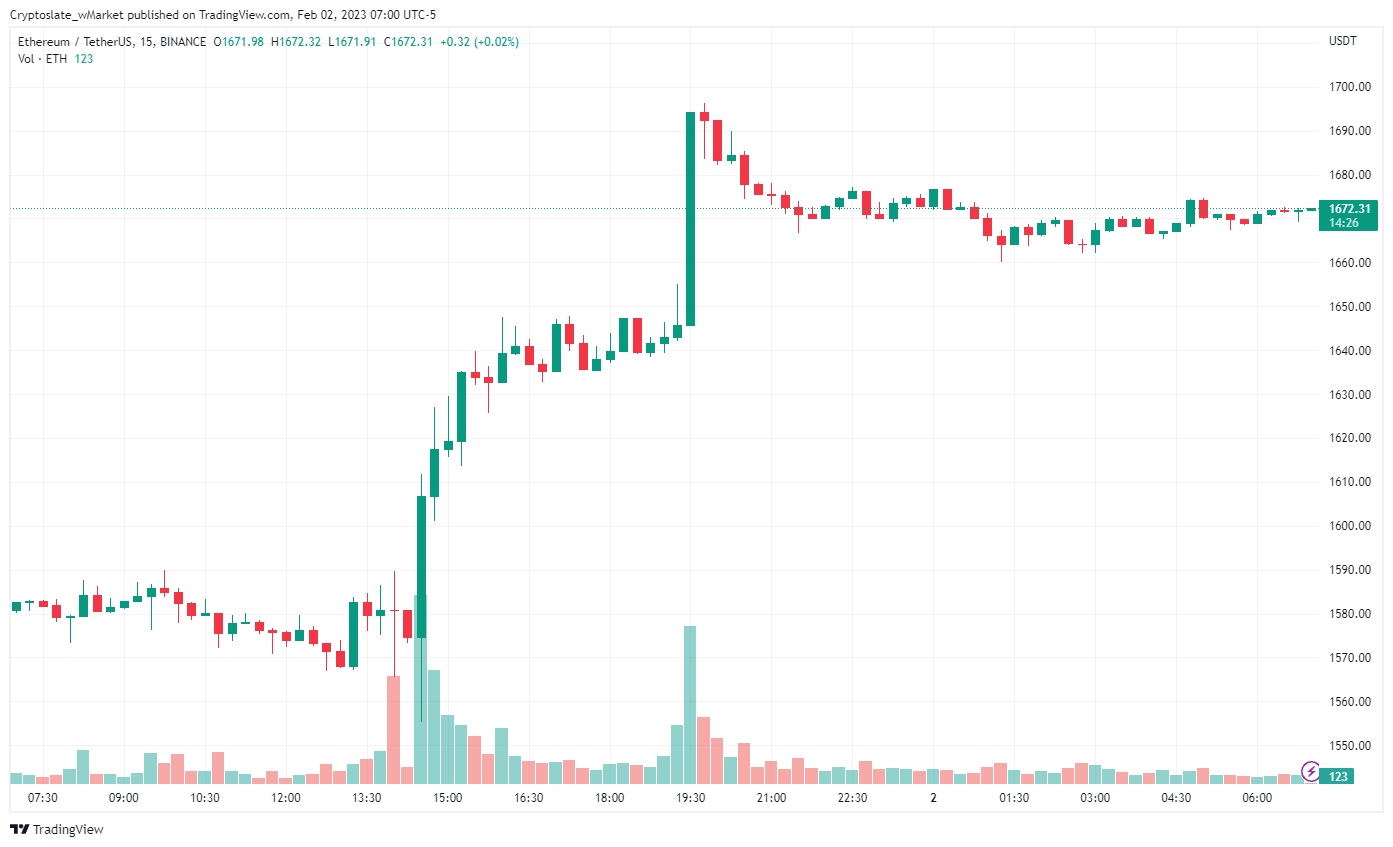

Ethereum grew 5.73% over the last 24 hours to trade at $1,671 as of 07:00 ET. Its market dominance rose to 18.7% from 18.5%.

Like BTC, ETH posted a substantial green candle that took its value near $1700 over the reporting period — peaking at $1689. During the early trading hours of Feb. 2, the asset mostly traded above the $1650 level.

Top 5 Gainers

Synapse

SYN is the day’s biggest gainer, rising 43.37% over the reporting period to $1.21 as of press time. The Synapse ecosystem token increased 39% over the last seven days. Its market cap stood at $168.95 million.

Magic

MAGIC grew 34.39% to $1.79 as of press time. The NFT-related token rose by over 250% in the last 30 days. Its market cap stood at $375.72 million.

Loopring

LRC gained 24.68% over the reporting period to trade at $0.43 as of press time. The Layer-2 solution has seen renewed attention due to its cheap gas fees for ERC20 and NFT transactions. Its market cap stood at $565.68 million.

Optimism

OP is another layer2 solution on the top gainer’s list. Its OP token surged 23.08% to another all-time high of $2.785. Transaction volume on the protocol peaked at over 800,000 in January when interest in its ecosystem was high. Its market cap stood at $651.98 million.

Hex

HEX jumped 19.9% to $0.032 as of press time. Interest in the PulseChain testnet v3 has reached a fevered high, with many community members speculating about the launch date. Its market cap stood at $5.63 billion.

Top 5 Losers

Wrapped Everscale

The wrapped version of Everscale, WEVER, is the day’s biggest loser. The token fell by 31.27% to $0.11 as of press time. The token appears to have shed some of its Feb. 1 gains. Its market cap stood at $195.91 million.

Everscale

EVER is on the top loser’s list for the second consecutive day. The token decreased by 3.32% over the reporting period to $0.11 as of press time. The project’s positive price performance over the last 30 days saw it rise by more than 300%. Its market cap stood at $193.62 million.

Status

SNT plunged 1.92% to $0.034 as of press time. The token rose by over 80% in the last 30 days. Its market cap stood at $137.7 million.

Gemini Dollar

GUSD is down 0.51% in the last 24 hours to $0.99 as of press time. The stablecoin has seen increased scrutiny following the recent issues plaguing its parent company, Gemini. The stablecoin briefly depegged earlier in the week. Its market cap stood at $605.82 million.

MobileCoin

MOB lost 0.31% in the last 24 hours to trade at $1.45 as of press time. The privacy-focused asset has plunged by 43% in the previous 30 days. Its market cap stood at $108.17 million.

Mentioned in this article

Bitcoin

Bitcoin  Ethereum

Ethereum  Everscale

Everscale  Wrapped Everscale

Wrapped Everscale  MobileCoin

MobileCoin  Status

Status  Gemini Dollar

Gemini Dollar  HEX

HEX  Treasure

Treasure  Loopring

Loopring  Optimism

Optimism  Synapse

Synapse

Farside Investors

Farside Investors

CoinGlass

CoinGlass