This data shows Bitcoin could soon see a retail investor frenzy

This data shows Bitcoin could soon see a retail investor frenzy This data shows Bitcoin could soon see a retail investor frenzy

Photo by Ryoji Iwata on Unsplash

Bitcoin’s sharp recovery from its meltdown in mid-March has revitalized its investor base, leading positive sentiment to flourish amongst market participants.

This positivity is likely rooted in its bullish performance against a backdrop of global instability, with comments from legendary investors like Paul Tudor Jones further vindicating the cryptocurrency’s value.

The benchmark cryptocurrency is now fast approaching a multi-year descending trendline that has been hampering its growth.

It is possible that growing investor sentiment will translate into heightened buying activity amongst retail traders that ultimately helps propel the crypto past this resistance.

Bitcoin market participants grow increasingly bullish, data indicates

Although Bitcoin is currently caught within a consolidation phase around $9,700, this hasn’t been enough to stop the cryptocurrency’s buyers from growing increasingly bullish.

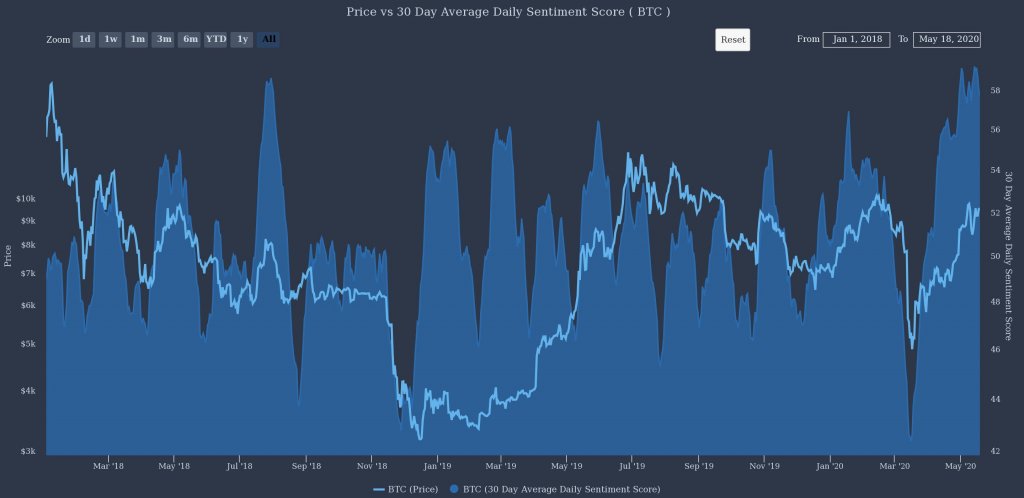

Newly released data from The TIE – a cryptocurrency analytics platform – indicates that Bitcoin as a topic has seen heightened discussion rates on social media platforms, while also seeing increasingly positive sentiment from those discussing it.

“Not only are the number of Twitter users discussing Bitcoin growing, but the sentiment expressed by those investing in Bitcoin recently hit its highest point since 2017. (Graph shows 30 Day Average Daily Sentiment Score vs. Price).”

The TIE’s data also reveals that the increased volume of tweets relating to Bitcoin has been coming from unique accounts. This shows that market participation rates have increased in recent months alongside BTC’s price.

“Not only are tweets up, but the percentage of BTC tweets from unique accounts has also surged in 2020. While Bitcoin had significantly more tweets in 2018 than today, the percentage of tweets from unique accounts has risen from 35% in May 2018 to ~50% today.”

Mounting investor sentiment comes as BTC pushes against key trendline

This increased discussion activity surrounding Bitcoin may also be emblematic of heightened retail purchasing activity that bolsters the cryptocurrency’s near-term trend.

If this is the case, the benchmark cryptocurrency could soon be able to surmount a heavy resistance level that has been guiding its price lower throughout the past several years.

Josh Rager – a respected analyst – spoke about this trendline in a recent tweet, pointing to a chart showing that Bitcoin is currently in the process of attempting to shatter it.

“BTC daily trendline from 2017 still in play on logarithmic line chart. Gotta close it out above $10k bulls.”

As seen in 2017, retail investors can have tremendous power over Bitcoin, and their involvement in the market should not be underestimated.

Bitcoin Market Data

At the time of press 3:40 pm UTC on May. 21, 2020, Bitcoin is ranked #1 by market cap and the price is down 5.69% over the past 24 hours. Bitcoin has a market capitalization of $168.5 billion with a 24-hour trading volume of $38.82 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 3:40 pm UTC on May. 21, 2020, the total crypto market is valued at at $253.77 billion with a 24-hour volume of $125.72 billion. Bitcoin dominance is currently at 66.53%. Learn more about the crypto market ›

CoinGlass

CoinGlass

Farside Investors

Farside Investors