Ethereum long positions on Bitfinex soar to $510M as uptrend builds momentum

Ethereum long positions on Bitfinex soar to $510M as uptrend builds momentum Ethereum long positions on Bitfinex soar to $510M as uptrend builds momentum

Photo by Ross Parmly on Unsplash

Ethereum’s price has been caught within the throes of an intense uptrend throughout the past few days, surging from its recent low of $230 to a high of $285 that was set earlier today.

The cryptocurrency’s intense strength is creating a tailwind that has even allowed Bitcoin to climb higher, with the benchmark cryptocurrency now pushing up towards $9,600.

One byproduct of the crypto’s strength has been a massive influx of long positions on Bitfinex.

Earlier today, the notional long count on the platform rocketed to fresh highs, with there now being over $510 million worth of open ETH longs.

From a technical perspective, Ethereum’s outlook is incredibly strong.

Analysts are closely watching the cryptocurrency’s weekly close for insights into where it might trend in the weeks ahead.

Ethereum rallies past $280 as technical outlook grows bright

At the time of writing, Ethereum is trading up over three percent at its current price of $283.25.

This marks a notable climb from its weekly low of $233 that was set on July 19th.

ETH’s overt strength throughout the past few weeks has allowed it to significantly outperform Bitcoin, even creating a tailwind that has lifted the benchmark crypto higher.

The over 20 percent climb it has posted this week has caused it to form a strong market structure.

While looking towards its weekly chart, one analyst who goes by the moniker “Cactus” noted that ETH is “super healthy” at the moment, remaining in firm bull territory as long as it trades above $250.

“ETH HTF Update: Market structure playing out perfectly, will not be bearish unless we close a daily or a weekly candle below $250, seems as though PA is looking super healthy right now!”

Notional ETH long count on Bitfinex rockets to $510 million

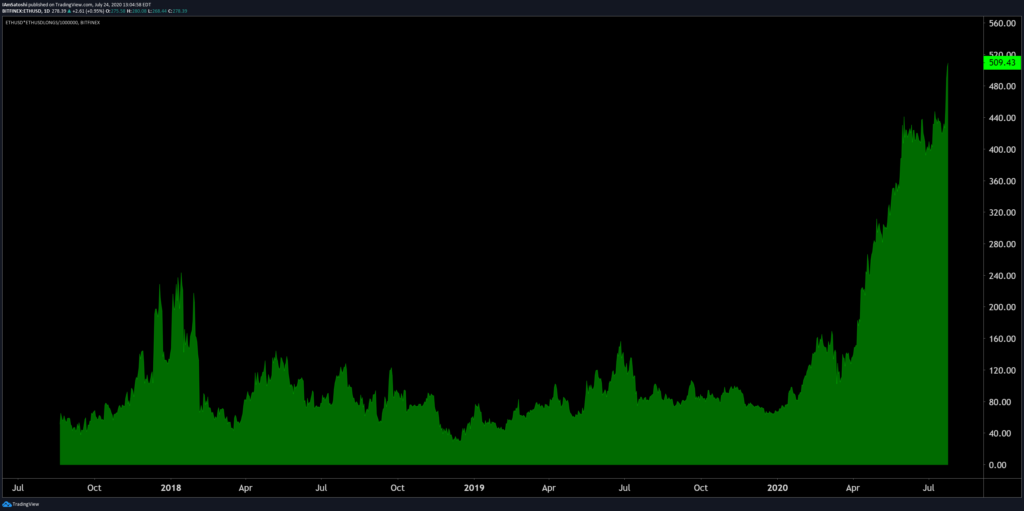

Over the past year, investors have been loading up on Ethereum long positions.

The notional ETH long count on Bitfinex has risen from just over $50 million at the start of 2020 to $510 million today – marking a roughly 900 percent increase.

This growth is likely premised upon the multiple bullish narratives that are currently counting in Ethereum’s favor.

As CryptoSlate reported earlier this month, three primary narratives could help fuel ETH’s upswing. These include:

- The upcoming transition to ETH 2.0, expected to launch in November of 2020

- EIP-1559 – which, if passed, could add a deflationary facet to ETH’s economic structure

- The DeFi sector’s growth is driving users and transaction volume to the Ethereum blockchain

Investors are likely considering these factors as they add to their Ethereum long exposure.

Ethereum Market Data

At the time of press 6:46 am UTC on Jul. 25, 2020, Ethereum is ranked #2 by market cap and the price is up 4.1% over the past 24 hours. Ethereum has a market capitalization of $31.67 billion with a 24-hour trading volume of $9.75 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 6:46 am UTC on Jul. 25, 2020, the total crypto market is valued at at $289.38 billion with a 24-hour volume of $64.77 billion. Bitcoin dominance is currently at 61.07%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass