Here’s what happens to Ethereum (ETH) revenue after multimillion NFT sales

Here’s what happens to Ethereum (ETH) revenue after multimillion NFT sales Here’s what happens to Ethereum (ETH) revenue after multimillion NFT sales

Does all of the money spent on NFTs actually stay in the market or is dumped on unsuspecting investors causing price fluctuations?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The latest research from crypto analytics company Nansen analyzed the flow of ether (ETH) that has come into the NFT market to determine whether it had any effect on ETH’s price.

Nansen’s report analyzed both the primary and the secondary market for NFTs, following where the money projects receive from NFT sales goes. After following four levels of transfers, the report found a healthy, robust market that seems to be experiencing organic growth despite skeptics seeing it as a bubble.

What happens to ETH revenue from NFT sales?

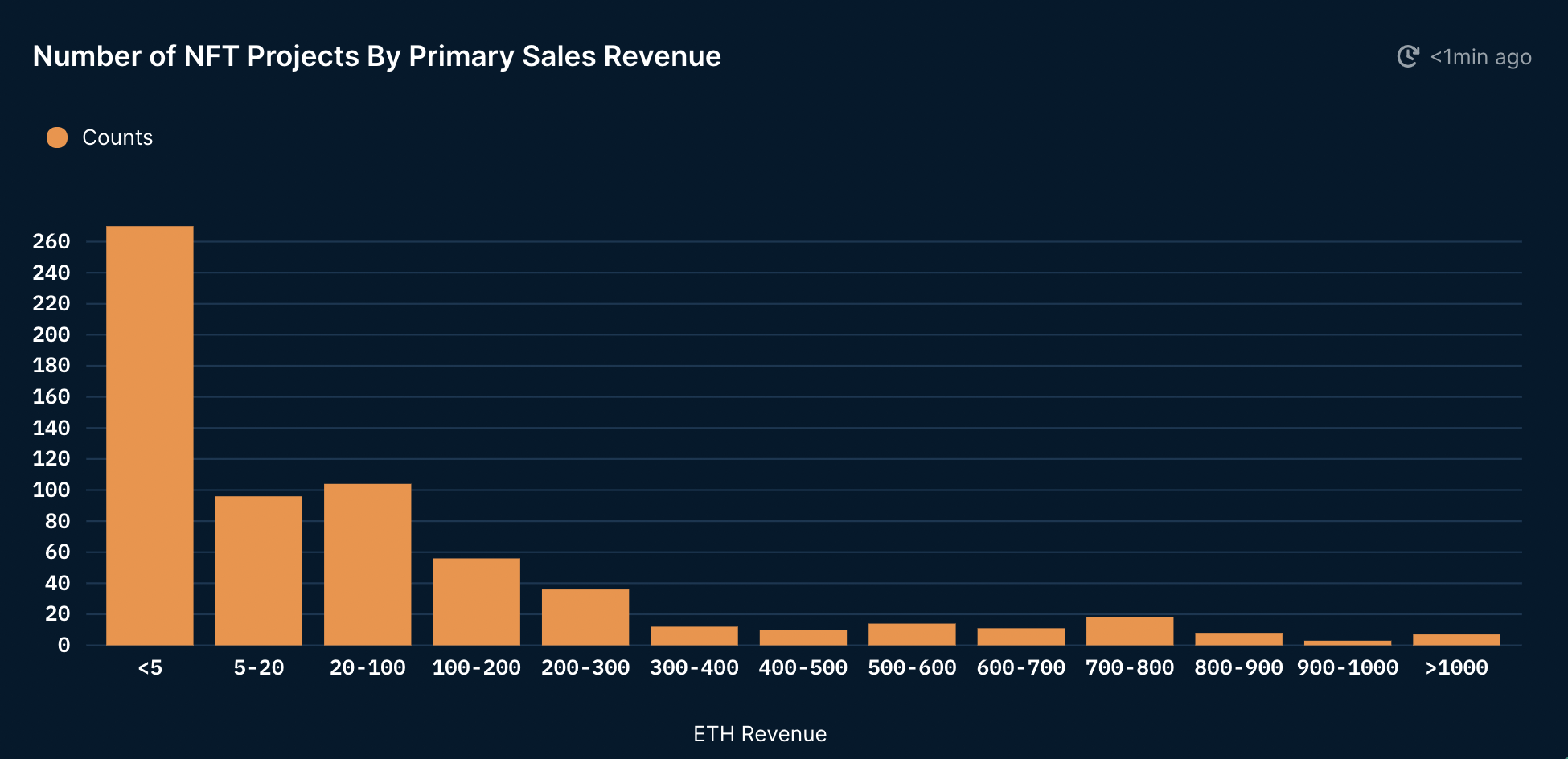

According to Nansen’s research, an estimated 84,000 ETH has been deposited into 645 different ERC-721 NFT contracts since June this year. This amount constitutes the primary sales revenue from addresses that are the first to mint NFTs. Out of 84,000 ETH, only around 74,000 ETH has been transferred out of such contracts, with 573 projects transferring ETH out and 72 projects still holding onto their funds.

To simplify the research process, Nansen only considered projects with primary sales revenues of more than 20 ETH in total and excluded Art Blocks and Cryptopunks due to smart contract differences.

The research then took the list of addresses and divided them into entity and contract addresses, analyzing four levels of transfers from entity addresses.

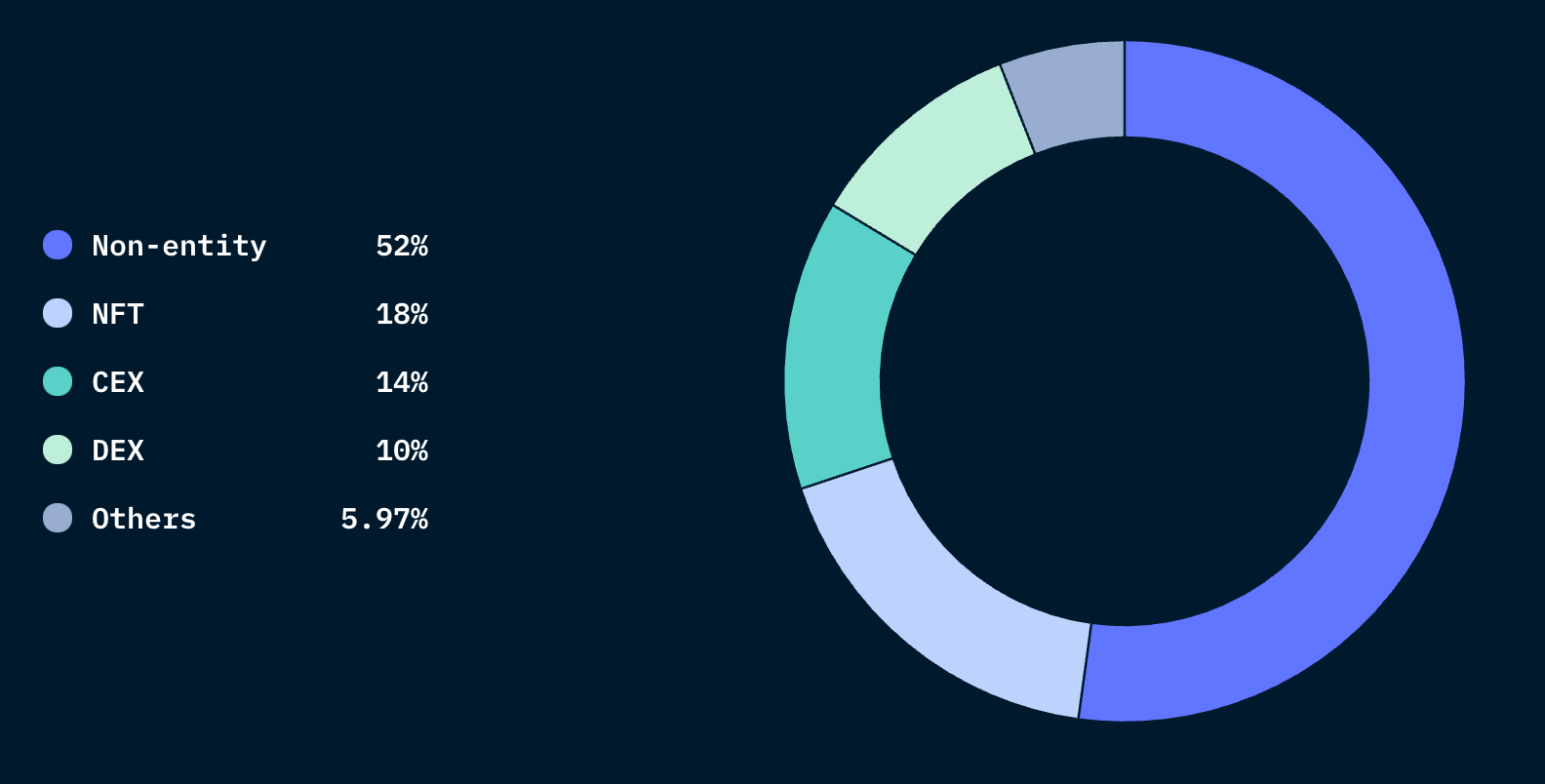

Approximately 52.3 $ of the ETH from primary NFT sales is still circulating among non-entity wallets, while 10% have been used on a decentralized exchange (DEX), either as liquidity or for swaps. Around 14% of the sales have been deposited on centralized exchanges (CEX). However, 18% of the sales have been poured back into other NFT projects, including primary NFT mints and secondary marketplaces such as OpenSea and Rarible.

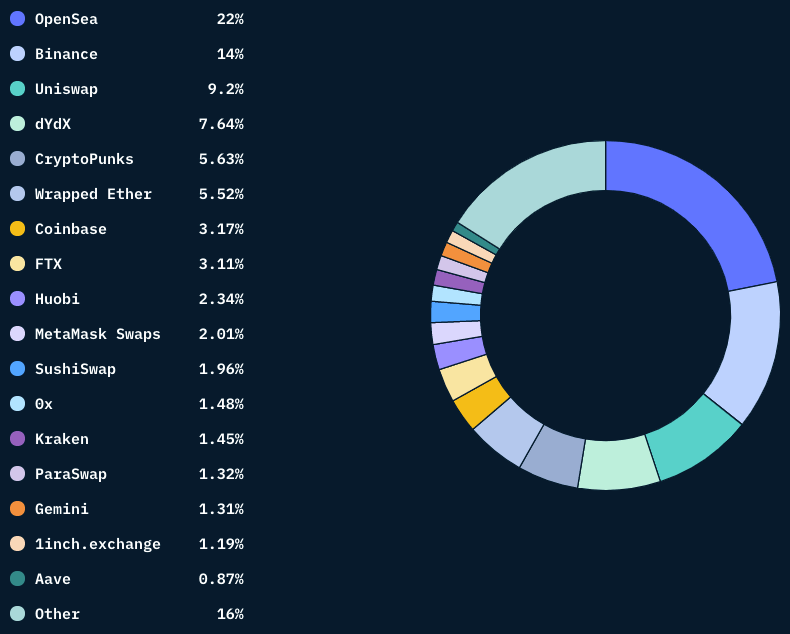

Examining the ETH flow in more detail reveals that almost 22% of the sales flow is returned to OpenSea. When it comes to deposits onto centralized exchanges, Binance tops the list with 14%, while Coinbase and FTX have each captured just over 3%.

Decentralized exchanges Uniswap and dYdX received 9.2% and 7.64% of the total ETH flow to entities.

Around 6% of the ETH revenue from NFT sales has also been used for CryptoPunk-related activities, most likely as capital for purchases.

And while Nansen noted that it did find some on-chain indicators that could indicate wash-trading, it concluded that NFTs represent a “bright new vertical catching product-market fit.”

“The healthy distribution of NFT minters and rising number of unique buyers point to a genuine, organic growth of the NFT community,” the company said in the report.

Farside Investors

Farside Investors

CoinGlass

CoinGlass