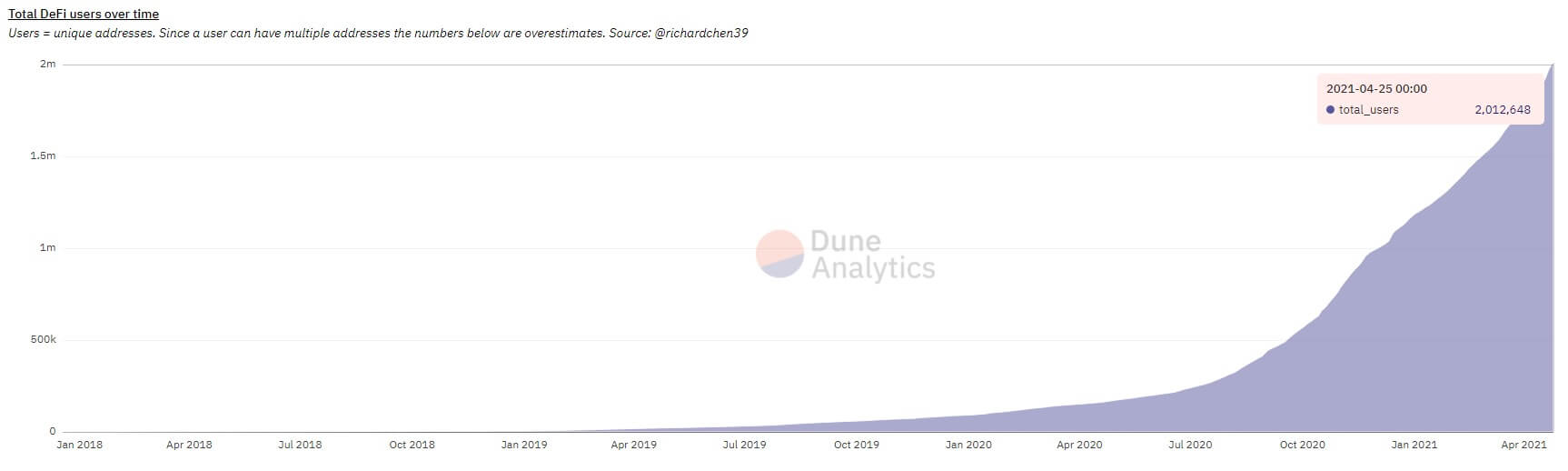

DeFi ecosystem now exceeds 2 million unique addresses

DeFi ecosystem now exceeds 2 million unique addresses DeFi ecosystem now exceeds 2 million unique addresses

The number of addresses in the decentralized finance sector has doubled in less than five months.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The total number of unique addresses (or wallets) in the decentralized finance (DeFi) space broke above two million today, according to crypto metrics platform Dune Analytics.

Notably, the previous major milestone of one million addresses was achieved just a few months ago—on December 4, 2020, according to Richard Chen, creator of the dashboard and partner at crypto-focused investment firm 1confirmation.

TWO MILLION DEFI USERS ?? https://t.co/RjNZoK7Lfz pic.twitter.com/HWk1FoVkHX

— Richard Chen (@richardchen39) April 25, 2021

At the same time, it’s worth pointing out that this figure does not represent the total number of actual users in DeFi. Just like with most digital services, each user can create a virtually unlimited number of addresses, so the figures are overestimated.

However, these metrics can be perceived as indicative of the overall growth and trends the DeFi market is seeing. In this light, a 100% increase in the number of addresses in less than five months demonstrates that the sector is still growing exponentially.

Uniswap is still leading

In terms of user activity, Ethereum-based decentralized exchange Uniswap is leading by far with 1.434 million addresses. It is followed by Compound (roughly 314,600), 1inch (184,400), Balancer (138,500), Kyber Network (120,400), and SushiSwap (119,000). Other DeFi platforms account for less than 100,000 addresses each.

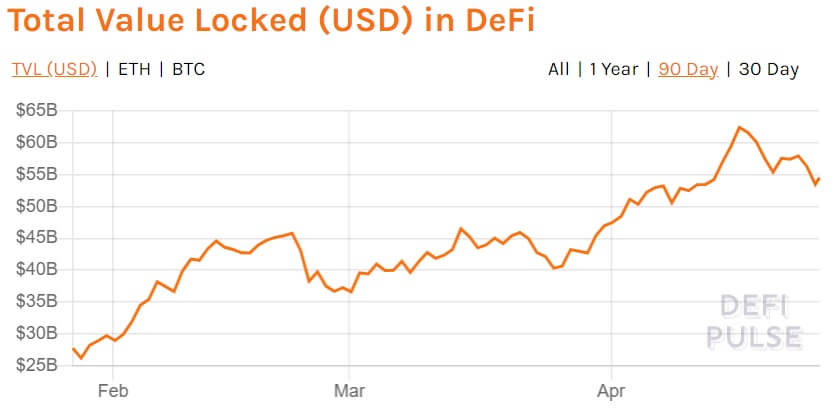

Another clear indicator of growth is the total dollar value currently locked (TVL) on various DeFi platforms. According to decentralized metrics website DeFi Pulse, the TVL reached another all-time high of over $62 billion on April 16.

However, the cryptocurrency market, in general, has somewhat plummeted since then, resulting in a sharp decrease in metrics across the board. Still, DeFi’s TVL stands at an impressive $54.3 billion at press time.

As CryptoSlate reported, while Ethereum is still the king of decentralized finance, other DeFi-focused networks have begun rising to prominence amid its blockchain’s congestion and skyrocketing transaction fees.

Farside Investors

Farside Investors

CoinGlass

CoinGlass